Question: Show all steps: Bookmark Chapter 8, Problem 4P ON The spreadsheet TRNSEXP.xls may be used in solving parts of problem. Boeing just signed a contract

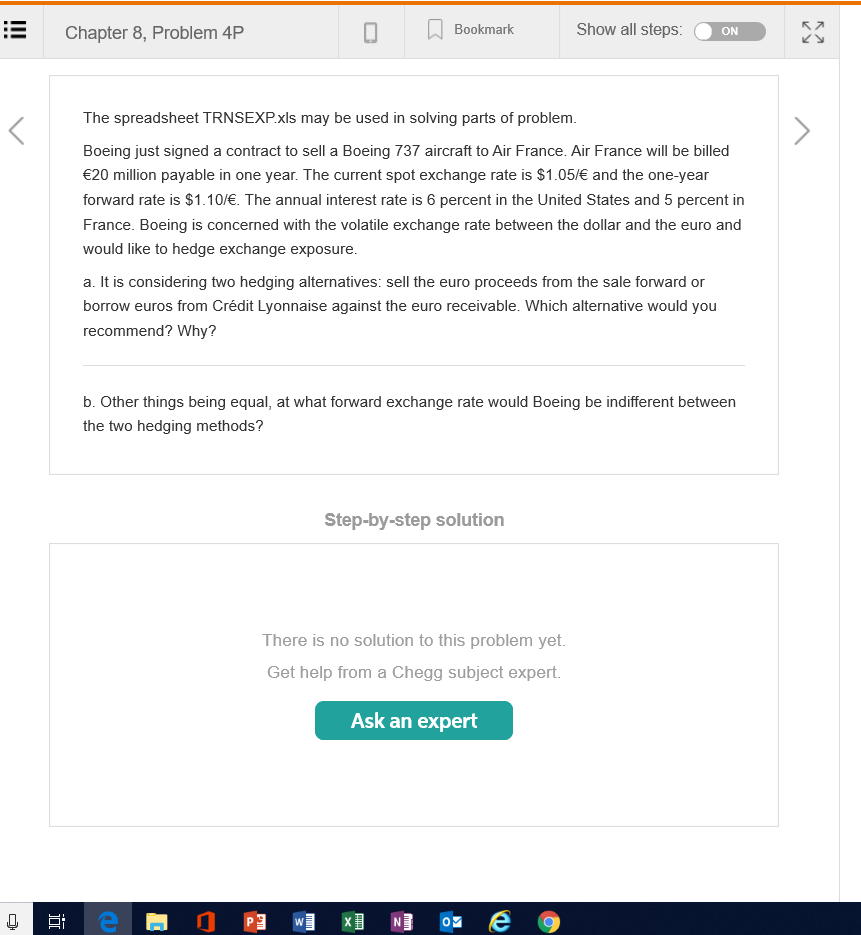

Show all steps: Bookmark Chapter 8, Problem 4P ON The spreadsheet TRNSEXP.xls may be used in solving parts of problem. Boeing just signed a contract to sell a Boeing 737 aircraft to Air France. Air France will be billed 20 million payable in one year. The current spot exchange rate is $1.05/ and the one-year forward rate is $1.10/E. The annual interest rate is 6 percent in the United States and 5 percent in France. Boeing is concerned with the volatile exchange rate between the dollar and the euro and would like to hedge exchange exposure a. It is considering two hedging alternatives: sell the euro proceeds from the sale forward or borrow euros from Crdit Lyonnaise against the euro receivable. Which alternative would you recommend? Why? b. Other things being equal, at what forward exchange rate would Boeing be indifferent between the two hedging methods? Step-by-step solution There is no solution to this problem yet. Get help from a Chegg subject expert. Ask an expert P3 w NON Show all steps: Bookmark Chapter 8, Problem 4P ON The spreadsheet TRNSEXP.xls may be used in solving parts of problem. Boeing just signed a contract to sell a Boeing 737 aircraft to Air France. Air France will be billed 20 million payable in one year. The current spot exchange rate is $1.05/ and the one-year forward rate is $1.10/E. The annual interest rate is 6 percent in the United States and 5 percent in France. Boeing is concerned with the volatile exchange rate between the dollar and the euro and would like to hedge exchange exposure a. It is considering two hedging alternatives: sell the euro proceeds from the sale forward or borrow euros from Crdit Lyonnaise against the euro receivable. Which alternative would you recommend? Why? b. Other things being equal, at what forward exchange rate would Boeing be indifferent between the two hedging methods? Step-by-step solution There is no solution to this problem yet. Get help from a Chegg subject expert. Ask an expert P3 w NON

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts