Question: Show all work. Provide explanations where asked. 3. Consider the following: Stock A Expected Return Standard Deviation (volatility) 25% 17% 35% 28% B a) Calculate

Show all work. Provide explanations where asked.

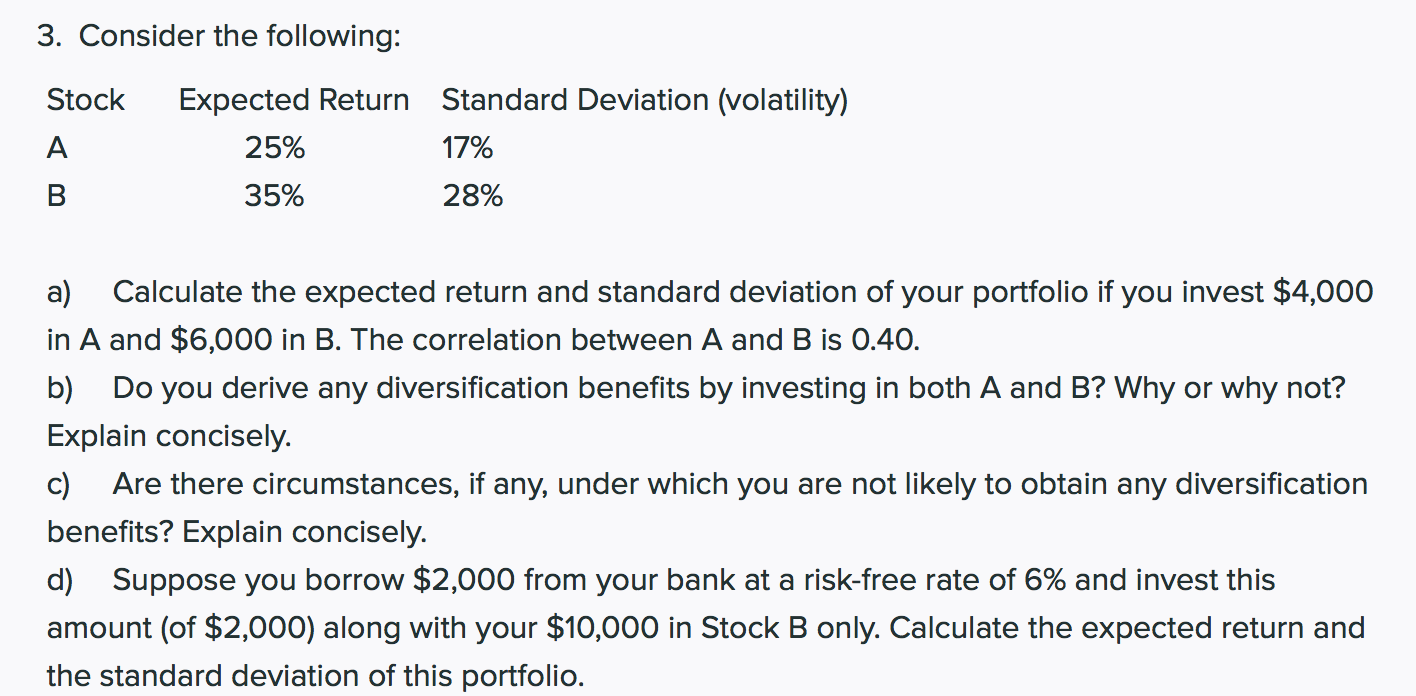

3. Consider the following: Stock A Expected Return Standard Deviation (volatility) 25% 17% 35% 28% B a) Calculate the expected return and standard deviation of your portfolio if you invest $4,000 in A and $6,000 in B. The correlation between A and B is 0.40. b) Do you derive any diversification benefits by investing in both A and B? Why or why not? Explain concisely. c) Are there circumstances, if any, under which you are not likely to obtain any diversification benefits? Explain concisely. d) Suppose you borrow $2,000 from your bank at a risk-free rate of 6% and invest this amount (of $2,000) along with your $10,000 in Stock B only. Calculate the expected return and the standard deviation of this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts