Question: Short Case Study ST 4 . 2 on page 2 0 1 of your textbook about a loan solicitation offer of $ 2 , 0

Short Case Study ST on page of your textbook about a loan solicitation offer of $ equal payments of $ each, etc. pts out total available points

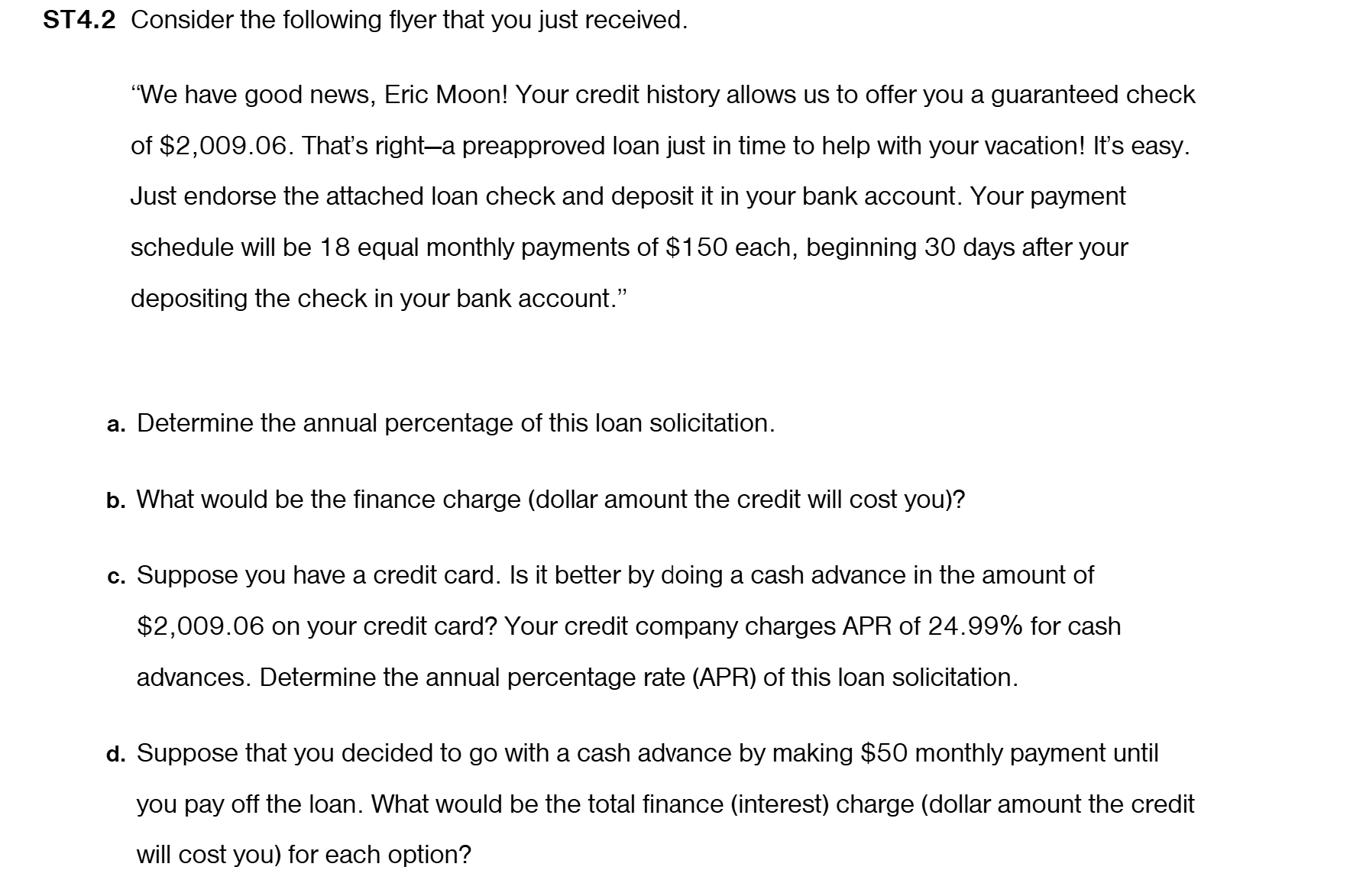

Consider the following flyer that you just received.

We have good news, Eric Moon! Your credit history allows us to offer you a guaranteed check of $ Thats righta preapproved loan just in time to help with your vacation! Its easy. Just endorse the attached loan check and deposit it in your bank account. Your payment schedule will be equal monthly payments of $ each, beginning days after your depositing the check in your bank account.

Determine the annual percentage of this loan solicitation.

What would be the finance charge dollar amount the credit will cost you

Suppose you have a credit card. Is it better by doing a cash advance in the amount of $ on your credit card? Your credit company charges APR of for cash advances. Determine the annual percentage rate APR of this loan solicitation.

Suppose that you decided to go with a cash advance by making $ monthly payment until you pay off the loan. What would be the total finance interest charge dollar amount the credit will cost you for each option?

Please ensure you are not using your textbook's international andor wrong version. You will lose a huge amount of valuable points if you use the wrong numbers.

Please submit a single Excel file with three tabs in it one tab for each case study.

Please show all your work clearly factor notations, working not screenshots Excel, andor mathematical formulas.

The more organized your work is the more chances to get a higher score. ST Consider the following flyer that you just received.

We have good news, Eric Moon! Your credit history allows us to offer you a guaranteed check of $ That's righta preapproved loan just in time to help with your vacation! It's easy. Just endorse the attached loan check and deposit it in your bank account. Your payment schedule will be equal monthly payments of $ each, beginning days after your depositing the check in your bank account."

a Determine the annual percentage of this loan solicitation.

b What would be the finance charge dollar amount the credit will cost you

c Suppose you have a credit card. Is it better by doing a cash advance in the amount of $ on your credit card? Your credit company charges APR of for cash advances. Determine the annual percentage rate APR of this loan solicitation.

d Suppose that you decided to go with a cash advance by making $ monthly payment until you pay off the loan. What would be the total finance interest charge dollar amount the credit will cost you for each option? Short Case Study ST on page of your textbook about a loan solicitation offer of $ equal payments of $ each, etc. pts out total available points

Short Case Study ST on page of your textbook about buying a home worth of $ with a downpayment of $ etc. pts out total available points

Please ensure you are not using your textbook's international andor wrong version. You will lose a huge amount of valuable points if you use the wrong numbers.

Please submit a single Excel file with three tabs in it one tab for each case study.

Please show all your work clearly factor notations, working not screenshots Excel, andor mathematical formulas.

The more organized your work is the more chances to get a higher score.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock