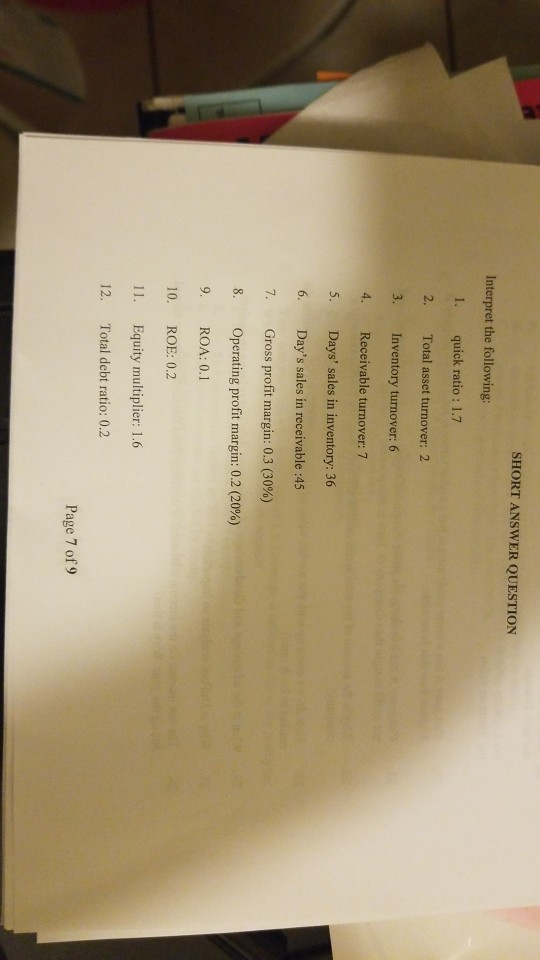

Question: SHORT ANSWER QUESTION Interpret the following: 1. quick ratio : 1.7 2. Total asset turnover: 2 3. Inventory turnover: 6 4. Receivable turnover:7 5. Days'

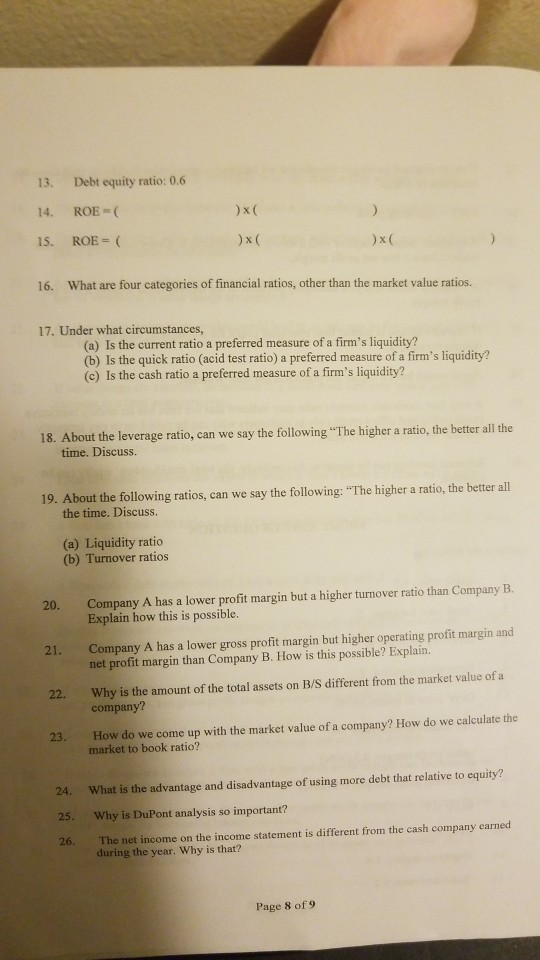

SHORT ANSWER QUESTION Interpret the following: 1. quick ratio : 1.7 2. Total asset turnover: 2 3. Inventory turnover: 6 4. Receivable turnover:7 5. Days' sales in inventory: 36 6. Day's sales in receivable:45 7, Gross profit margin: 0.3 (30%) Operating profit margin: 0.2 (20%) 9. ROA:0.1 10. ROE: 0.2 11. Equity multiplier: 1.6 12. Total debt ratio: 0.2 Page 7 of 9 13. Debt equity ratio: 0.6 14. ROE 1S. ROE-( 16. What are four categories of financial ratios, other than the market value ratios. 17. Under what circumstances (a) Is the current ratio a preferred measure of a firm's liquidity? (b) Is the quick ratio (acid test ratio) a preferred measure of a firm's liquidity? (c) Is the cash ratio a preferred measure of a firm's liquidity? 18. About the leverage ratio, can we say the following "The higher a ratio, the better all the time. Discuss. 19. About the following ratios, can we say the following: "The higher a ratio, the better all the time. Discuss. (a) Liquidity ratio (b) Turnover ratios Company A has a lower profit margin but a higher turnover ratio than Company B. Explain how this is possible. 20. Company A has a lower gross profit margin but higher operating profit margin and net profit margin than Company B. How is this possible? Explain. 21. Why is the amount of the total assets on B/S different from the market value of a company? 22. How do we come up with the market value of a company? How do we calculate the market to book ratio? 23. 24. 25. 26. What is the advantage and disadvantage of using more debt that relative to equity? Why is DuPont analysis so important? The net income on the income statement is different from the cash company earned during the year. Why is that? Page 8 of9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts