Question: Show all your workings when calculations are required and round off your FINAL result to TWO decimal places. a) Sam has just started his medicine

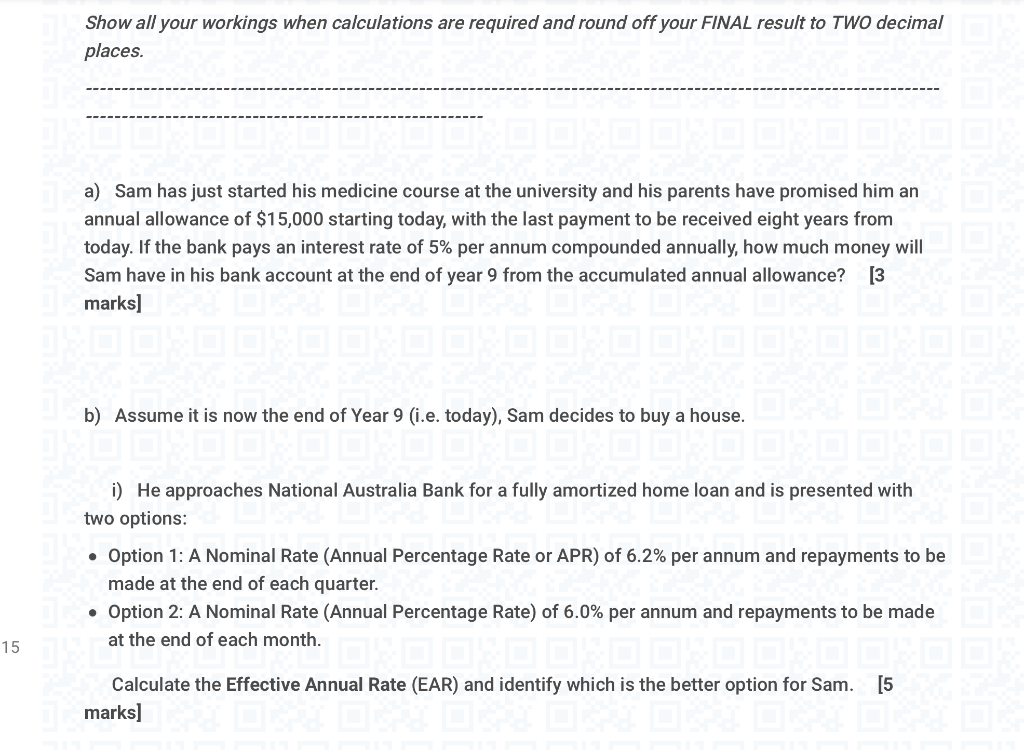

Show all your workings when calculations are required and round off your FINAL result to TWO decimal places. a) Sam has just started his medicine course at the university and his parents have promised him an annual allowance of $15,000 starting today, with the last payment to be received eight years from today. If the bank pays an interest rate of 5% per annum compounded annually, how much money will Sam have in his bank account at the end of year 9 from the accumulated annual allowance? [3 marks] b) Assume it is now the end of Year 9 (i.e. today), Sam decides to buy a house. i) He approaches National Australia Bank for a fully amortized home loan and is presented with two options: Option 1: A Nominal Rate (Annual Percentage Rate or APR) of 6.2% per annum and repayments to be made at the end of each quarter. Option 2: A Nominal Rate (Annual Percentage Rate) of 6.0% per annum and repayments to be made at the end of each month. 15 Calculate the Effective Annual Rate (EAR) and identify which is the better option for Sam. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts