Question: show all work A few students would like to start an electronic surfboard business under a company called EBOARDs, Inc. This startup, wants to sell

show all work

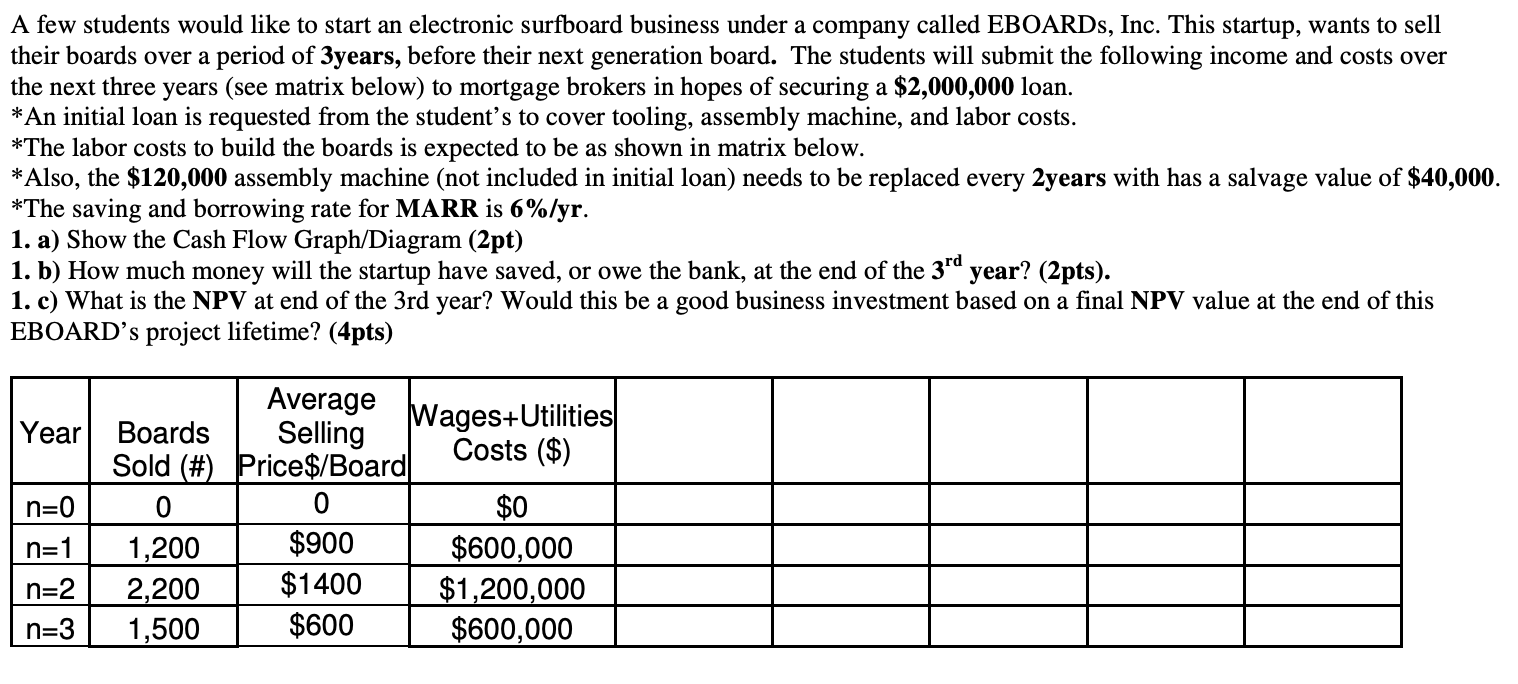

A few students would like to start an electronic surfboard business under a company called EBOARDs, Inc. This startup, wants to sell their boards over a period of 3years, before their next generation board. The students will submit the following income and costs over the next three years (see matrix below) to mortgage brokers in hopes of securing a $2,000,000 loan. *An initial loan is requested from the student's to cover tooling, assembly machine, and labor costs. *The labor costs to build the boards is expected to be as shown in matrix below. * Also, the $120,000 assembly machine (not included in initial loan) needs to be replaced every 2years with has a salvage value of $40,000. *The saving and borrowing rate for MARR is 6%/yr. 1. a) Show the Cash Flow Graph/Diagram (2pt) 1. b) How much money will the startup have saved, or owe the bank, at the end of the 3rd year? (2pts). 1. c) What is the NPV at end of the 3rd year? Would this be a good business investment based on a final NPV value at the end of this EBOARD's project lifetime? (4pts) Year n=0 Boards Sold (#) 0 1,200 2,200 1,500 Average Wages+Utilities Selling Costs ($) Price$/Board 0 $0 $900 $600,000 $1400 $1,200,000 $600 $600,000 n=1 n=2 n=3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts