Question: Sheridan Ltd., which uses ASPE, recently expanded its operations into an adjoining municipality, and on March 30, 2020, it signed a 15-year lease with its

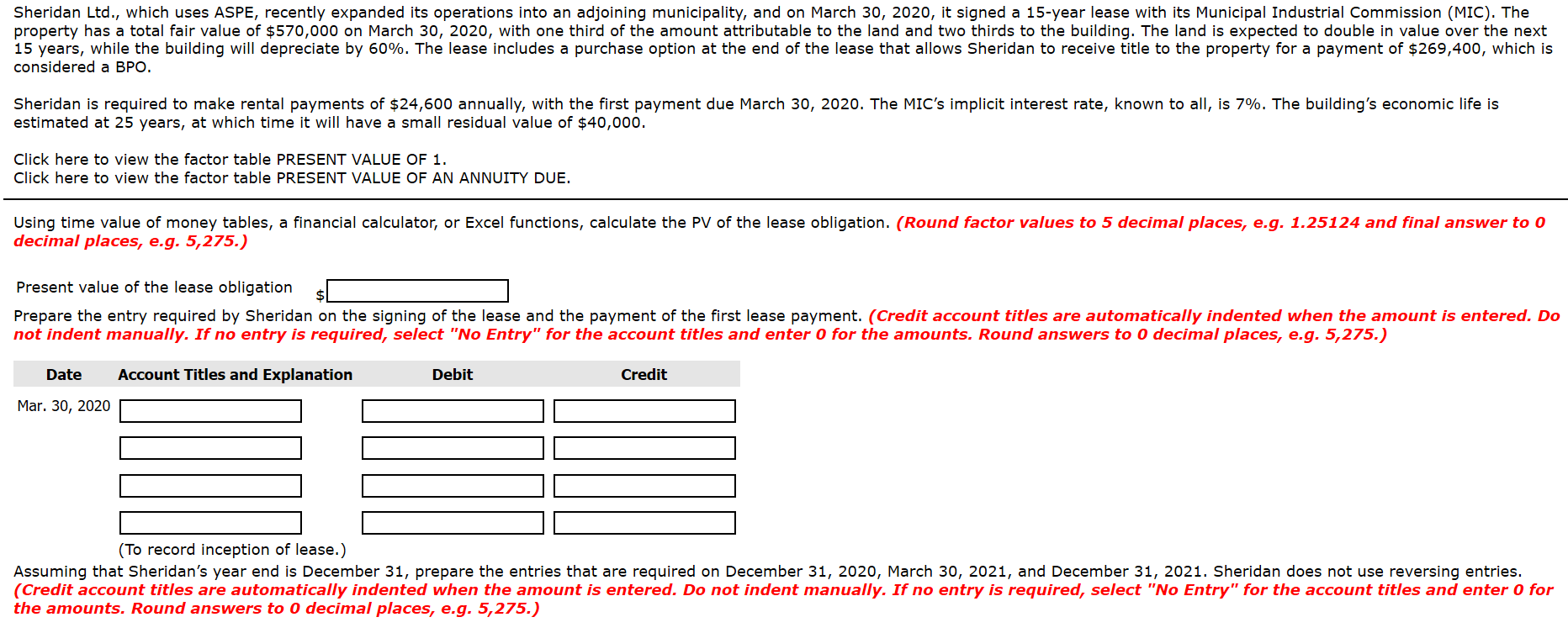

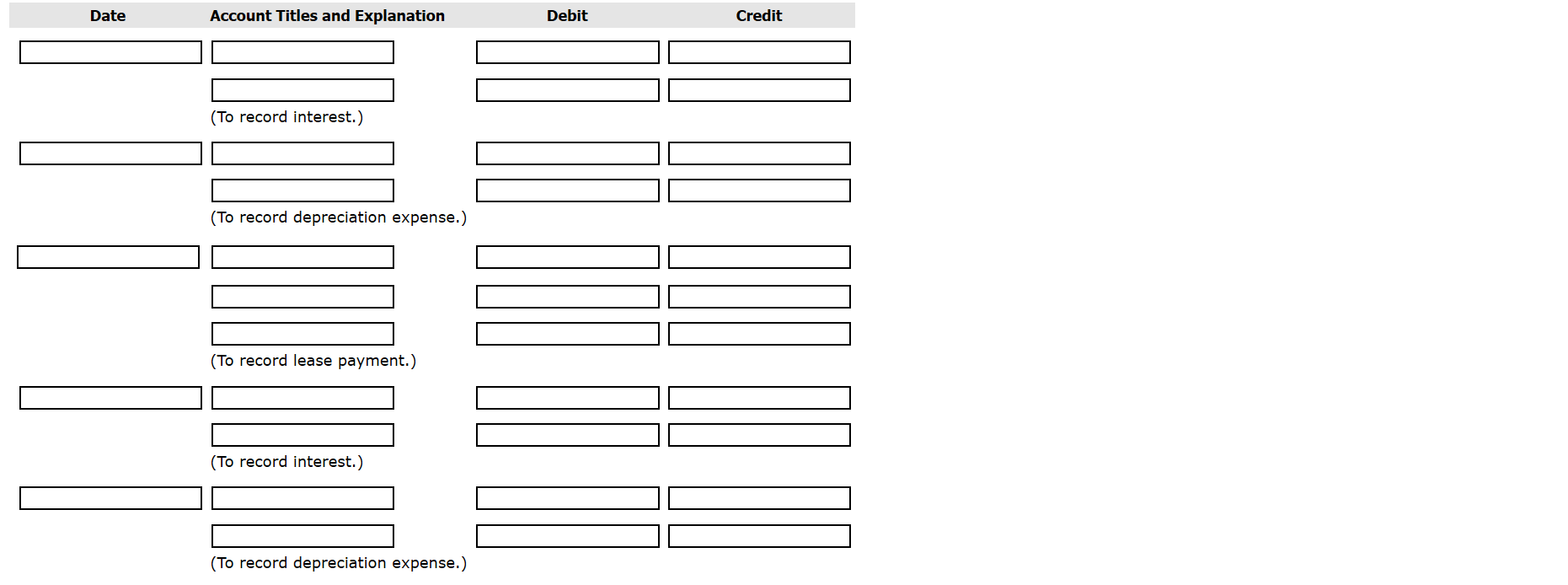

Sheridan Ltd., which uses ASPE, recently expanded its operations into an adjoining municipality, and on March 30, 2020, it signed a 15-year lease with its Municipal Industrial Commission (MIC). The property has a total fair value of $570,000 on March 30, 2020, with one third of the amount attributable to the land and two thirds to the building. The land is expected to double in value over the next 15 years, while the building will depreciate by 60%. The lease includes a purchase option at the end of the lease that allows Sheridan to receive title to the property for a payment of $269,400, which is considered a BPO. Sheridan is required to make rental payments of $24,600 annually, with the first payment due March 30, 2020. The MIC's implicit interest rate, known to all, is 7%. The building's economic life is estimated at 25 years, at which time it will have a small residual value of $40,000. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE. Using time value of money tables, a financial calculator, or Excel functions, calculate the PV of the lease obligation. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 5,275.) Present value of the lease obligation Prepare the entry required by Sheridan on the signing of the lease and the payment of the first lease payment. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to 0 decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Mar. 30, 2020 (To record inception of lease.) Assuming that Sheridan's year end is December 31, prepare the entries that are required on December 31, 2020, March 30, 2021, and December 31, 2021. Sheridan does not use reversing entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to 0 decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit (To record interest.) (To record depreciation expense.) (To record lease payment.) (To record interest.) 0 (To record depreciation expense.) Sheridan Ltd., which uses ASPE, recently expanded its operations into an adjoining municipality, and on March 30, 2020, it signed a 15-year lease with its Municipal Industrial Commission (MIC). The property has a total fair value of $570,000 on March 30, 2020, with one third of the amount attributable to the land and two thirds to the building. The land is expected to double in value over the next 15 years, while the building will depreciate by 60%. The lease includes a purchase option at the end of the lease that allows Sheridan to receive title to the property for a payment of $269,400, which is considered a BPO. Sheridan is required to make rental payments of $24,600 annually, with the first payment due March 30, 2020. The MIC's implicit interest rate, known to all, is 7%. The building's economic life is estimated at 25 years, at which time it will have a small residual value of $40,000. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE. Using time value of money tables, a financial calculator, or Excel functions, calculate the PV of the lease obligation. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 5,275.) Present value of the lease obligation Prepare the entry required by Sheridan on the signing of the lease and the payment of the first lease payment. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to 0 decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Mar. 30, 2020 (To record inception of lease.) Assuming that Sheridan's year end is December 31, prepare the entries that are required on December 31, 2020, March 30, 2021, and December 31, 2021. Sheridan does not use reversing entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to 0 decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit (To record interest.) (To record depreciation expense.) (To record lease payment.) (To record interest.) 0 (To record depreciation expense.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts