Question: short answer please Question no 2 Mark and co. are selling a machine they acquire at the cost of $500,000; the freight and installation charges

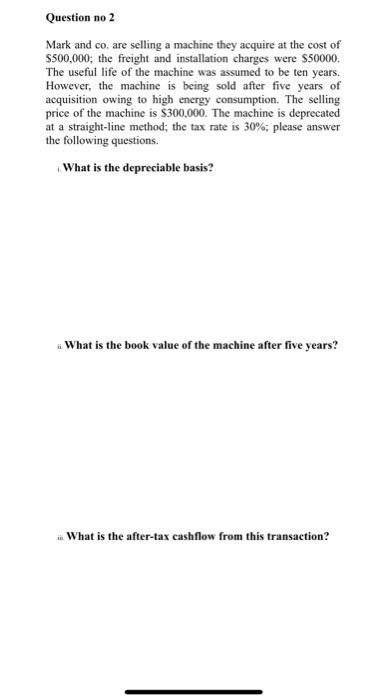

Question no 2 Mark and co. are selling a machine they acquire at the cost of $500,000; the freight and installation charges were $50000. The useful life of the machine was assumed to be ten years. However, the machine is being sold after five years of acquisition owing to high energy consumption. The selling price of the machine is $300,000. The machine is deprecated at a straight-line method; the tax rate is 30%; please answer the following questions. What is the depreciable basis? What is the book value of the machine after five years? What is the after-tax cashflow from this transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts