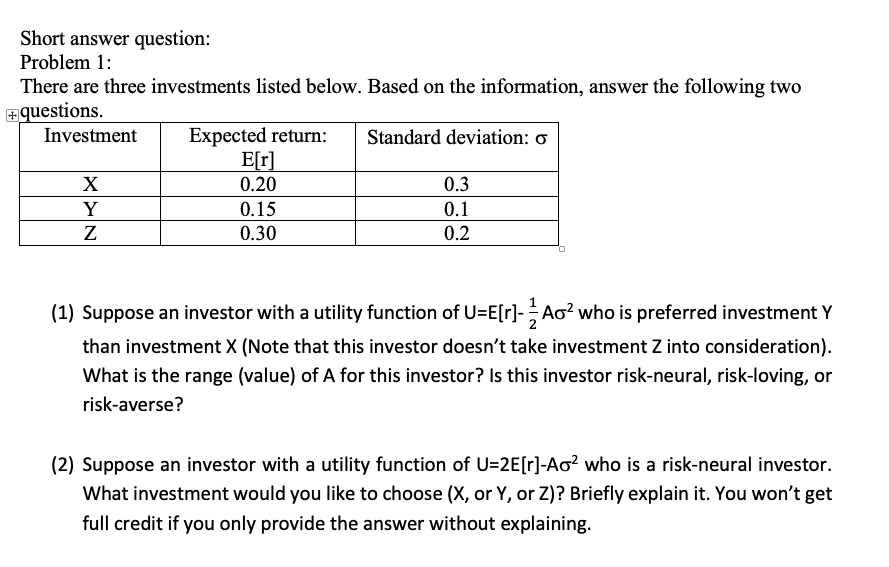

Question: Short answer question: Problem 1: There are three investments listed below. Based on the information, answer the following two questions. Investment Expected return: Standard deviation:

Short answer question: Problem 1: There are three investments listed below. Based on the information, answer the following two questions. Investment Expected return: Standard deviation: o E[r] X 0.20 0.3 Y 0.15 0.1 Z 0.30 0.2 (1) Suppose an investor with a utility function of U=E[r]. Ao? who is preferred investment Y than investment X (Note that this investor doesn't take investment Z into consideration). What is the range (value) of A for this investor? Is this investor risk-neural, risk-loving, or risk-averse? (2) Suppose an investor with a utility function of U=2E[r]-Ag? who is a risk-neural investor. What investment would you like to choose (X, or Y, or Z)? Briefly explain it. You won't get full credit if you only provide the answer without explaining. Short answer question: Problem 1: There are three investments listed below. Based on the information, answer the following two questions. Investment Expected return: Standard deviation: o E[r] X 0.20 0.3 Y 0.15 0.1 Z 0.30 0.2 (1) Suppose an investor with a utility function of U=E[r]. Ao? who is preferred investment Y than investment X (Note that this investor doesn't take investment Z into consideration). What is the range (value) of A for this investor? Is this investor risk-neural, risk-loving, or risk-averse? (2) Suppose an investor with a utility function of U=2E[r]-Ag? who is a risk-neural investor. What investment would you like to choose (X, or Y, or Z)? Briefly explain it. You won't get full credit if you only provide the answer without explaining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts