Question: Sheridan Company has the following two temporary differences between its income tax expense and income taxes payable. Pretax financial income Excess depreciation expense on tax

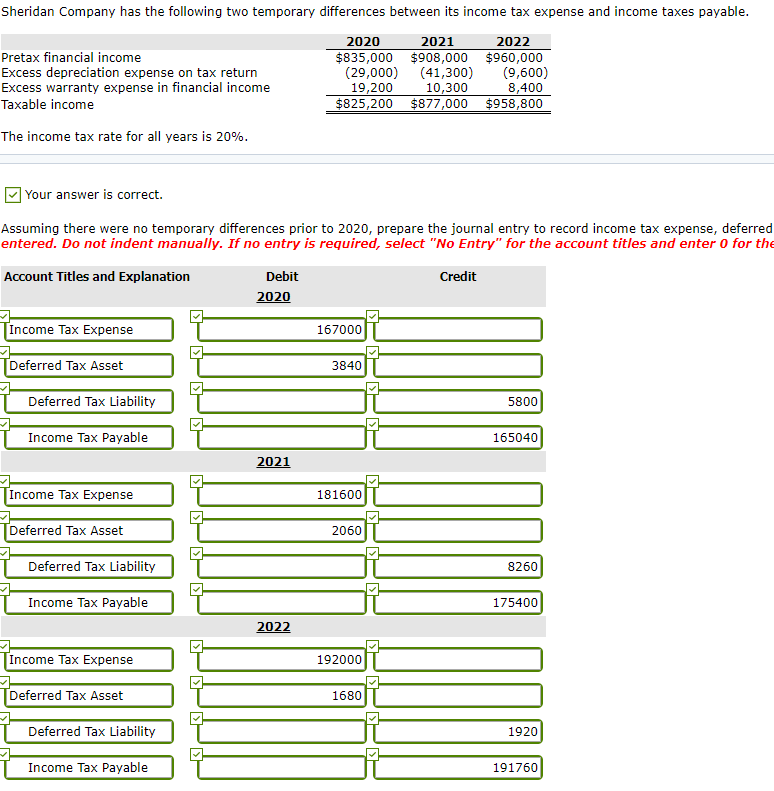

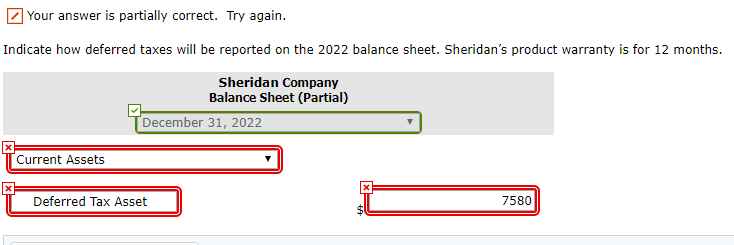

Sheridan Company has the following two temporary differences between its income tax expense and income taxes payable. Pretax financial income Excess depreciation expense on tax return Excess warranty expense in financial income Taxable income 2020 $835,000 (29,000) 19,200 $825,200 2021 $908,000 (41,300) 10,300 $877,000 2022 $960,000 (9,600) 8,400 $958,800 The income tax rate for all years is 20%. Your answer is correct. Assuming there were no temporary differences prior to 2020, prepare the journal entry to record income tax expense, deferred entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the Account Titles and Explanation Credit Debit 2020 Income Tax Expense Deferred Tax Asset | Deferred Tax Liability 5800 | Income Tax Payable 165040 2021 Income Tax Expense 18160 Deferred Tax Asset I Deferred Tax Liability 8260 T Income Tax Payable 175400 2022 Income Tax Expense TDeferred Tax Asset | Deferred Tax Liability 1920 Income Tax Payable 191760 Your answer is partially correct. Try again. Indicate how deferred taxes will be reported on the 2022 balance sheet. Sheridan's product warranty is for 12 months. Sheridan Company Balance Sheet (Partial) TDecember 31, 2022 T Current Assets X I Deferred Tax Asset 7580

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts