Question: Should Marshall acquire Electro-Engineering (EE)? Even if the NPV is zero, should she still proceed? Given the close-to-zero leverage of EE, consider using the unlevered

Should Marshall acquire Electro-Engineering (EE)? Even if the NPV is zero, should she still proceed? Given the close-to-zero leverage of EE, consider using the unlevered cost of capital of 9%. Also, consider a 3.5% perpetual growth rate. What is the effect if the growth rate is lower at, say, 2%?

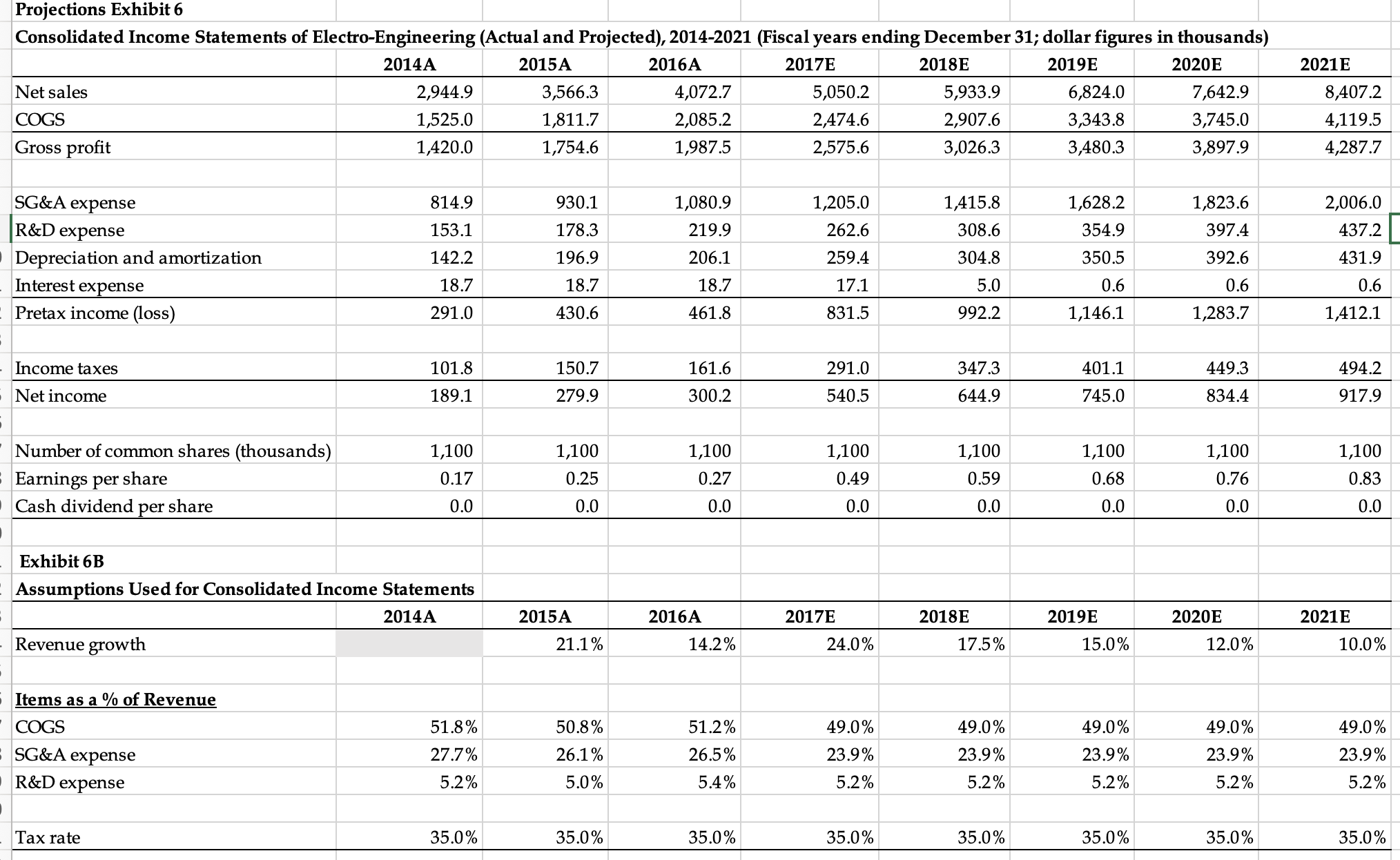

Projections Exhibit 6 Consolidated Income Statements of Electro-Engineering (Actual and Projected), 2014-2021 (Fiscal years ending December 31; dollar figures in thousands) Exhibit 6B Assumptions Used for Consolidated Income Statements Items as a % of Revenue Projections Exhibit 6 Consolidated Income Statements of Electro-Engineering (Actual and Projected), 2014-2021 (Fiscal years ending December 31; dollar figures in thousands) Exhibit 6B Assumptions Used for Consolidated Income Statements Items as a % of Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts