Question: Show all your work. I can only give you partial credit if you show how you approached the problem! For the time value of money

Show all your work. I can only give you partial credit if you show how you approached the problem! For the time value of money computations show what information you used to calculate the answer. Do not just write down the final answer.

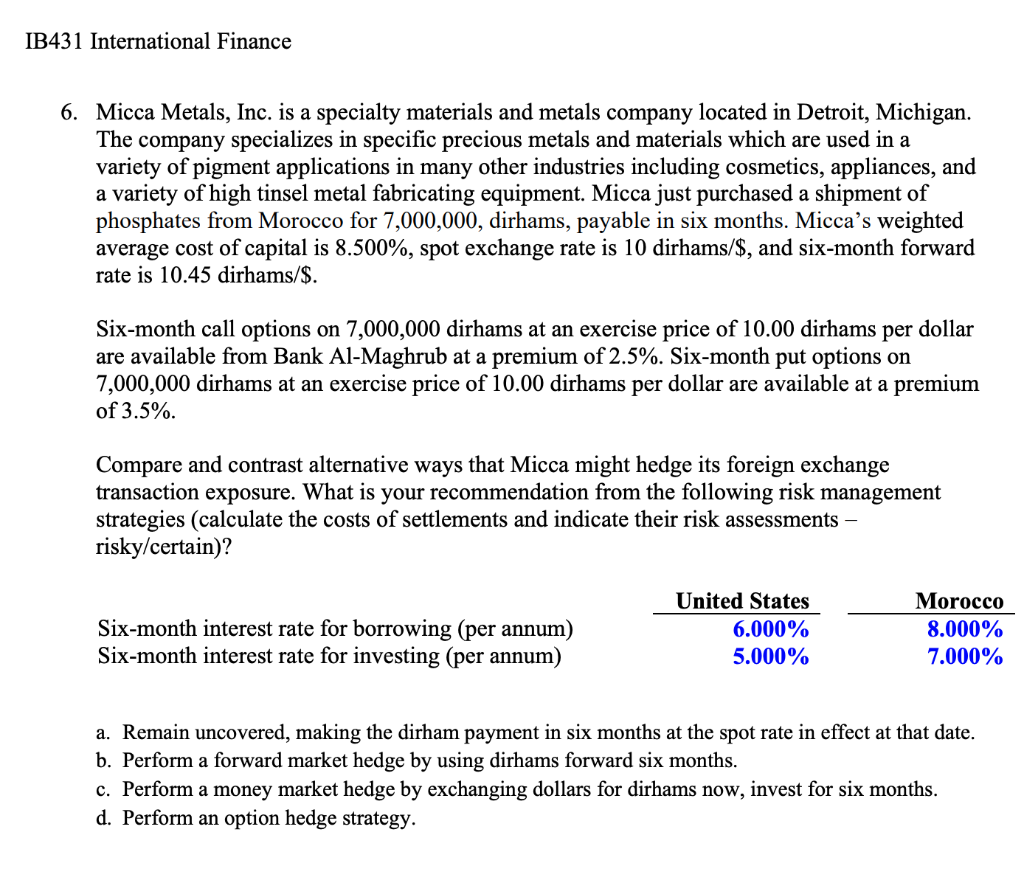

IB431 International Finance 6. Micca Metals, Inc. is a specialty materials and metals company located in Detroit, Michigan. The company specializes in specific precious metals and materials which are used in a variety of pigment applications in many other industries including cosmetics, appliances, and a variety of high tinsel metal fabricating equipment. Micca just purchased a shipment of phosphates from Morocco for 7,000,000, dirhams, payable in six months. Micca's weighted average cost of capital is 8.500%, spot exchange rate is 10 dirhams/$, and six-month forward rate is 10.45 dirhams/$. Six-month call options on 7,000,000 dirhams at an exercise price of 10.00 dirhams per dollar are available from Bank Al-Maghrub at a premium of 2.5%. Six-month put options on 7,000,000 dirhams at an exercise price of 10.00 dirhams per dollar are available at a premium of 3.5%. Compare and contrast alternative ways that Micca might hedge its foreign exchange transaction exposure. What is your recommendation from the following risk management strategies (calculate the costs of settlements and indicate their risk assessments - risky/certain)? Six-month interest rate for borrowing (per annum) Six-month interest rate for investing (per annum) United States 6.000% 5.000% Morocco 8.000% 7.000% a. Remain uncovered, making the dirham payment in six months at the spot rate in effect at that date. b. Perform a forward market hedge by using dirhams forward six months. c. Perform a money market hedge by exchanging dollars for dirhams now, invest for six months. d. Perform an option hedge strategy. IB431 International Finance 6. Micca Metals, Inc. is a specialty materials and metals company located in Detroit, Michigan. The company specializes in specific precious metals and materials which are used in a variety of pigment applications in many other industries including cosmetics, appliances, and a variety of high tinsel metal fabricating equipment. Micca just purchased a shipment of phosphates from Morocco for 7,000,000, dirhams, payable in six months. Micca's weighted average cost of capital is 8.500%, spot exchange rate is 10 dirhams/$, and six-month forward rate is 10.45 dirhams/$. Six-month call options on 7,000,000 dirhams at an exercise price of 10.00 dirhams per dollar are available from Bank Al-Maghrub at a premium of 2.5%. Six-month put options on 7,000,000 dirhams at an exercise price of 10.00 dirhams per dollar are available at a premium of 3.5%. Compare and contrast alternative ways that Micca might hedge its foreign exchange transaction exposure. What is your recommendation from the following risk management strategies (calculate the costs of settlements and indicate their risk assessments - risky/certain)? Six-month interest rate for borrowing (per annum) Six-month interest rate for investing (per annum) United States 6.000% 5.000% Morocco 8.000% 7.000% a. Remain uncovered, making the dirham payment in six months at the spot rate in effect at that date. b. Perform a forward market hedge by using dirhams forward six months. c. Perform a money market hedge by exchanging dollars for dirhams now, invest for six months. d. Perform an option hedge strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts