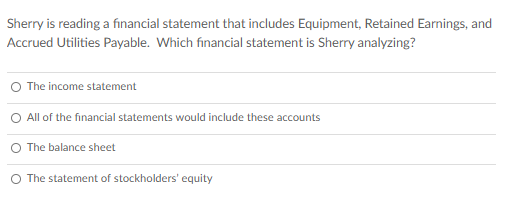

Question: Sherry is reading a financial statement that includes Equipment, Retained Earnings, and Accrued Utilities Payable. Which financial statement is Sherry analyzing? The income statement All

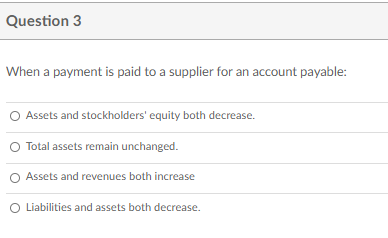

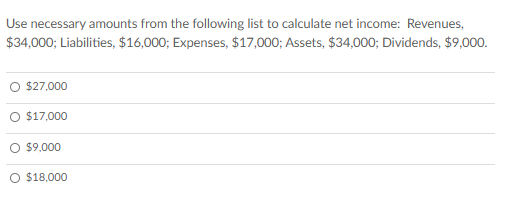

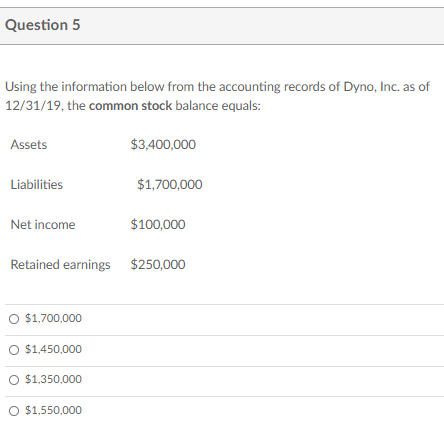

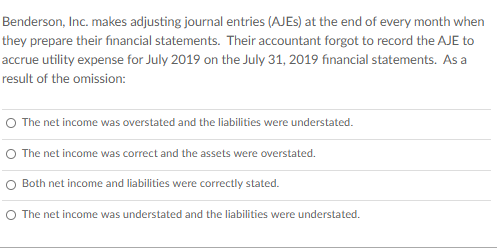

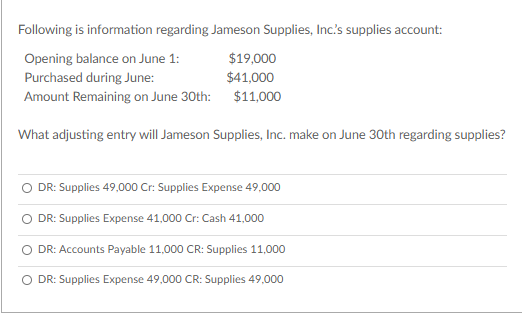

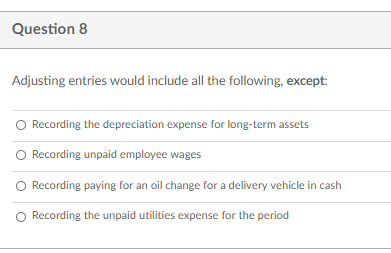

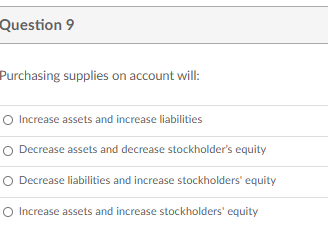

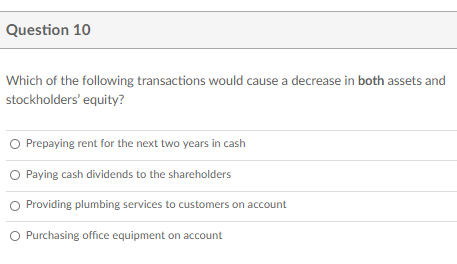

Sherry is reading a financial statement that includes Equipment, Retained Earnings, and Accrued Utilities Payable. Which financial statement is Sherry analyzing? The income statement All of the financial statements would include these accounts The balance sheet The statement of stockholders' equity Question 3 When a payment is paid to a supplier for an account payable: Assets and stockholders' equity both decrease. Total assets remain unchanged. Assets and revenues both increase Liabilities and assets both decrease. Use necessary amounts from the following list to calculate net income: Revenues, $34,000; Liabilities, $16,000; Expenses, $17,000; Assets, $34,000; Dividends, $9,000. O $27,000 O $17,000 $9.000 O $18,000 Question 5 Using the information below from the accounting records of Dyno, Inc. as of 12/31/19, the common stock balance equals: Assets $3,400,000 Liabilities $1,700,000 Net income $100,000 Retained earnings $250,000 O $1,700,000 $1,450,000 O $1,350,000 O $1,550,000 Benderson, Inc. makes adjusting journal entries (AJES) at the end of every month when they prepare their financial statements. Their accountant forgot to record the AJE to accrue utility expense for July 2019 on the July 31, 2019 financial statements. As a result of the omission: The net income was overstated and the liabilities were understated. The net income was correct and the assets were overstated. Both net income and liabilities were correctly stated. The net income was understated and the liabilities were understated. Following is information regarding Jameson Supplies, Inc's supplies account: Opening balance on June 1: $19,000 Purchased during June: $41,000 Amount Remaining on June 30th: $11,000 What adjusting entry will Jameson Supplies, Inc. make on June 30th regarding supplies? DR: Supplies 49,000 Cr: Supplies Expense 49,000 O DR: Supplies Expense 41,000 Cr: Cash 41,000 O DR: Accounts Payable 11,000 CR: Supplies 11,000 O DR: Supplies Expense 49,000 CR: Supplies 49.000 Question 8 Adjusting entries would include all the following, except: Recording the depreciation expense for long-term assets Recording unpaid employee wages Recording paying for an oil change for a delivery vehicle in cash Recording the unpaid utilities expense for the period Question 9 Purchasing supplies on account will: Increase assets and increase liabilities Decrease assets and decrease stockholder's equity Decrease liabilities and increase stockholders' equity Increase assets and increase stockholders' equity Question 10 Which of the following transactions would cause a decrease in both assets and stockholders' equity? Prepaying rent for the next two years in cash Paying cash dividends to the shareholders Providing plumbing services to customers on account O Purchasing office equipment on account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts