Question: Short Numerical Problems Problem 1 (10 points) . A mutual fund manager is offering a portfolio that will provide return of 6%, 8%, 12%, and

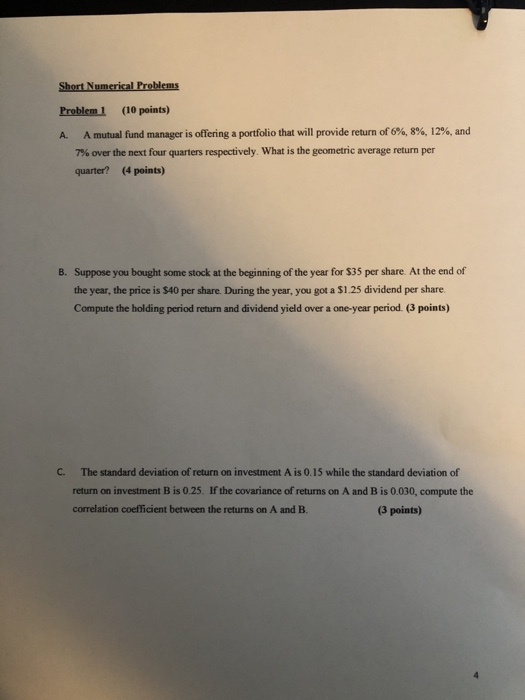

Short Numerical Problems Problem 1 (10 points) . A mutual fund manager is offering a portfolio that will provide return of 6%, 8%, 12%, and 7% over the next four quarters respectively. What is the geometric average return per quarter? (4 points) B. Suppose you bought some stock at the beginning of the year for $35 per share. At the end of the year, the price is $40 per share. During the year, you got a $1.25 dividend per share. Compute the holding period return and dividend yield over a one-year period. (3 points) C. The standard deviation of return on investment A is 0.15 while the standard deviation of return on investment B is 0.25. If the covariance of returns on A and B is 0.030, compute the correlation coefficient between the returns on A and B. (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts