Question: Show all work. Problems worth points indicated. 1 . ( 8 points ) Robert Parish Corporation purchased a new machine for its assembly process o

Show all work. Problems worth points indicated.

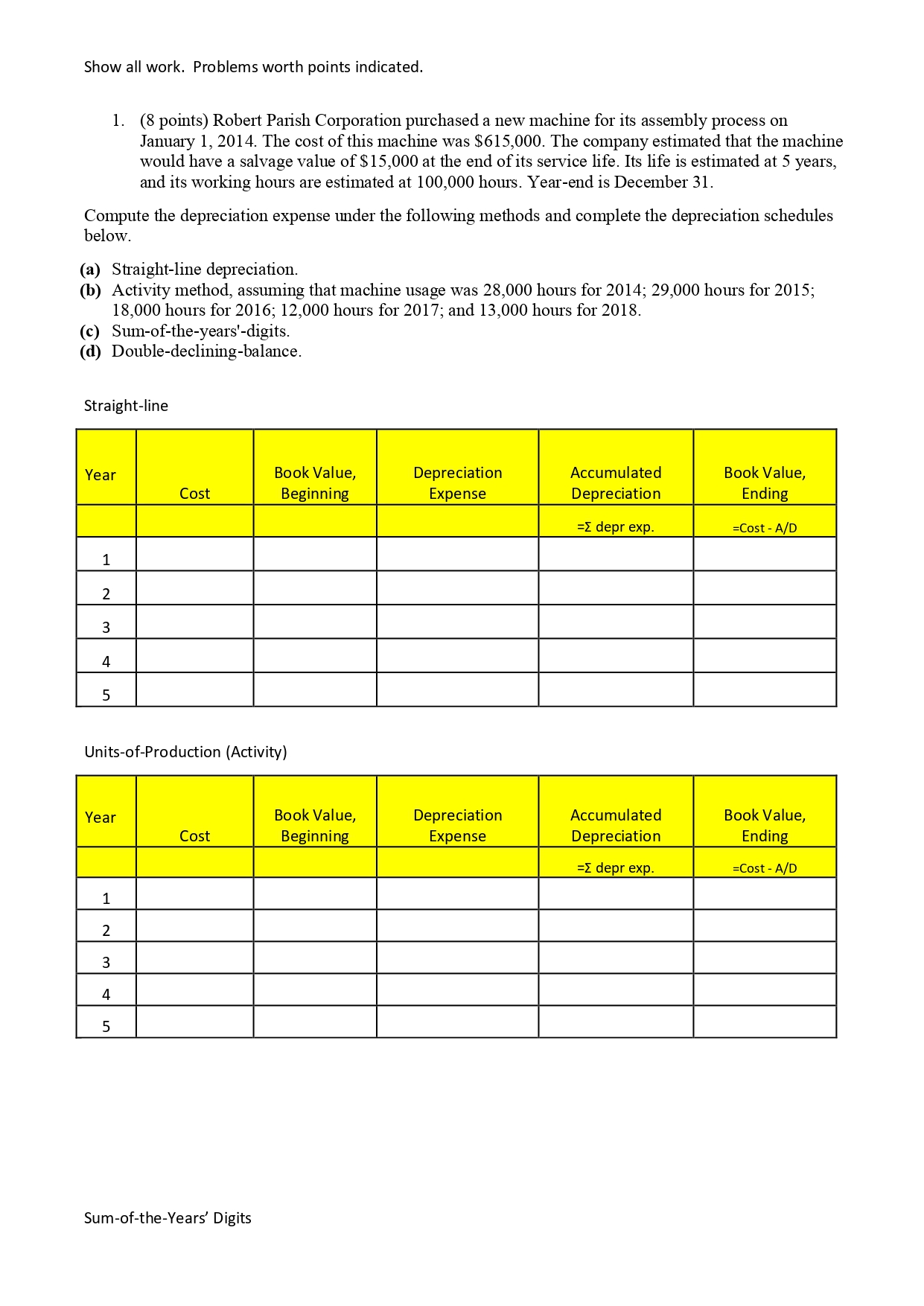

points Robert Parish Corporation purchased a new machine for its assembly process January The cost this machine was The company estimated that the machine would have a salvage value the end its service life. Its life estimated years, and its working hours are estimated hours. Yearend December

Compute the depreciation expense under the following methods and complete the depreciation schedules below.

Straightline depreciation.

Activity method, assuming that machine usage was hours for ; hours for ; hours for ; hours for ; and hours for

Sumtheyears'digits.

Doubledecliningbalance.

Straightline

UnitsProduction

Double Declining Balance

points Machinery purchased for $ Tom Brady the beginning the

year was originally estimated have a life years with a salvage value $ the end

that time. Depreciation has been recorded for years this basis. determined that

the total estimated life should years with a salvage value $ the end that time.

Assume straightline depreciation.

Instructions

Determine the depreciation expense for

points June Pina Company issued $ face value year bonds

$ a yield Pina uses the effectiveinterest method amortize bond

premium discount. The bonds pay semiannual interest June and December Prepare the journal entries record the following transactions.

The issuance the bonds June

The payment interest and the amortization the premium December

The payment interest and the amortization the premium June

The payment interest and the amortization the premium December

points January Swifty Company sold bonds having a maturity value $ which provides the bondholders with yield. The bonds are dated January and mature January year bonds with interest payable June

Page annual bonds carrying value.

points January Ivanhoe Company acquired a computer from Plato Corporation

issuing $year noninterestbearing note, payable full December Ivanhoe

Company's credit rating permits borrow funds from its several lines credit The computer

expected have year life and $ salvage value.

Prepare the journal entry for the purchase January

Prepare any necessary adjusting entries relative depreciation straightline and

amortization effectiveinterest method December

points January Piper issued tenyear bonds with a face value $ and

stated interest rate payable semiannually June and December The bonds were sold

yield

Calculate the issue price the bond. points Pronghorn Corporation purchases a patent from Crane Company January for

$ The patent has a remaining legal life years. Pronghorn feels the patent will useful

for years.

Prepare Pronghorn's journal entries record the purchase the patent and amortization.

points September Sheffield Corporation acquired Aumont Enterprises for a cash

payment $ the time purchase, Aumont's balance sheet showed assets

$ liabilities $ and owners' equity $ The fair value Aumont's

assets estimated $

Compute the amount goodwill acquired Sheffield.

points Martinez Corporation owns a patent that has a carrying amount $ Martinez

expects future net cash flows from this patent total $ The fair value the patent

$

Prepare Martinez's journal entry record the loss impairment necessary

points Bridgeport Corporation purchased Johnson Company years ago and that time recorded

goodwill $ The Johnson Division's net assets, including the goodwill, have a carrying

amount $ The fair value the division estimated $

Prepare Bridgeport journal entry record impairment the goodwill necessary

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock