Question: Should be formatted like this Directions: 1. Read each question carefully 2. SHOW ALL WORK! 3. Label your answer clearly. 1. CAPITAL BUDGETING -- THE

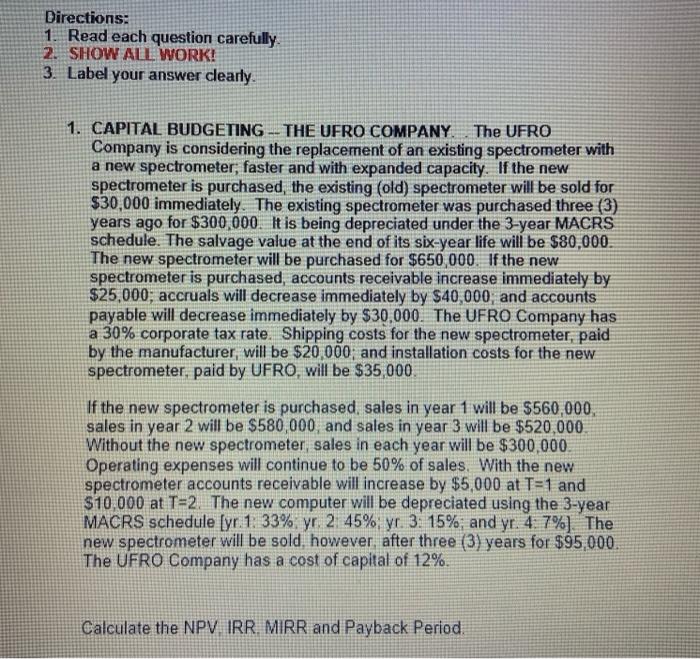

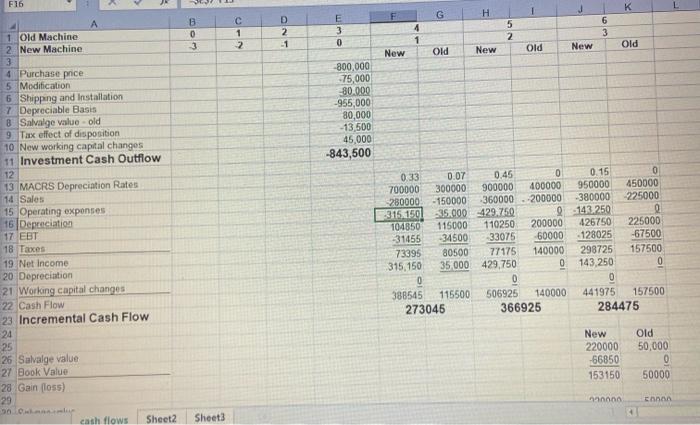

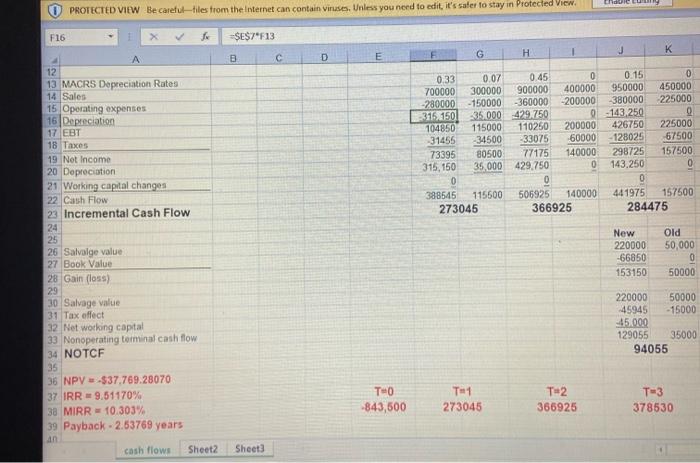

Directions: 1. Read each question carefully 2. SHOW ALL WORK! 3. Label your answer clearly. 1. CAPITAL BUDGETING -- THE UFRO COMPANY. The UFRO Company is considering the replacement of an existing spectrometer with a new spectrometer, faster and with expanded capacity. If the new spectrometer is purchased the existing (old) spectrometer will be sold for $30,000 immediately. The existing spectrometer was purchased three (3) years ago for $300.000. It is being depreciated under the 3-year MACRS schedule. The salvage value at the end of its six-year life will be $80,000. The new spectrometer will be purchased for $650,000. If the new spectrometer is purchased, accounts receivable increase immediately by $25,000; accruals will decrease immediately by $40,000, and accounts payable will decrease immediately by $30,000. The UFRO Company has a 30% corporate tax rate. Shipping costs for the new spectrometer, paid by the manufacturer will be $20 000 and installation costs for the new spectrometer, paid by UFRO, will be $35,000. If the new spectrometer is purchased, sales in year 1 will be $560,000, sales in year 2 will be $580,000, and sales in year 3 will be $520,000 Without the new spectrometer sales in each year will be $300,000 Operating expenses will continue to be 50% of sales. With the new spectrometer accounts receivable will increase by $5,000 at T=1 and $10,000 at T=2. The new computer will be depreciated using the 3-year MACRS schedule [yr. 1. 33% yr 2 45% yr 3. 15%, and yr. 4:7%). The new spectrometer will be sold, however after three (3) years for $95,000 The UFRO Company has a cost of capital of 12%. Calculate the NPV IRR. MIRR and Payback Period. F16 K H . G 1 2 D 2 E 3 0 5 2 6 3 AN 3 Old Old New Old New New 800,000 -75,000 80.000 -955,000 80,000 -13,500 45,000 -843,500 1. Old Machine 2 New Machine 3 4 Purchase price 5 Modification 6 Shipping and Installation 7 Depreciable Basis 8 Salvalge value old 9. Tax effect of disposition 10 New working capital changes 11 Investment Cash Outflow 12 13 MACRS Depreciation Rates 14 Sales 15 Operating exponses 16 Depreciation 17 EBT 18 Taxes 19 Net Income 20 Depreciation 21 Working capital changes 22 Cash Flow 23 Incremental Cash Flow -24 25 26 Salvalge value 27 Book Value 28 Gain (loss) 29 90 . cash flows Sheet2 0.33 0.07 0.45 0 700000 300000 900000 400000 280000 - 150000 360000 200000 -315.150 35.000429.750 9 104850 115000 110250 200000 31455 34500 33075 -60000 73395 80500 77175 140000 315,150 35 000 429.750 0 0 0 388545 115500 506925 140000 273046 366925 0.15 950000 -380000 143.250 426750 128025 298725 143,250 0 450000 225000 0 225000 -67500 157500 0 441975 157500 284475 Old 50,000 New 220000 -66850 153150 50000 non CA Sheets Choice PROTECTED VIEW Be careful-files from the Internet can contain Viruses. Unless you need to edit it's safer to stay in Protected View F16 -$E$7*F13 K 3 D H E G 0.33 0.07 0.45 0 0.15 0 700000 300000 900000 400000 950000 450000 -280000 - 150000 -360000 -200000 -380000 225000 315150 -35.000429.750 0.143.250 104850 115000 110250 200000 426750 225000 31455 -34500 33075 60000 -128025 67500 73395 80500 77175 140000 298725 157500 315,150 35,000 429.750 0 143.250 0 0 9 0 388545 115500 506925 140000 441975 157500 273045 366925 284475 A 12 13 MACRS Depreciation Rates 14 Sales 15 Operating expenses 16 Depreciation 17 EBT 18 Taxes 19 Not Income 20 Depreciation 21 Working capital changes 22 Cash Flow 23 Incremental Cash Flow 24 25 26 Salvalge value 27 Book Value 28 Gain (loss) 29 30 Salvage value 31 Tax effect 32 Net working capital 33 Nonoperating terminal cash flow 34 NOTCF 35 36 NPV = -$37.769.28070 37 IRR = 9.51170% 38 MIRR = 10.303% 39 Payback -2.63769 years New 220000 -66850 153150 Old 50,000 0 50000 220000 50000 45945 - 15000 45.000 129055 35000 94055 TO -843,500 T1 273045 T=2 366925 T-3 378530 cash flows Sheet2 Sheet Directions: 1. Read each question carefully 2. SHOW ALL WORK! 3. Label your answer clearly. 1. CAPITAL BUDGETING -- THE UFRO COMPANY. The UFRO Company is considering the replacement of an existing spectrometer with a new spectrometer, faster and with expanded capacity. If the new spectrometer is purchased the existing (old) spectrometer will be sold for $30,000 immediately. The existing spectrometer was purchased three (3) years ago for $300.000. It is being depreciated under the 3-year MACRS schedule. The salvage value at the end of its six-year life will be $80,000. The new spectrometer will be purchased for $650,000. If the new spectrometer is purchased, accounts receivable increase immediately by $25,000; accruals will decrease immediately by $40,000, and accounts payable will decrease immediately by $30,000. The UFRO Company has a 30% corporate tax rate. Shipping costs for the new spectrometer, paid by the manufacturer will be $20 000 and installation costs for the new spectrometer, paid by UFRO, will be $35,000. If the new spectrometer is purchased, sales in year 1 will be $560,000, sales in year 2 will be $580,000, and sales in year 3 will be $520,000 Without the new spectrometer sales in each year will be $300,000 Operating expenses will continue to be 50% of sales. With the new spectrometer accounts receivable will increase by $5,000 at T=1 and $10,000 at T=2. The new computer will be depreciated using the 3-year MACRS schedule [yr. 1. 33% yr 2 45% yr 3. 15%, and yr. 4:7%). The new spectrometer will be sold, however after three (3) years for $95,000 The UFRO Company has a cost of capital of 12%. Calculate the NPV IRR. MIRR and Payback Period. F16 K H . G 1 2 D 2 E 3 0 5 2 6 3 AN 3 Old Old New Old New New 800,000 -75,000 80.000 -955,000 80,000 -13,500 45,000 -843,500 1. Old Machine 2 New Machine 3 4 Purchase price 5 Modification 6 Shipping and Installation 7 Depreciable Basis 8 Salvalge value old 9. Tax effect of disposition 10 New working capital changes 11 Investment Cash Outflow 12 13 MACRS Depreciation Rates 14 Sales 15 Operating exponses 16 Depreciation 17 EBT 18 Taxes 19 Net Income 20 Depreciation 21 Working capital changes 22 Cash Flow 23 Incremental Cash Flow -24 25 26 Salvalge value 27 Book Value 28 Gain (loss) 29 90 . cash flows Sheet2 0.33 0.07 0.45 0 700000 300000 900000 400000 280000 - 150000 360000 200000 -315.150 35.000429.750 9 104850 115000 110250 200000 31455 34500 33075 -60000 73395 80500 77175 140000 315,150 35 000 429.750 0 0 0 388545 115500 506925 140000 273046 366925 0.15 950000 -380000 143.250 426750 128025 298725 143,250 0 450000 225000 0 225000 -67500 157500 0 441975 157500 284475 Old 50,000 New 220000 -66850 153150 50000 non CA Sheets Choice PROTECTED VIEW Be careful-files from the Internet can contain Viruses. Unless you need to edit it's safer to stay in Protected View F16 -$E$7*F13 K 3 D H E G 0.33 0.07 0.45 0 0.15 0 700000 300000 900000 400000 950000 450000 -280000 - 150000 -360000 -200000 -380000 225000 315150 -35.000429.750 0.143.250 104850 115000 110250 200000 426750 225000 31455 -34500 33075 60000 -128025 67500 73395 80500 77175 140000 298725 157500 315,150 35,000 429.750 0 143.250 0 0 9 0 388545 115500 506925 140000 441975 157500 273045 366925 284475 A 12 13 MACRS Depreciation Rates 14 Sales 15 Operating expenses 16 Depreciation 17 EBT 18 Taxes 19 Not Income 20 Depreciation 21 Working capital changes 22 Cash Flow 23 Incremental Cash Flow 24 25 26 Salvalge value 27 Book Value 28 Gain (loss) 29 30 Salvage value 31 Tax effect 32 Net working capital 33 Nonoperating terminal cash flow 34 NOTCF 35 36 NPV = -$37.769.28070 37 IRR = 9.51170% 38 MIRR = 10.303% 39 Payback -2.63769 years New 220000 -66850 153150 Old 50,000 0 50000 220000 50000 45945 - 15000 45.000 129055 35000 94055 TO -843,500 T1 273045 T=2 366925 T-3 378530 cash flows Sheet2 Sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts