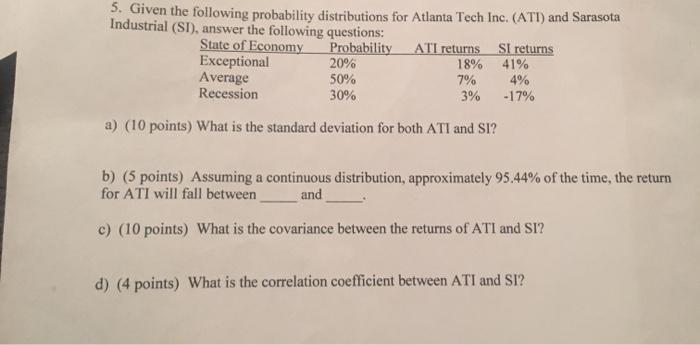

Question: show all work using formulas for C and D 5. Given the following probability distributions for Atlanta Tech Inc. (ATI) and Sarasota Industrial (SI), answer

5. Given the following probability distributions for Atlanta Tech Inc. (ATI) and Sarasota Industrial (SI), answer the following questions: State of Economy Probability ATI returns SI returns Exceptional 20% 18% 41% Average 50% 4% Recession 30% 3% -17% 7% a) (10 points) What is the standard deviation for both ATI and SI? b) (5 points) Assuming a continuous distribution, approximately 95.44% of the time, the return for ATI will fall between and c) (10 points) What is the covariance between the returns of ATI and SI? d) (4 points) What is the correlation coefficient between ATI and SI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts