Question: Show all workings Class Question (14) - (Capital Allowances) The directors of Goddard Limited are considering a new project, the details of which are as

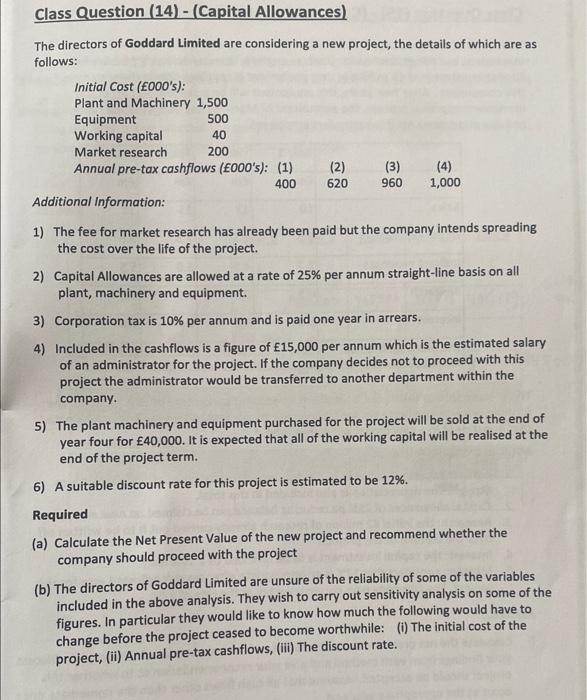

Class Question (14) - (Capital Allowances) The directors of Goddard Limited are considering a new project, the details of which are as follows: Additionum mjormuton: 1) The fee for market research has already been paid but the company intends spreading the cost over the life of the project. 2) Capital Allowances are allowed at a rate of 25% per annum straight-line basis on all plant, machinery and equipment. 3) Corporation tax is 10% per annum and is paid one year in arrears. 4) Included in the cashflows is a figure of 15,000 per annum which is the estimated salary of an administrator for the project. If the company decides not to proceed with this project the administrator would be transferred to another department within the company. 5) The plant machinery and equipment purchased for the project will be sold at the end of year four for 40,000. It is expected that all of the working capital will be realised at the end of the project term. 6) A suitable discount rate for this project is estimated to be 12%. Required (a) Calculate the Net Present Value of the new project and recommend whether the company should proceed with the project (b) The directors of Goddard Limited are unsure of the reliability of some of the variables included in the above analysis. They wish to carry out sensitivity analysis on some of the figures. In particular they would like to know how much the following would have to change before the project ceased to become worthwhile: (i) The initial cost of the project, (ii) Annual pre-tax cashflows, (iii) The discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts