Question: show all work and right answer because ive been on this problem for a bit Suppose you are a British venture capitalist holding a major

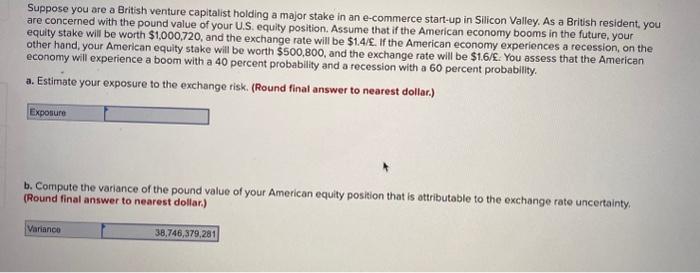

Suppose you are a British venture capitalist holding a major stake in an e-commerce start-up in Silicon Valley. As a British resident, you are concerned with the pound value of your U.S. equity position. Assume that if the American economy booms in the future, your equity stake will be worth $1,000,720, and the exchange rate will be $1,4/. If the American economy experiences a recession, on the other hand, your American equity stake will be worth $500,800, and the exchange rate will be $1.6/k. You assess that the American economy will experience a boom with a 40 percent probability and a fecession with a 60 percent probability. a. Estimate your exposure to the exchange risk, (Round final answer to nearest dollar.) b. Compute the variance of the pound value of your American equity position that is ottributable to the exchange rate uncertainty. (Round final answer to nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts