Question: Short explaining for the choices For calculation questions, include the steps how you get the result for each question. For journal entry questions, provide the

- Short explaining for the choices

- For calculation questions, include the steps how you get the result for each question.

- For journal entry questions, provide the complete journal entry for the question;

- for the conceptual questions, explain the reason why you choose the one.

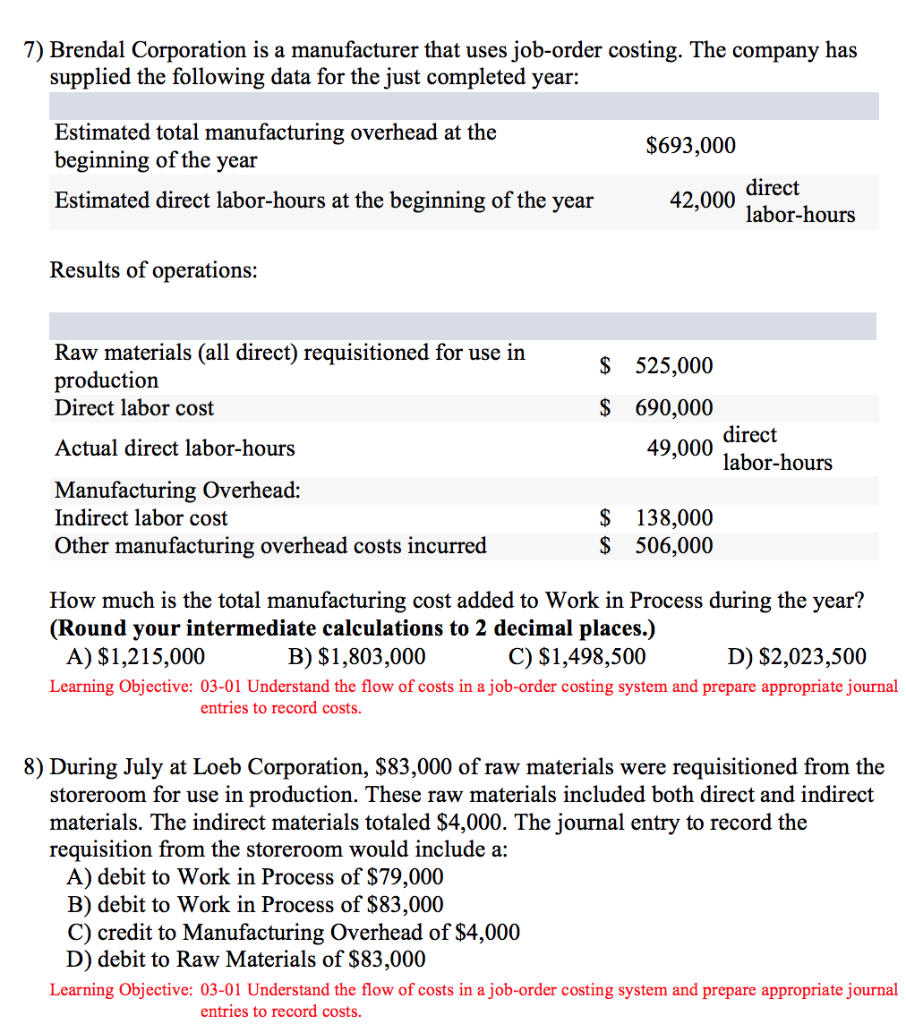

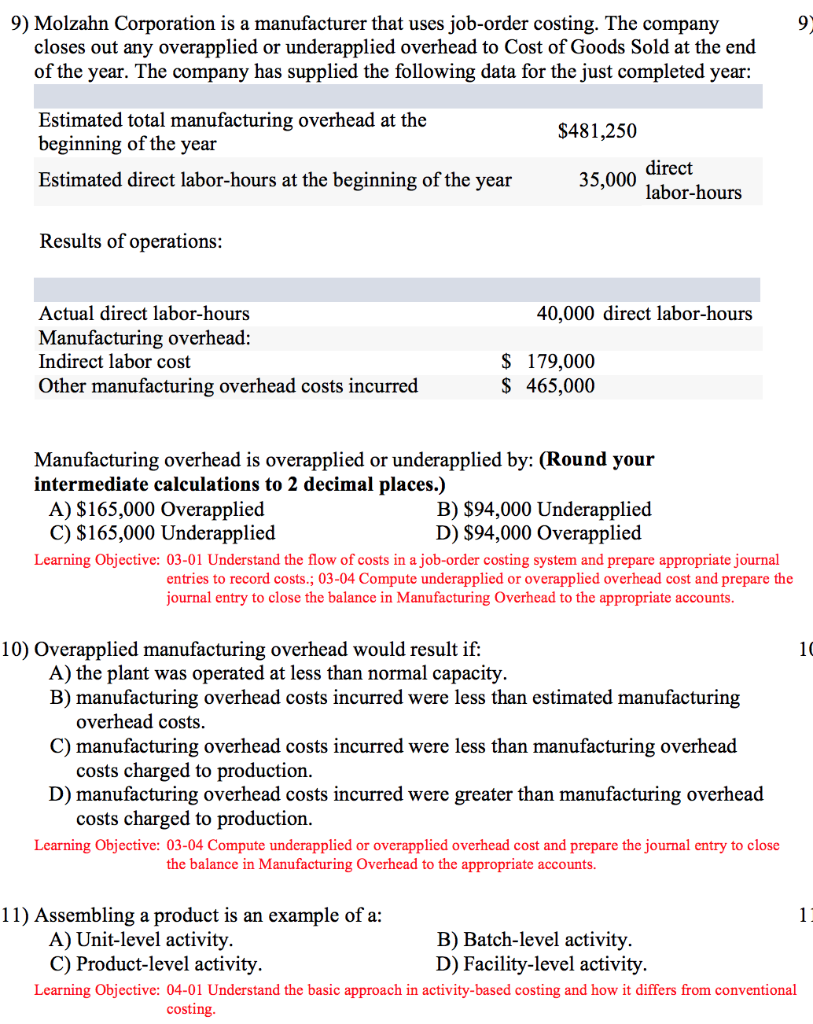

7) Brendal Corporation is a manufacturer that uses job-order costing. The company has supplied the following data for the just completed year: Estimated total manufacturing overhead at the beginning of the year Estimated direct labor-hours at the beginning of the year $693,000 42,000 direct labor-hours Results of operations: Raw materials (all direct) requisitioned for use in production Direct labor cost S 525,000 $ 690,000 49,000 direct labor-hours Actual direct labor-hours Manufacturing Overhead: Indirect labor cost Other manufacturing overhead costs incurred $ 138,000 S 506,000 How much is the total manufacturing cost added to Work in Process during the year? (Round your intermediate calculations to 2 decimal places.) B) $1,803,000 A) $1,215,000 Learning Objective: 03-01 Understand the flow of costs in a job-order costing system and prepare appropriate journal C) $1,498,500 D) $2,023,500 entries to record costs. 8) During July at Loeb Corporation, $83,000 of raw materials were requisitioned from the storeroom for use in production. These raw materials included both direct and indirect materials. The indirect materials totaled $4,000. The journal entry to record the requisition from the storeroom would include a: A) debit to Work in Process of $79,000 B) debit to Work in Process of $83,000 C) credit to Manufacturing Overhead of $4,000 D) debit to Raw Materials of $83,000 Learning Objective: 03-01 Understand the flow of costs in a job-order costing system and prepare appropriate journal entries to record costs. 9) Molzahn Corporation is a manufacturer that uses job-order costing. The company closes out any overapplied or underapplied overhead to Cost of Goods Sold at the end of the year. The company has supplied the following data for the just completed year: Estimated total manufacturing overhead at the beginning of the year $481,250 Estimated direct labor-hours at the beginning of the year 35,000 direct labor-hours Results of operations: Actual direct labor-hours Manufacturing overhead Indirect labor cost Other manufacturing overhead costs incurred 40,000 direct labor-hours $ 179,000 S 465,000 Manufacturing overhead is overapplied or underapplied by: (Round your intermediate calculations to 2 decimal places.) A) S165,000 Overapplied C) S165,000 Underapplied B) S94,000 Underapplied D) S94,000 Overapplied Learning Objective: 03-01 Understand the flow of costs in a job-order costing system and prepare appropriate journal entries to record costs.; 03-04 Compute underapplied or overapplied overhead cost and prepare the ournal entry to close the balance in Manufacturing Overhead to the appropriate accounts. 10) Overapplied manufacturing overhead would result if: 1( A) the plant was operated at less than normal capacity. B) manufacturing overhead costs incurred were less than estimated manufacturing overhead costs costs charged to production costs charged to production C) manufacturing overhead costs incurred were less than manufacturing overhead D) manufacturing overhead costs incurred were greater than manufacturing overhead Learning Objective: 03-04 Compute underapplied or overapplied overhead cost and prepare the journal entry to close the balance in Manufacturing Overhead to the appropriate accounts. 11) Assembling a product is an example of a: A) Unit-level activity. C) Product-level activity. B) Batch-level activity. D) Facility-level activity Learning Objective: 04-01 Understand the basic approach in activity-based costing and how it differs from conventional costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts