Question: Short Answer (20 marks; 2 marks for each question) 1) Webster and Words manage a product with a 3.5 degree of operating leverage Sales of

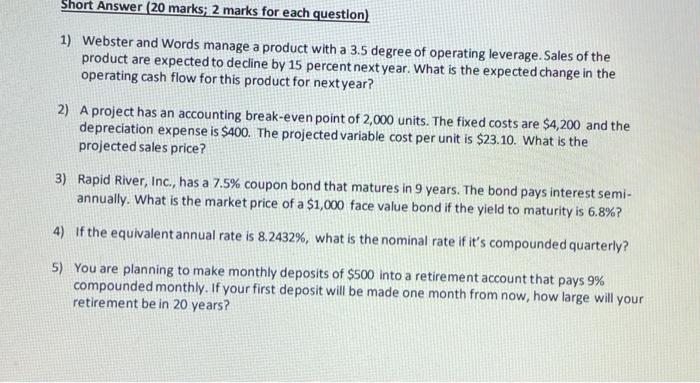

Short Answer (20 marks; 2 marks for each question) 1) Webster and Words manage a product with a 3.5 degree of operating leverage Sales of the product are expected to decline by 15 percent next year. What is the expected change in the operating cash flow for this product for next year? 2) A project has an accounting break-even point of 2,000 units. The fixed costs are $4,200 and the depreciation expense is $400. The projected variable cost per unit is $23.10. What is the projected sales price? 3) Rapid River, Inc., has a 7.5% coupon bond that matures in 9 years. The bond pays interest semi- annually. What is the market price of a $1,000 face value bond if the yield to maturity is 6.8%? 4) If the equivalent annual rate is 8.2432%, what is the nominal rate if it's compounded quarterly? 5) You are planning to make monthly deposits of $500 into a retirement account that pays 9% compounded monthly. If your first deposit will be made one month from now, how large will your retirement be in 20 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts