Question: show all work, no excel please; Answer A-F 3. Zach Enterprises is in the process of arranging financing for its proposed $140 million capital budget

show all work, no excel please; Answer A-F

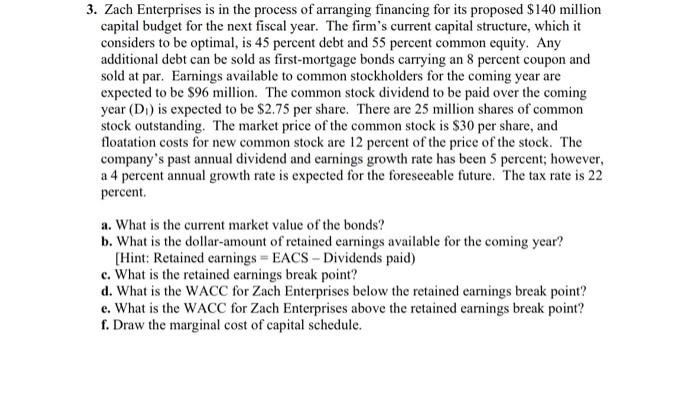

3. Zach Enterprises is in the process of arranging financing for its proposed $140 million capital budget for the next fiscal year. The firm's current capital structure, which it considers to be optimal, is 45 percent debt and 55 percent common equity. Any additional debt can be sold as first-mortgage bonds carrying an 8 percent coupon and sold at par. Earnings available to common stockholders for the coming year are expected to be $96 million. The common stock dividend to be paid over the coming year (D1) is expected to be $2.75 per share. There are 25 million shares of common stock outstanding. The market price of the common stock is $30 per share, and floatation costs for new common stock are 12 percent of the price of the stock. The company's past annual dividend and earnings growth rate has been 5 percent; however, a 4 percent annual growth rate is expected for the foreseeable future. The tax rate is 22 percent. a. What is the current market value of the bonds? b. What is the dollar-amount of retained earnings available for the coming year? [Hint: Retained earnings =EACS Dividends paid) c. What is the retained earnings break point? d. What is the WACC for Zach Enterprises below the retained earnings break point? e. What is the WACC for Zach Enterprises above the retained earnings break point? f. Draw the marginal cost of capital schedule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts