Question: Show all the formulas, computations, and a step-by-step process to earn full credit. Question 1 Aaron, Ben, Collins, Drew and Eli are five, financially loaded

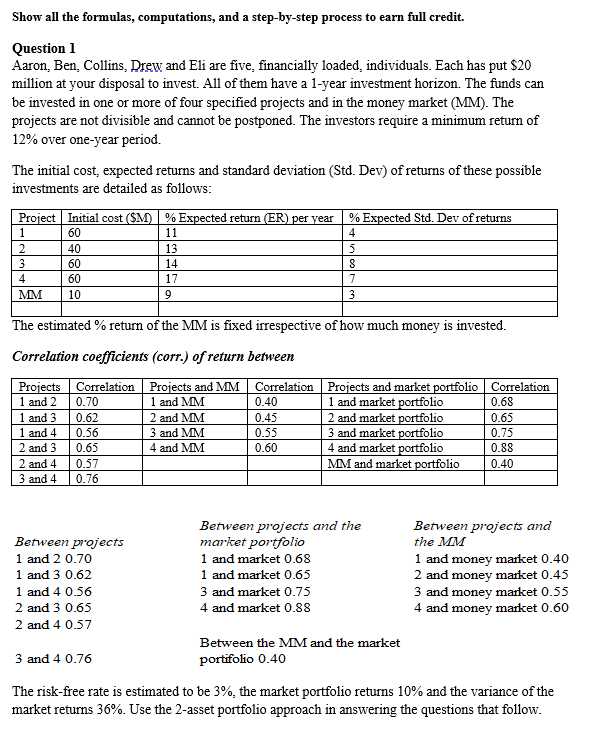

Show all the formulas, computations, and a step-by-step process to earn full credit. Question 1 Aaron, Ben, Collins, Drew and Eli are five, financially loaded individuals. Each has put $20 million at your disposal to invest. All of them have a 1-year investment horizon. The funds can be invested in one or more of four specified projects and in the money market (MM). The projects are not divisible and cannot be postponed. The investors require a minimum return of 12% over one-year period. The initial cost, expected returns and standard deviation (Std. Dev) of returns of these possible investments are detailed as follows: Project Initial cost (SM) % Expected return (ER) per year 1 60 11 2 40 13 3 60 14 4 60 17 MM 10 9 % Expected Std. Dev of returns 4 5 8 7 3 The estimated % return of the MM is fixed irrespective of how much money is invested. Correlation coefficients (corr.) of return between Projects Correlation Projects and MM Correlation Projects and market portfolio Correlation 1 and 2 0.70 1 and MM 0.40 1 and market portfolio 0.68 1 and 3 0.62 2 and MM 0.45 2 and market portfolio 0.65 1 and 4 0.56 3 and MM 0.55 3 and market portfolio 0.75 2 and 3 0.65 4 and MM 0.60 4 and market portfolio 0.88 2 and 4 0.57 MM and market portfolio 0.40 3 and 4 0.76 Between projects 1 and 2 0.70 1 and 3 0.62 1 and 4 0.56 2 and 3 0.65 2 and 4 0.57 Between projects and the market portfolio 1 and market 0.68 1 and market 0.65 3 and market 0.75 4 and market 0.88 Between projects and the MM 1 and money market 0.40 2 and money market 0.45 3 and money market 0.55 4 and money market 0.60 3 and 4 0.76 Between the MM and the market portifolio 0.40 The risk-free rate is estimated to be 3%, the market portfolio returns 10% and the variance of the market returns 36%. Use the 2-asset portfolio approach in answering the questions that follow. Required: a) Evaluate how the money should be invested using i) Portfolio theory ii) The capital asset pricing model (35 points) b) Identify, number and explain (Do not use more than 3 sentences per point) 5 problems or weaknesses associated with the use and application of the CAPM. (10 points). c) Why does the Portfolio approach and CAPM approach yield different project selection outcomes or decisions in part (a) of the question? State and number 5 reasons. (5 points) Show all the formulas, computations, and a step-by-step process to earn full credit. Question 1 Aaron, Ben, Collins, Drew and Eli are five, financially loaded individuals. Each has put $20 million at your disposal to invest. All of them have a 1-year investment horizon. The funds can be invested in one or more of four specified projects and in the money market (MM). The projects are not divisible and cannot be postponed. The investors require a minimum return of 12% over one-year period. The initial cost, expected returns and standard deviation (Std. Dev) of returns of these possible investments are detailed as follows: Project Initial cost (SM) % Expected return (ER) per year 1 60 11 2 40 13 3 60 14 4 60 17 MM 10 9 % Expected Std. Dev of returns 4 5 8 7 3 The estimated % return of the MM is fixed irrespective of how much money is invested. Correlation coefficients (corr.) of return between Projects Correlation Projects and MM Correlation Projects and market portfolio Correlation 1 and 2 0.70 1 and MM 0.40 1 and market portfolio 0.68 1 and 3 0.62 2 and MM 0.45 2 and market portfolio 0.65 1 and 4 0.56 3 and MM 0.55 3 and market portfolio 0.75 2 and 3 0.65 4 and MM 0.60 4 and market portfolio 0.88 2 and 4 0.57 MM and market portfolio 0.40 3 and 4 0.76 Between projects 1 and 2 0.70 1 and 3 0.62 1 and 4 0.56 2 and 3 0.65 2 and 4 0.57 Between projects and the market portfolio 1 and market 0.68 1 and market 0.65 3 and market 0.75 4 and market 0.88 Between projects and the MM 1 and money market 0.40 2 and money market 0.45 3 and money market 0.55 4 and money market 0.60 3 and 4 0.76 Between the MM and the market portifolio 0.40 The risk-free rate is estimated to be 3%, the market portfolio returns 10% and the variance of the market returns 36%. Use the 2-asset portfolio approach in answering the questions that follow. Required: a) Evaluate how the money should be invested using i) Portfolio theory ii) The capital asset pricing model (35 points) b) Identify, number and explain (Do not use more than 3 sentences per point) 5 problems or weaknesses associated with the use and application of the CAPM. (10 points). c) Why does the Portfolio approach and CAPM approach yield different project selection outcomes or decisions in part (a) of the question? State and number 5 reasons. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts