Question: Show all steps 1. WACC is 13%. D/E = 2.0. This investment requires $1 million up front. CFs are expected to be indefinite and will

Show all steps

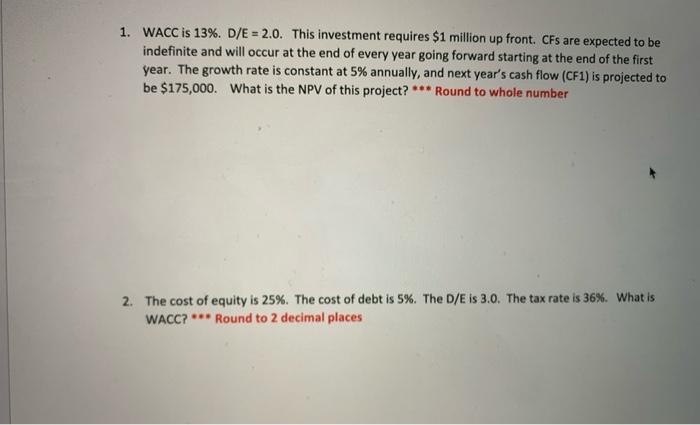

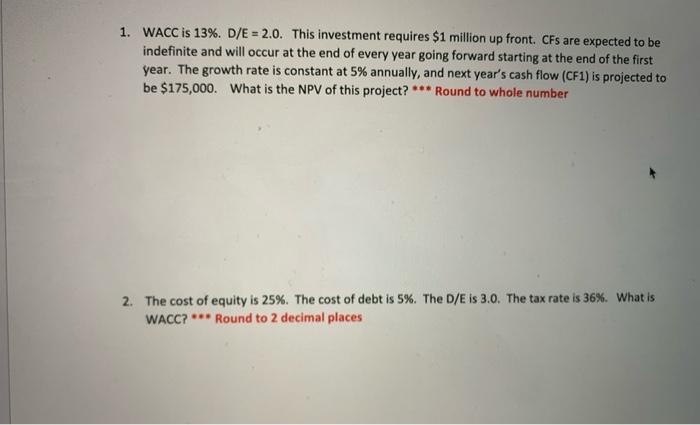

1. WACC is 13%. D/E = 2.0. This investment requires $1 million up front. CFs are expected to be indefinite and will occur at the end of every year going forward starting at the end of the first year. The growth rate is constant at 5% annually, and next year's cash flow (CF1) is projected to be $175,000. What is the NPV of this project? *** Round to whole number 2. The cost of equity is 25%. The cost of debt is 5%. The D/E is 3.0. The tax rate is 36 %. What is WACC? Round to 2 decimal places ***

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock