Question: Short Answer Question 3: Table 3 provides the most recent financial values for Firm Z. The CFO wants to implement strategic and operational changes that

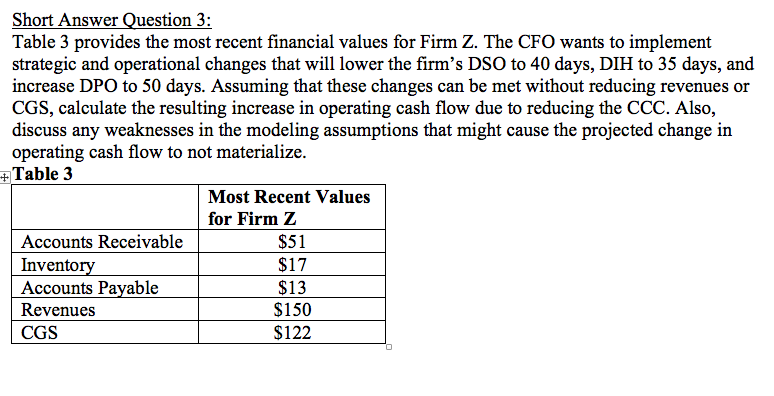

Short Answer Question 3: Table 3 provides the most recent financial values for Firm Z. The CFO wants to implement strategic and operational changes that will lower the firm's DSO to 40 days, DIH to 35 days, and increase DPO to 50 days. Assuming that these changes can be met without reducing revenues or CGS, calculate the resulting increase in operating cash flow due to reducing the CCC. Also, discuss any weaknesses in the modeling assumptions that might cause the projected change in operating cash flow to not materialize. + Table 3 Most Recent Values for Firm Z Accounts Receivable Inventory $17 Accounts Payable $13 Revenues $150 CGS $122 $51

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts