Question: Show all work and highlight final answer. DO NOT answer if you cannot answer them all. 12. The Lumber Yard is considering adding a new

Show all work and highlight final answer. DO NOT answer if you cannot answer them all.

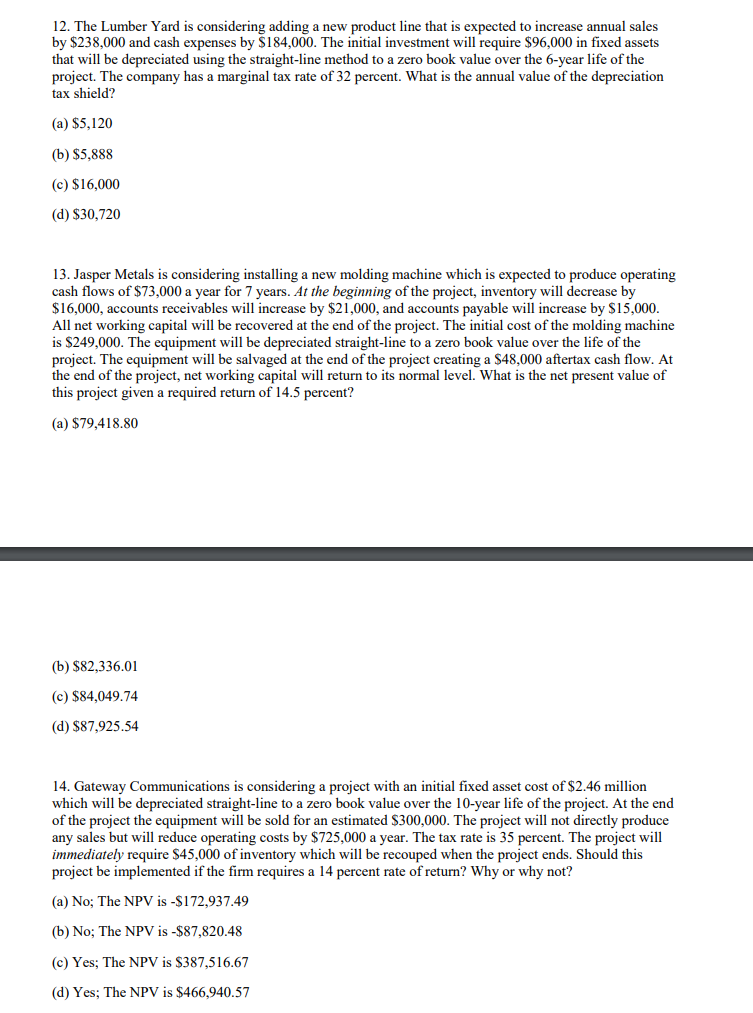

12. The Lumber Yard is considering adding a new product line that is expected to increase annual sale:s by $238,000 and cash expenses by S that will be depreciated using the straight-line method to a zero book value over the 6-year life of the project. The company has a marginal tax rate of 32 percent. What is the annual value of the depreciation tax shield? 184,000. The initial investment will require $96,000 in fixed assets (a) $5,120 (b) $5,888 (c) $16,000 (d) $30,720 13. Jasper Metals is considering installing a new molding machine which is expected to produce operating cash flows of $73,000 a year for 7 years. At the beginning of the project, inventory will decrease by $16,000, accounts receivables will increase by $21,000, and accounts payable will increase by $15,000 All net working capital will be recovered at the end of the project. The initial cost of the molding machine is $249,000. The equipment will be depreciated straight-line to a zero book value over the life of the project. The equipment will be salvaged at the end of the project creating a $48,000 aftertax cash flow. At the end of the project, net working capital will return to its normal level. What is the net present value of this project given a required return of 14.5 percent? (a) $79,418.80 (b) $82,336.01 (c) $84,049.74 (d) $87,925.54 14. Gateway Communications is considering a project with an initial fixed asset cost of $2.46 million which will be depreciated straight-line to a zero book value over the 10-year life of the project. At the end of the project the equipment will be sold for an estimated S300,000. The project will not directly produce any sales but will reduce operating costs by $725,000 a year. The tax rate is 35 percent. The project will immediately require $45,000 of inventory which will be recouped when the project ends. Should this project be implemented if the firm requires a 14 percent rate of return? Why or why not? (a) No; The NPV is -$172,937.49 (b) No; The NPV is -$87,820.48 (c) Yes; The NPV is $387,516.67 (d) Yes; The NPV is $466,940.57

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts