Question: Show all your steps please, preferably use excel d) Tefifza Ltd is considering opening a small store. The initial outlay of this investment is 150

Show all your steps please, preferably use excel

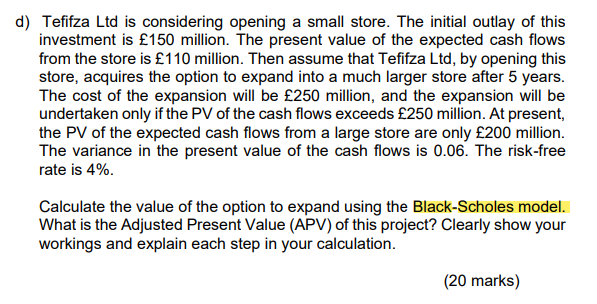

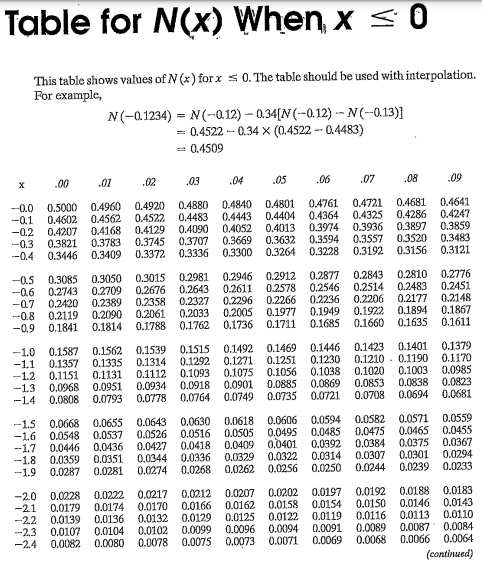

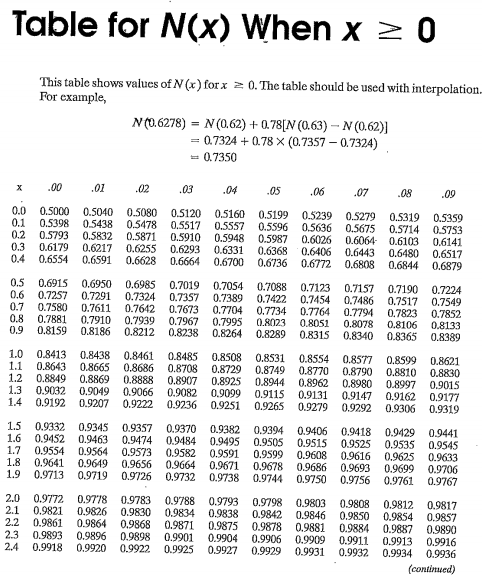

d) Tefifza Ltd is considering opening a small store. The initial outlay of this investment is 150 million. The present value of the expected cash flows from the store is 110 million. Then assume that Tefifza Ltd, by opening this store, acquires the option to expand into a much larger store after 5 years. The cost of the expansion will be 250 million, and the expansion will be undertaken only if the PV of the cash flows exceeds 250 million. At present, the PV of the expected cash flows from a large store are only 200 million. The variance in the present value of the cash flows is 0.06. The risk-free rate is 4%. Calculate the value of the option to expand using the Black-Scholes model. What is the Adjusted Present Value (APV) of this project? Clearly show your workings and explain each step in your calculation. (20 marks) Table for N(x) When x 50 This table shows values of N(x) for x S 0. The table should be used with interpolation. For example, N(-0.1234) = N(-0.12) -0.34[N(-0.12) -- N(-0.13)] = 0.4522 - 0.34 (0.4522 -0.4483) = 0.4509 .00 .01 .02 .03 .04 .05 .06 .07 .09 .08 -0.0 -0.1 -0.2 -0.3 -0.4 0.5000 0.4960 0.4602 0.4562 0.4207 0.4168 0.3821 0.3783 0.3446 0.3409 0.4920 0.4880 0.4522 0.4483 0.4129 0.4090 0.3745 0.3707 0.3372 0.3336 0.4840 0.4801 0.4443 0.4404 0.4052 0.4013 0.3669 0.3632 0.3300 0.3264 0.4761 0.4364 0.3974 0.3594 0.3228 0.4721 0.4681 0.4641 0.4325 0.4286 0.4247 0.3936 0.3897 0.3859 0.3557 0.3520 0.3483 0.3192 0.3156 0.3121 -0.5 0.3085 0.3050 0.3015 0.2981 0.2946 0.2912 0.2877 0.2843 0.2810 0.2776 -0.6 0.2743 0.2709 0.2676 0.2643 0.2611 0.2578 0.2546 0.2514 0.2483 0.2451 -07 0.2420 0.2389 0.2358 0.2327 0.2296 0.2266 0.2236 0.2206 0.2177 0.2148 -0.8 0.2119 0.2090 0.2061 0.2033 0.2005 0.1977 0.1949 0.1922 0.1894 0.1867 -0.9 0.1841 0.1814 0.1788 0.1762 0.1736 0.1711 0.1685 0.1660 0.1635 0.1611 -1.0 0.1587 0.1562 0.1539 0.1515 0.1492 0.1469 0.1446 0.1423 0.1401 0.1379 -1.1 0.1357 0.1335 0.1314 0.1292 0.1271 0.1251 0.1230 0.1210 - 0.1190 0.1170 -1.2 0.1151 0.1131 0.1112 0.1093 0.1075 0.1056 0.1038 0.1020 0.1003 0.0985 -13 0.0968 0.0951 0.0934 0.0918 0.0901 0.0885 0.0869 0.0853 0.0838 0.0823 -14 0.0808 0.0793 0.0778 0.0764 0.0749 0.0735 0.0721 0.0708 0.0694 0.0681 -1.5 0.0668 0.0655 0.0643 0.0630 0.0618 0.0606 0.0594 0.0582 0.0571 0.0559 -1.6 0.0548 0.0537 0.0526 0.0516 0.0505 0.0495 0.0485 0,0475 0.0465 0.0455 -1.7 0.0446 0.0436 0.0427 0.0418 0.0409 0.0401 0.0392 0.0384 0.0375 0.0367 -- 1.8 0.0359 0.0351 0.0344 0.0336 0.0329 0.0322 0.0314 0.0307 0.0301 0.0294 -1.9 0.0287 0.0281 0.0274 0.0268 0,0262 0.0256 0.0250 0.0244 0.0239 0.0233 -20 -2.1 -2.2 -2.3 -2.4 0.0228 0.0222 0.0217 0.0212 0.0207 0.0202 0.0197 0.0179 0.0174 0.0170 0.0166 0.0162 0.0158 0.0154 0.0139 0.0136 0.0132 0.0129 0.0125 0.0122 0.0119 0.0107 0.0104 0.0102 0.0099 0.0096 0.0094 0.0091 0.0082 0.0080 0.0078 0.0075 0.0073 0.0071 0.0069 0.0192 0.0188 0.0183 0.0150 0.0146 0.0143 0.0116 0.0113 0.0110 0.0089 0.0087 0.0084 0.0068 0.0066 0.0064 (continued) Table for N(x) When x 20 This table shows values of N(x) for x 20. The table should be used with interpolation For example, N(0.6278) = N(0.62) + 0.78[N (0.63) - N(0.62) = 0.7324 +0.78 X (0.7357 -0.7324) = 0.7350 X .00 .01 .02 .03 .04 .05 .06 .07 .08 .09 0.0 0.5000 0.1 0.5398 0.2 0.5793 0.3 0.6179 0.4 0.6554 0.5040 0.5438 0.5832 0.6217 0.6591 0.5080 0.5120 0.5478 0.5517 0.58710.5910 0.6255 0.6293 0.6628 0.6664 0.5160 0.5199 0.5239 0.5279 0.5319 0.5359 0.5557 0.5596 0.5636 0.5675 0.5714 0.5753 0.5948 0.5987 0.6026 0.6064 0.6103 0.6141 0.6331 0.6368 0.6406 0.6443 0.6480 0.6517 0.6700 0.6736 0.6772 0.6808 0.6844 0.6879 0.5 0.6915 0.6950 0.6985 0.7019 0.7054 0.7088 0.7123 0.7157 0.7190 0.7224 0.6 0.7257 0.7291 0.7324 0.7357 0.7389 0.7422 0.7454 0.7486 0.7517 0.7549 0.7 0.7580 0.7611 0.7642 0.7673 0.7704 0.7734 0.7764 0.7794 0.7823 0.7852 0.8 0.7881 0.7910 0.7939 0.7967 0.7995 0.8023 0.8051 0.8078 0.8106 0.8133 0.9 0.8159 0.8186 0.8212 0.8238 0.8264 0.8289 0.8315 0.8340 0.8365 0.8389 1.0 1.1 1.2 0.8413 0.8643 0.8849 0.9032 0.9192 0.8438 0.8665 0.8869 0.9049 0.9207 0.8461 0.8686 0.8888 0.9066 0.9222 0.8485 0.8708 0.8907 0.9082 0.9236 0.8508 0.8531 0.8554 0.8577 0.8599 0.8621 0.8729 0.8749 0.8770 0.8790 0.8810 0.8830 0.8925 0.8944 0.8962 0.8980 0.8997 0.9015 0.9099 0.9115 0.9131 0.9147 0.9162 0.9177 0.9251 0.9265 0.9279 0.9292 0.9306 0.9319 1.3 1.4 1.5 1.6 1.7 1.8 1.9 0.9332 0.9345 0.9357 0.9452 0.9463 0.9474 0.9554 0.9564 0.9573 0.9641 0.9649 0.9656 0.9713 0.9719 0.9726 0.9370 0.9382 0.9394 0.9406 0.9418 0.9429 0.9441 0.9484 0.9495 0.9505 0.9515 0.9525 0.9535 0.9545 0.9582 0.9591 0.9599 0.9608 0.9616 0.9625 0.9633 0.9664 0.9671 0.9678 0.9686 0.9693 0.9699 0.9706 0.9732 0.9738 0.9744 0.9750 0.9756 0.9761 0.9767 2.0 0.9772 2.1 0.9821 2.2 0.9861 2.3 0.9893 2.4 0.9918 0.9778 0.9783 0.9788 0.9793 0.9826 0.9830 0.9834 0.9838 0.9864 0.9868 0.9871 0.9875 0.9896 0.9898 0.9901 0.9904 0.9920 0.9922 0.9925 0.9927 0.9798 0.9803 0.9842 0.9846 0.9878 0.9881 0.9906 0.9909 0.9929 0.9931 0.9808 0.9812 0.9817 0.9850 0.9854 0.9857 0.9884 0.9887 0.9890 0.9911 0.9913 0.9916 0.9932 0.9934 0.9936 (continued) d) Tefifza Ltd is considering opening a small store. The initial outlay of this investment is 150 million. The present value of the expected cash flows from the store is 110 million. Then assume that Tefifza Ltd, by opening this store, acquires the option to expand into a much larger store after 5 years. The cost of the expansion will be 250 million, and the expansion will be undertaken only if the PV of the cash flows exceeds 250 million. At present, the PV of the expected cash flows from a large store are only 200 million. The variance in the present value of the cash flows is 0.06. The risk-free rate is 4%. Calculate the value of the option to expand using the Black-Scholes model. What is the Adjusted Present Value (APV) of this project? Clearly show your workings and explain each step in your calculation. (20 marks) Table for N(x) When x 50 This table shows values of N(x) for x S 0. The table should be used with interpolation. For example, N(-0.1234) = N(-0.12) -0.34[N(-0.12) -- N(-0.13)] = 0.4522 - 0.34 (0.4522 -0.4483) = 0.4509 .00 .01 .02 .03 .04 .05 .06 .07 .09 .08 -0.0 -0.1 -0.2 -0.3 -0.4 0.5000 0.4960 0.4602 0.4562 0.4207 0.4168 0.3821 0.3783 0.3446 0.3409 0.4920 0.4880 0.4522 0.4483 0.4129 0.4090 0.3745 0.3707 0.3372 0.3336 0.4840 0.4801 0.4443 0.4404 0.4052 0.4013 0.3669 0.3632 0.3300 0.3264 0.4761 0.4364 0.3974 0.3594 0.3228 0.4721 0.4681 0.4641 0.4325 0.4286 0.4247 0.3936 0.3897 0.3859 0.3557 0.3520 0.3483 0.3192 0.3156 0.3121 -0.5 0.3085 0.3050 0.3015 0.2981 0.2946 0.2912 0.2877 0.2843 0.2810 0.2776 -0.6 0.2743 0.2709 0.2676 0.2643 0.2611 0.2578 0.2546 0.2514 0.2483 0.2451 -07 0.2420 0.2389 0.2358 0.2327 0.2296 0.2266 0.2236 0.2206 0.2177 0.2148 -0.8 0.2119 0.2090 0.2061 0.2033 0.2005 0.1977 0.1949 0.1922 0.1894 0.1867 -0.9 0.1841 0.1814 0.1788 0.1762 0.1736 0.1711 0.1685 0.1660 0.1635 0.1611 -1.0 0.1587 0.1562 0.1539 0.1515 0.1492 0.1469 0.1446 0.1423 0.1401 0.1379 -1.1 0.1357 0.1335 0.1314 0.1292 0.1271 0.1251 0.1230 0.1210 - 0.1190 0.1170 -1.2 0.1151 0.1131 0.1112 0.1093 0.1075 0.1056 0.1038 0.1020 0.1003 0.0985 -13 0.0968 0.0951 0.0934 0.0918 0.0901 0.0885 0.0869 0.0853 0.0838 0.0823 -14 0.0808 0.0793 0.0778 0.0764 0.0749 0.0735 0.0721 0.0708 0.0694 0.0681 -1.5 0.0668 0.0655 0.0643 0.0630 0.0618 0.0606 0.0594 0.0582 0.0571 0.0559 -1.6 0.0548 0.0537 0.0526 0.0516 0.0505 0.0495 0.0485 0,0475 0.0465 0.0455 -1.7 0.0446 0.0436 0.0427 0.0418 0.0409 0.0401 0.0392 0.0384 0.0375 0.0367 -- 1.8 0.0359 0.0351 0.0344 0.0336 0.0329 0.0322 0.0314 0.0307 0.0301 0.0294 -1.9 0.0287 0.0281 0.0274 0.0268 0,0262 0.0256 0.0250 0.0244 0.0239 0.0233 -20 -2.1 -2.2 -2.3 -2.4 0.0228 0.0222 0.0217 0.0212 0.0207 0.0202 0.0197 0.0179 0.0174 0.0170 0.0166 0.0162 0.0158 0.0154 0.0139 0.0136 0.0132 0.0129 0.0125 0.0122 0.0119 0.0107 0.0104 0.0102 0.0099 0.0096 0.0094 0.0091 0.0082 0.0080 0.0078 0.0075 0.0073 0.0071 0.0069 0.0192 0.0188 0.0183 0.0150 0.0146 0.0143 0.0116 0.0113 0.0110 0.0089 0.0087 0.0084 0.0068 0.0066 0.0064 (continued) Table for N(x) When x 20 This table shows values of N(x) for x 20. The table should be used with interpolation For example, N(0.6278) = N(0.62) + 0.78[N (0.63) - N(0.62) = 0.7324 +0.78 X (0.7357 -0.7324) = 0.7350 X .00 .01 .02 .03 .04 .05 .06 .07 .08 .09 0.0 0.5000 0.1 0.5398 0.2 0.5793 0.3 0.6179 0.4 0.6554 0.5040 0.5438 0.5832 0.6217 0.6591 0.5080 0.5120 0.5478 0.5517 0.58710.5910 0.6255 0.6293 0.6628 0.6664 0.5160 0.5199 0.5239 0.5279 0.5319 0.5359 0.5557 0.5596 0.5636 0.5675 0.5714 0.5753 0.5948 0.5987 0.6026 0.6064 0.6103 0.6141 0.6331 0.6368 0.6406 0.6443 0.6480 0.6517 0.6700 0.6736 0.6772 0.6808 0.6844 0.6879 0.5 0.6915 0.6950 0.6985 0.7019 0.7054 0.7088 0.7123 0.7157 0.7190 0.7224 0.6 0.7257 0.7291 0.7324 0.7357 0.7389 0.7422 0.7454 0.7486 0.7517 0.7549 0.7 0.7580 0.7611 0.7642 0.7673 0.7704 0.7734 0.7764 0.7794 0.7823 0.7852 0.8 0.7881 0.7910 0.7939 0.7967 0.7995 0.8023 0.8051 0.8078 0.8106 0.8133 0.9 0.8159 0.8186 0.8212 0.8238 0.8264 0.8289 0.8315 0.8340 0.8365 0.8389 1.0 1.1 1.2 0.8413 0.8643 0.8849 0.9032 0.9192 0.8438 0.8665 0.8869 0.9049 0.9207 0.8461 0.8686 0.8888 0.9066 0.9222 0.8485 0.8708 0.8907 0.9082 0.9236 0.8508 0.8531 0.8554 0.8577 0.8599 0.8621 0.8729 0.8749 0.8770 0.8790 0.8810 0.8830 0.8925 0.8944 0.8962 0.8980 0.8997 0.9015 0.9099 0.9115 0.9131 0.9147 0.9162 0.9177 0.9251 0.9265 0.9279 0.9292 0.9306 0.9319 1.3 1.4 1.5 1.6 1.7 1.8 1.9 0.9332 0.9345 0.9357 0.9452 0.9463 0.9474 0.9554 0.9564 0.9573 0.9641 0.9649 0.9656 0.9713 0.9719 0.9726 0.9370 0.9382 0.9394 0.9406 0.9418 0.9429 0.9441 0.9484 0.9495 0.9505 0.9515 0.9525 0.9535 0.9545 0.9582 0.9591 0.9599 0.9608 0.9616 0.9625 0.9633 0.9664 0.9671 0.9678 0.9686 0.9693 0.9699 0.9706 0.9732 0.9738 0.9744 0.9750 0.9756 0.9761 0.9767 2.0 0.9772 2.1 0.9821 2.2 0.9861 2.3 0.9893 2.4 0.9918 0.9778 0.9783 0.9788 0.9793 0.9826 0.9830 0.9834 0.9838 0.9864 0.9868 0.9871 0.9875 0.9896 0.9898 0.9901 0.9904 0.9920 0.9922 0.9925 0.9927 0.9798 0.9803 0.9842 0.9846 0.9878 0.9881 0.9906 0.9909 0.9929 0.9931 0.9808 0.9812 0.9817 0.9850 0.9854 0.9857 0.9884 0.9887 0.9890 0.9911 0.9913 0.9916 0.9932 0.9934 0.9936 (continued)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts