Question: Show all work. Highlight final answer. DO NOT answer questions if you cannot answer them all. 15. Automated Manufacturers uses high-tech equipment to produce specialized

Show all work. Highlight final answer. DO NOT answer questions if you cannot answer them all.

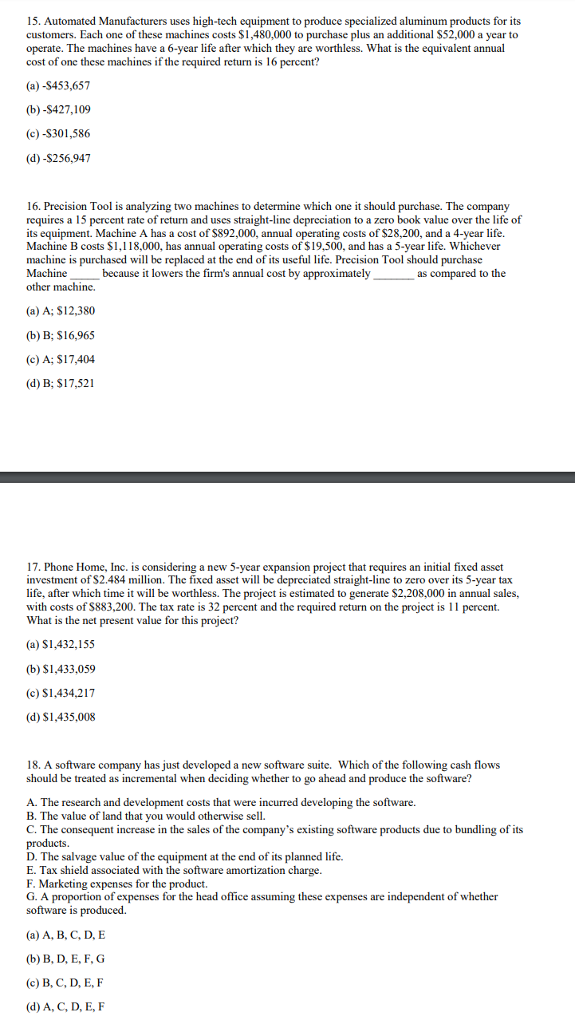

15. Automated Manufacturers uses high-tech equipment to produce specialized aluminum products for its customers. Each one of these machines costs $1,480,000 to purchase plus an additional $52,000 a year to operate. The machines have a 6-year life after which they are worthless. What is the equivalent annual cost of one these machines if the required return is 16 percent? (a) -S453,657 (b) -$427,109 (c) -S301,586 (d)-S256,947 16. Precision Tool is analyzing two machines to determine which one it should purchase. The company requires a 15 percent rate of return and uses straight-line depreciation to a zcro book value over the life of its equipment. Machine A has a cost of $892,000, annual operating costs of $28,200, and a 4-year life. Machine B costs $1,118,000, has annual operating costs of $19,500, and has a 5-year life. Whichever machine is purchased will be replaced at the end of its useful life. Precision Tool should purchase Machine because it lowers the firm's annual cost by approximately other machine. as compared to the (a) A; S12,380 (b) B; S16,965 (c) A; $17,404 (d) B; $17,521 17. Phone Home, Inc. is considering a new 5-year expansion project that requires an initial fixed asset investment of S2.484 million. The fixed asset will be depreciated straight-line to zero over its 5-year tax life, after which time it will be worthless. The project is estimated to generate $2,208,000 in annual sales, with costs of S883,200. The tax rate is 32 percent and the required return on the project is 11 percent. What is the net present value for this project? (a) S1,432,155 (b) S1,433,059 (c) S1,434,217 (d) S1,435,008 18. A software company has just developed a new software suite. Which of the following cash flows should be treated as incremental when deciding whether to go ahead and produce the software? A. The research and development costs that were incurred developing the software. B. The value of land that you would otherwise sell. C. The consequent increase in the sales of the company's existing software products due to bundling of its D. The salvage value of the equipment at the end of its planned life. E. Tax shield associated with the software amortization charge F. Marketing expenses for the product. G. A proportion of expenses for the head office assuming these expenses are independent of whether software is produced. (a) A, B, C, D, E (b) B, D, E, F, G (c) B, C, D, E, F (d) A, C, D, E, F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts