Question: Show all your workings? CBA Co. has established a defined benefit pension plan for its employees. Annual payments under the pension plan are equal to

Show all your workings?

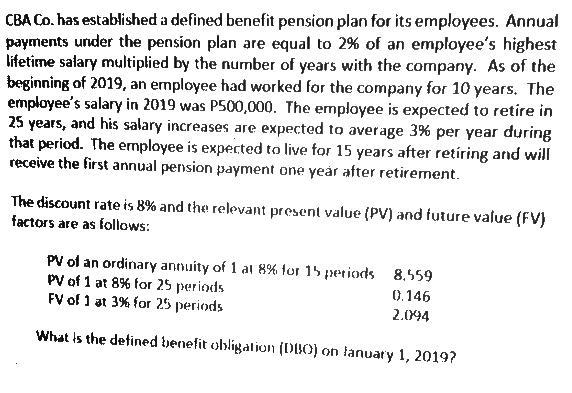

CBA Co. has established a defined benefit pension plan for its employees. Annual payments under the pension plan are equal to 2% of an employee's highest lifetime salary multiplied by the number of years with the company. As of the beginning of 2019, an employee had worked for the company for 10 years. The employee's salary in 2019 was P500,000. The employee is expected to retire in 25 years, and his salary increases are expected to average 3% per year during that period. The employee is expected to live for 15 years after retiring and will receive the first annual pension payment one year after retirement. The discount rate is 8% and the relevant present value (PV) and future value (FV) factors are as follows: PV of an ordinary annuity of 1 al 8% for 15 periods 8,559 PV of 1 at 8% for 25 periods 0.146 FV of 1 at 3% for 25 periods 2.0894 What is the defined benefit obligation (DIO) on January 1, 2019? CBA Co. has established a defined benefit pension plan for its employees. Annual payments under the pension plan are equal to 2% of an employee's highest lifetime salary multiplied by the number of years with the company. As of the beginning of 2019, an employee had worked for the company for 10 years. The employee's salary in 2019 was P500,000. The employee is expected to retire in 25 years, and his salary increases are expected to average 3% per year during that period. The employee is expected to live for 15 years after retiring and will receive the first annual pension payment one year after retirement. The discount rate is 8% and the relevant present value (PV) and future value (FV) factors are as follows: PV of an ordinary annuity of 1 al 8% for 15 periods 8,559 PV of 1 at 8% for 25 periods 0.146 FV of 1 at 3% for 25 periods 2.0894 What is the defined benefit obligation (DIO) on January 1, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts