Question: SHOW ALL WORK FOR ALL HIGHLIGHTED, AND ROUND ALL VALUES TO 5 DECIMALS PLEASE . Foreign Exchange Risk and the Cost of Borrowing Swiss Francs.

SHOW ALL WORK FOR ALL HIGHLIGHTED, AND ROUND ALL VALUES TO 5 DECIMALS PLEASE.

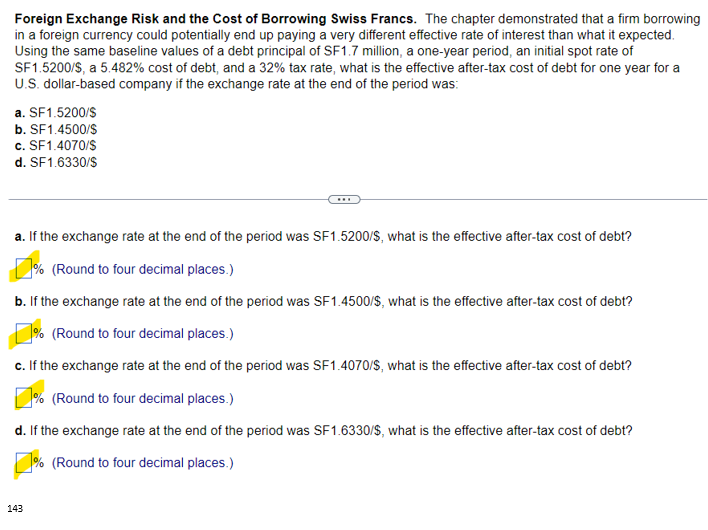

Foreign Exchange Risk and the Cost of Borrowing Swiss Francs. The chapter demonstrated that a firm borrowing in a foreign currency could potentially end up paying a very different effective rate of interest than what it expected. Using the same baseline values of a debt principal of SF1.7 million, a one-year period, an initial spot rate of SF1.5200/\$, a 5.482% cost of debt, and a 32% tax rate, what is the effective after-tax cost of debt for one year for a U.S. dollar-based company if the exchange rate at the end of the period was: a. SF1.5200/S b. SF1.4500/S c. SF1.4070/S d. SF1.6330/S a. If the exchange rate at the end of the period was SF1.5200/\$, what is the effective after-tax cost of debt? % (Round to four decimal places.) b. If the exchange rate at the end of the period was SF1.4500/\$, what is the effective after-tax cost of debt? % (Round to four decimal places.) c. If the exchange rate at the end of the period was SF1.4070/\$, what is the effective after-tax cost of debt? (Round to four decimal places.) d. If the exchange rate at the end of the period was SF1.6330/\$, what is the effective after-tax cost of debt? \% (Round to four decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts