Question: show all work and right answer because ive been on this problem for 2 hrs Suppose that you hold a piece of land in the

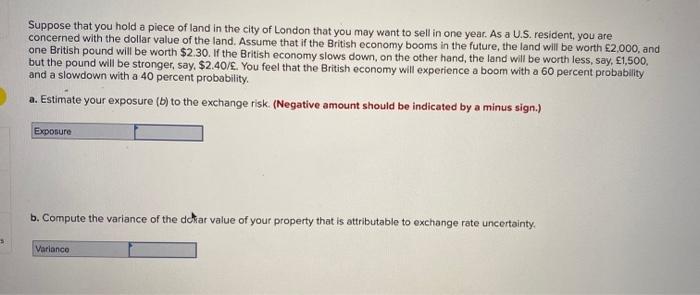

Suppose that you hold a piece of land in the city of London that you may want to sell in one year. As a U.S. resident, you are concerned with the dollar value of the land. Assume that if the British economy booms in the future, the land will be worth $2.000, and one British pound will be worth $2.30. If the British economy slows down, on the other hand, the land will be worth less, say, E1,500, but the pound will be stronger, say, $2.40/E. You feel that the British economy will experience a boom with a 60 percent probability and a slowdown with a 40 percent probability. a. Estimate your exposure (b) to the exchange risk. (Negative amount should be indicated by a minus sign.) b. Compute the variance of the dchar value of your property that is attributable to exchange rate uncertainty

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts