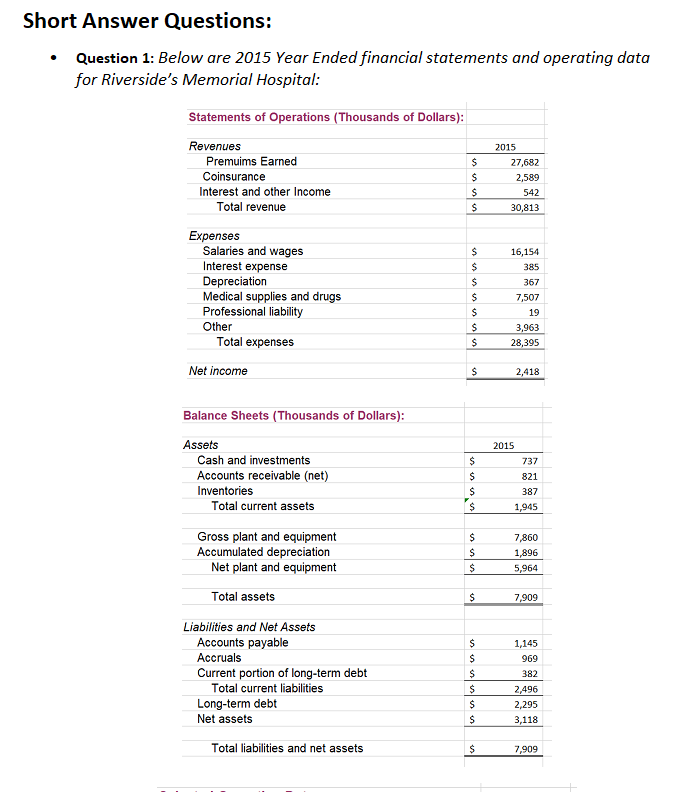

Question: Short Answer Questions: Question 1: Below are 2015 Year Ended financial statements and operating data for Riverside's Memorial Hospital: Statements of Operations (Thousands of Dollars):

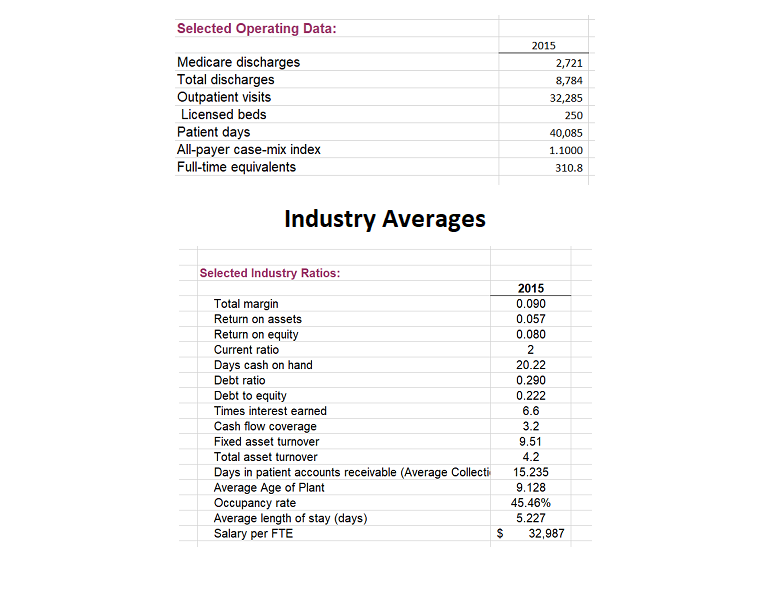

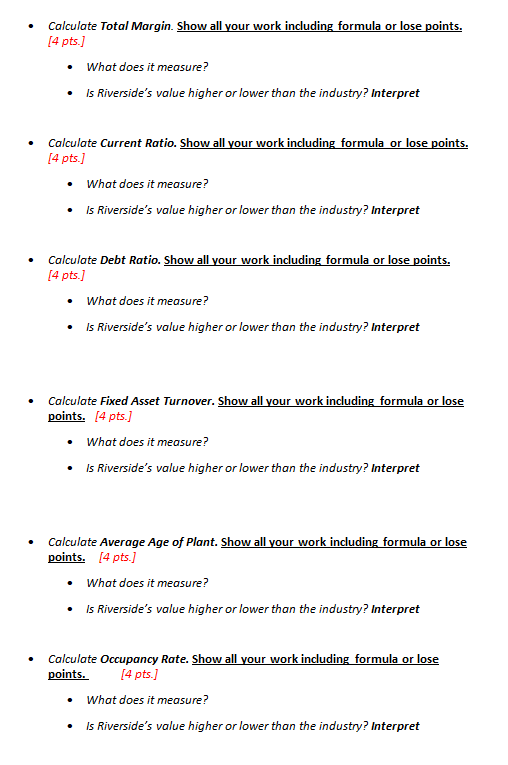

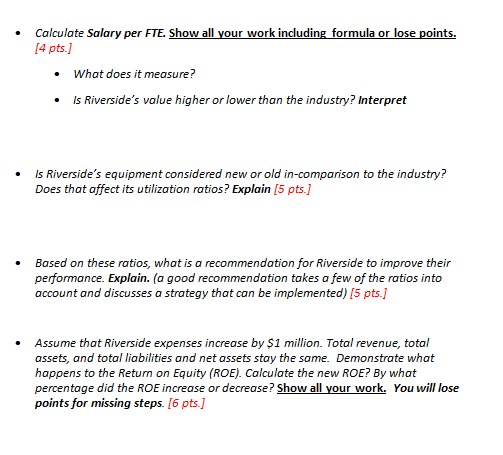

Short Answer Questions: Question 1: Below are 2015 Year Ended financial statements and operating data for Riverside's Memorial Hospital: Statements of Operations (Thousands of Dollars): Revenues Premuims Earned Coinsurance Interest and other Income Total revenue $ $ $ S 2015 27,682 2,589 542 30,813 > Expenses Salaries and wages Interest expense Depreciation Medical supplies and drugs Professional liability Other Total expenses Net income $ $ $ $ $ $ 16,154 385 367 7,507 19 3,963 28,395 $ 2,418 2015 Balance Sheets (Thousands of Dollars): Assets Cash and investments Accounts receivable (net) Inventories Total current assets $ $ $ $ 737 821 387 1,945 Gross plant and equipment Accumulated depreciation Net plant and equipment Total assets $ $ $ 7,860 1,896 5,964 $ 7,909 Liabilities and Net Assets Accounts payable Accruals Current portion of long-term debt Total current liabilities Long-term debt Net assets 1,145 969 382 $ $ $ $ $ $ 2,496 2,295 3,118 Total liabilities and net assets $ 7,909 Selected Operating Data: Medicare discharges Total discharges Outpatient visits Licensed beds Patient days All-payer case-mix index Full-time equivalents 2015 2,721 8,784 32,285 250 40,085 1.1000 310.8 Industry Averages Selected Industry Ratios: Total margin Return on assets Return on equity Current ratio Days cash on hand Debt ratio Debt to equity Times interest earned Cash flow coverage Fixed asset turnover Total asset turnover Days in patient accounts receivable (Average Collecti Average Age of Plant Occupancy rate Average length of stay (days) Salary per FTE 2015 0.090 0.057 0.080 2 20.22 0.290 0.222 6.6 3.2 9.51 4.2 15.235 9.128 45.46% 5.227 32,987 $ Calculate Total Margin. Show all your work including formula or lose points. [4 pts.) What does it measure? Is Riverside's value higher or lower than the industry? Interpret Calculate Current Ratio. Show all your work including formula or lose points. [4 pts.] What does it measure? Is Riverside's value higher or lower than the industry? Interpret Calculate Debt Ratio. Show all your work including formula or lose points. [4 pts.] What does it measure? Is Riverside's value higher or lower than the industry? Interpret Calculate Fixed Asset Turnover. Show all your work including formula or lose points. [4 pts.) What does it measure? Is Riverside's value higher or lower than the industry? Interpret Calculate Average Age of Plant. Show all your work including formula or lose points. [4 pts.) What does it measure? Is Riverside's value higher or lower than the industry? Interpret Calculate Occupancy Rate. Show all your work including formula or lose points. [4 pts.) What does it measure? Is Riverside's value higher or lower than the industry? Interpret Calculate Salary per FTE. Show all your work including formula or lose points. [4 pts.] What does it measure? Is Riverside's value higher or lower than the industry? Interpret Is Riverside's equipment considered new or old in-comparison to the industry? Does that affect its utilization ratios? Explain (5 pts.] Based on these ratios, what is a recommendation for Riverside to improve their performance. Explain. (a good recommendation takes a few of the ratios into account and discusses a strategy that can be implemented) [5 pts.] Assume that Riverside expenses increase by $1 million. Total revenue, total assets, and total liabilities and net assets stay the same. Demonstrate what happens to the Return on Equity (ROE). Calculate the new ROE? By what percentage did the ROE increase or decrease? Show all your work. You will lose points for missing steps. [6 pts.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts