Question: Short-term borrowing, when needed, is done at the beginning of the month in increments of $1,000. The annual interest rate on any such loans

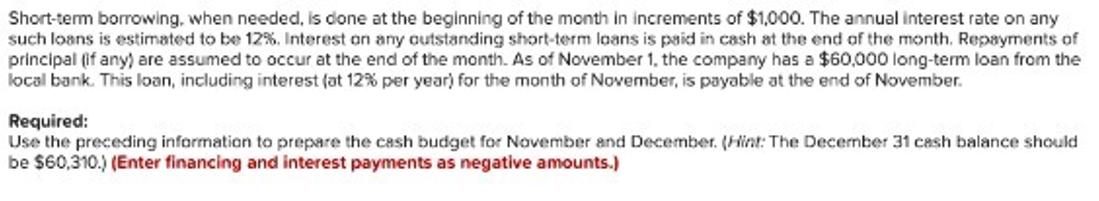

Short-term borrowing, when needed, is done at the beginning of the month in increments of $1,000. The annual interest rate on any such loans is estimated to be 12%. Interest on any outstanding short-term loans is paid in cash at the end of the month. Repayments of principal (if any) are assumed to occur at the end of the month. As of November 1, the company has a $60,000 long-term loan from the local bank. This loan, including interest (at 12% per year) for the month of November, is payable at the end of November. Required: Use the preceding information to prepare the cash budget for November and December. (Hint: The December 31 cash balance should be $60,310.) (Enter financing and interest payments as negative amounts.)

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

To prepare the cash budget for November and December we need to estimate the companys cash inflows a... View full answer

Get step-by-step solutions from verified subject matter experts