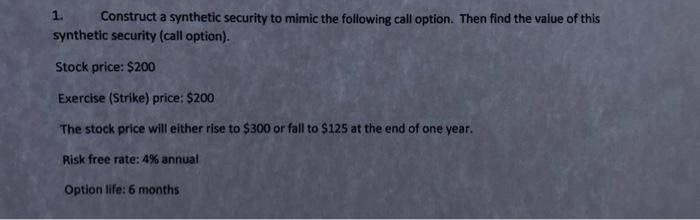

Question: show all work please 1. Construct a synthetic security to mimic the following call option. Then find the value of this synthetic security (call option).

1. Construct a synthetic security to mimic the following call option. Then find the value of this synthetic security (call option). Stock price: $200 Exercise (Strike) price: $200 The stock price will either rise to $300 or fall to $125 at the end of one year. Risk free rate: 4% annual Option life: 6 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts