Question: Short Answer Questions (5 points each) General Instructions: The financial statements are in the Appendix and figures are all in millions. Any of your answers

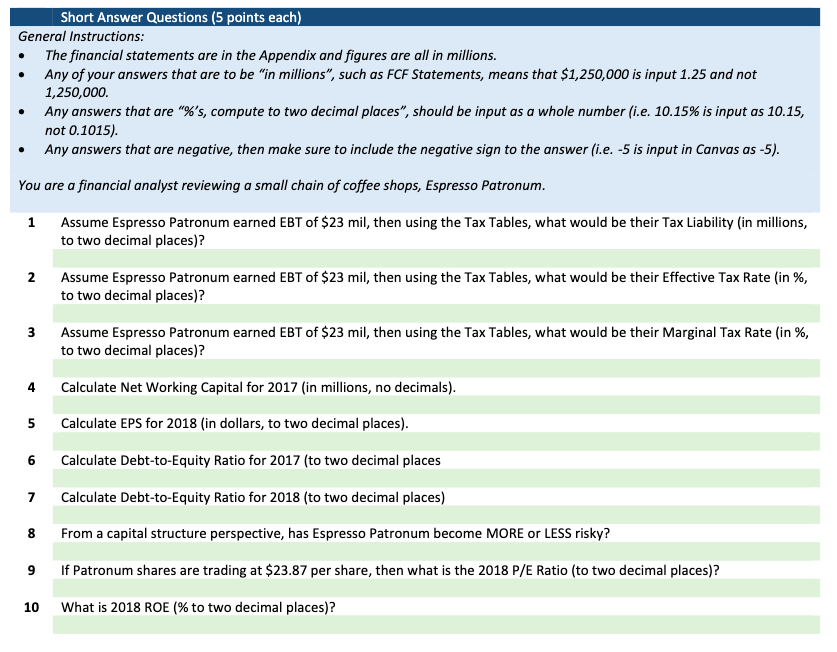

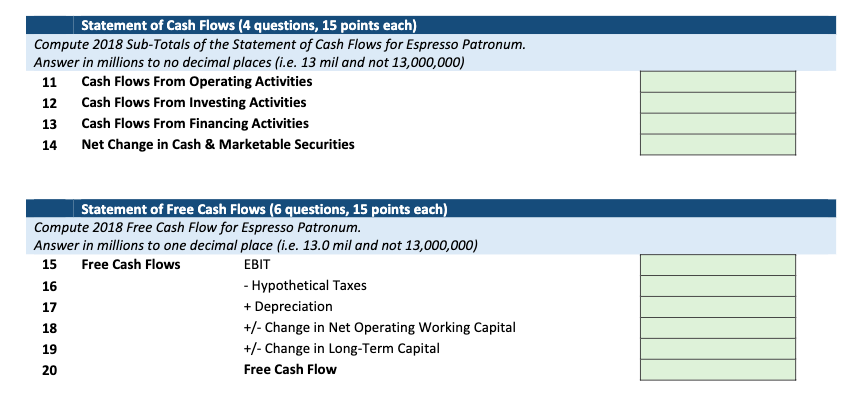

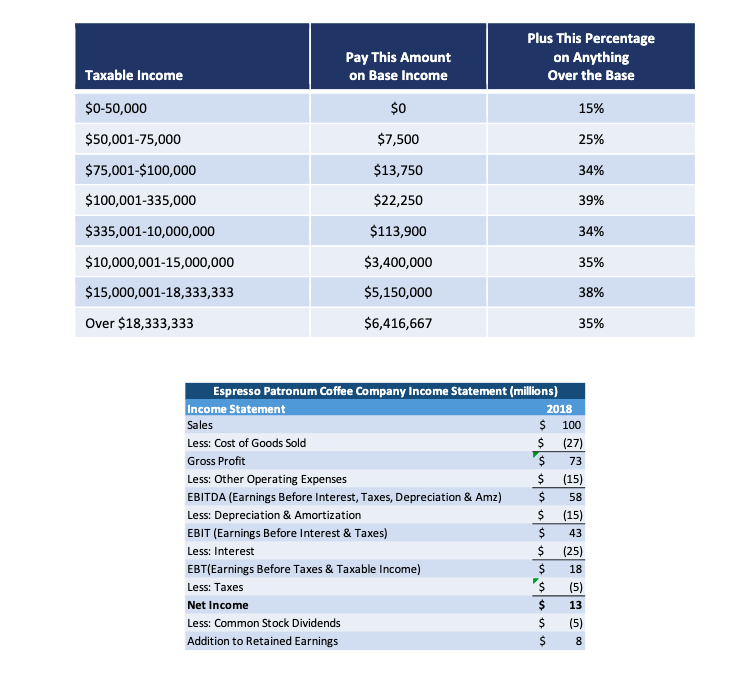

Short Answer Questions (5 points each) General Instructions: The financial statements are in the Appendix and figures are all in millions. Any of your answers that are to be "in millions", such as FCF Statements, means that $1,250,000 is input 1.25 and not 1,250,000 Any answers that are "%s, compute to two decimal places", should be input as a whole number (i.e. 10.15% is input as 10.15, not 0.1015) Any answers that are negative, then make sure to include the negative sign to the answer (i.e. -5 is input in Canvas as -5). You are a financial analyst reviewing a small chain of coffee shops, Espresso Patronum. 1 Assume Espresso Patronum earned EBT of $23 mil, then using the Tax Tables, what would be their Tax Liability (in millions, to two decimal places)? 2 Assume Espresso Patronum earned EBT of $23 mil, then using the Tax Tables, what would be their Effective Tax Rate (in %, to two decimal places)? 3 Assume Espresso Patronum earned EBT of $23 mil, then using the Tax Tables, what would be their Marginal Tax Rate (in %, to two decimal places)? 4 Calculate Net Working Capital for 2017 (in millions, no decimals). 5 Calculate EPS for 2018 (in dollars, to two decimal places). 6 Calculate Debt-to-Equity Ratio for 2017 (to two decimal places 7 Calculate Debt-to-Equity Ratio for 2018 (to two decimal places) 8 From a capital structure perspective, has Espresso Patronum become MORE or LESS risky? 9 If Patronum shares are trading at $23.87 per share, then what is the 2018 P/E Ratio (to two decimal places)? 10 What is 2018 ROE (% to two decimal places)? Statement of Cash Flows (4 questions, 15 points each) Compute 2018 Sub-Totals of the Statement of Cash Flows for Espresso Patronum. Answer in millions to no decimal places (i.e. 13 mil and not 13,000,000) 11 Cash Flows From Operating Activities 12 Cash Flows From Investing Activities 13 Cash Flows From Financing Activities 14 Net Change in Cash & Marketable Securities Statement of Free Cash Flows (6 questions, 15 points each) Compute 2018 Free Cash Flow for Espresso Patronum. Answer in millions to one decimal place (i.e. 13.0 mil and not 13,000,000) 15 Free Cash Flows EBIT 16 - Hypothetical Taxes 17 + Depreciation 18 +/- Change in Net Operating Working Capital +/- Change in Long-Term Capital Free Cash Flow 19 20 Pay This Amount on Base Income $0 $7,500 Plus This Percentage on Anything Over the Base 15% 25% $13,750 34% Taxable Income $0-50,000 $50,001-75,000 $75,001-$100,000 $100,001-335,000 $335,001-10,000,000 $10,000,001-15,000,000 $15,000,001-18,333,333 Over $18,333,333 $22,250 39% $113,900 34% 35% $3,400,000 $5,150,000 38% $6,416,667 35% Espresso Patronum Coffee Company Income Statement (millions) Income Statement 2018 Sales $ 100 Less: Cost of Goods Sold $ (27) Gross Profit 73 Less: Other Operating Expenses $ (15) EBITDA (Earnings Before Interest, Taxes, Depreciation & Amz) $ 58 Less: Depreciation & Amortization $ (15) EBIT (Earnings Before Interest & Taxes) $ 43 Less: Interest $ (25) EBT(Earnings Before Taxes & Taxable income) $ Less: Taxes $ (5) Net Income $ 13 Less: Common Stock Dividends $ (5) Addition to Retained Earnings nonnnuuniniu 18 8 Assets Current Assets Cash Accounts Receivable Inventory Total Espresso Patronum Coffee Company Balance Sheet (millions) 2018 2017 Liabilities & Equity 2018 2017 $ 55 $ 50 Current Liabilities Accrued Wages & Taxes $ 12 $ 10 $ 10 $ 20 Accounts Payable $ 10 $ $ 120 $ 100 Notes Payable $ 5 $ 10 $ 185 $ 170 Total $ 27'$ 25 Fixed Assets 135 $ $ 185 $ 212 $ 160 Plant & Equipment Less: Depreciation Net Plant & Equip Other Fixed Assets $ $ $ $ 25 125 $ 65 Long-Term Debt (35) $ (20) Total Debt 90 $ 45 25 $ 25 Stockholder's Equity Common Stock* Retained Earnings Total Equity 300 $ 240 Total Liabilities & Equity *6 million common shares are outstanding 55 $ $ $ $ 25 $ 63 $ 88 $ 300 $ 80 Total Assets $ 240

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts