Question: Show all the steps with formula please c. Consider the following three-period binomial tree model for a stock that pays dividends continuously at a rate

Show all the steps with formula please

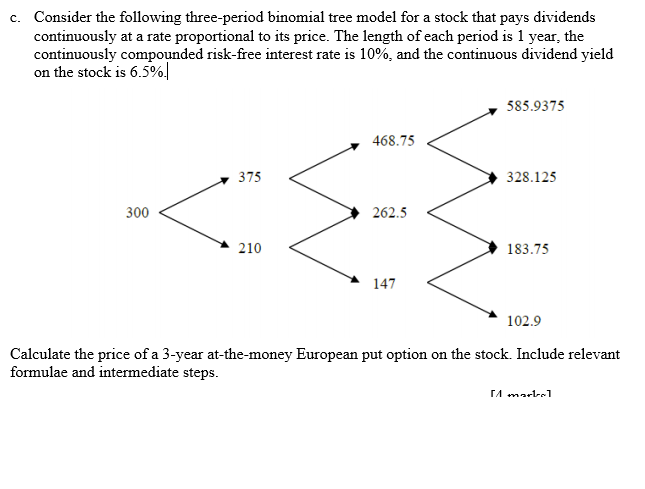

c. Consider the following three-period binomial tree model for a stock that pays dividends continuously at a rate proportional to its price. The length of each period is 1 year, the continuously compounded risk-free interest rate is 10%, and the continuous dividend yield on the stock is 6.5%. 585.9375 468.75 M 375 328.125 300 262.5 210 183.75 147 102.9 Calculate the price of a 3-year at-the-money European put option on the stock. Include relevant formulae and intermediate steps. 11 mart 1

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock