Question: Show All Your Works For Your Answer: Calculate Debit for Depreciation expense, fixtures Sep 30 On January 2, 2018, Bright Lighting purchased showroom fixtures for

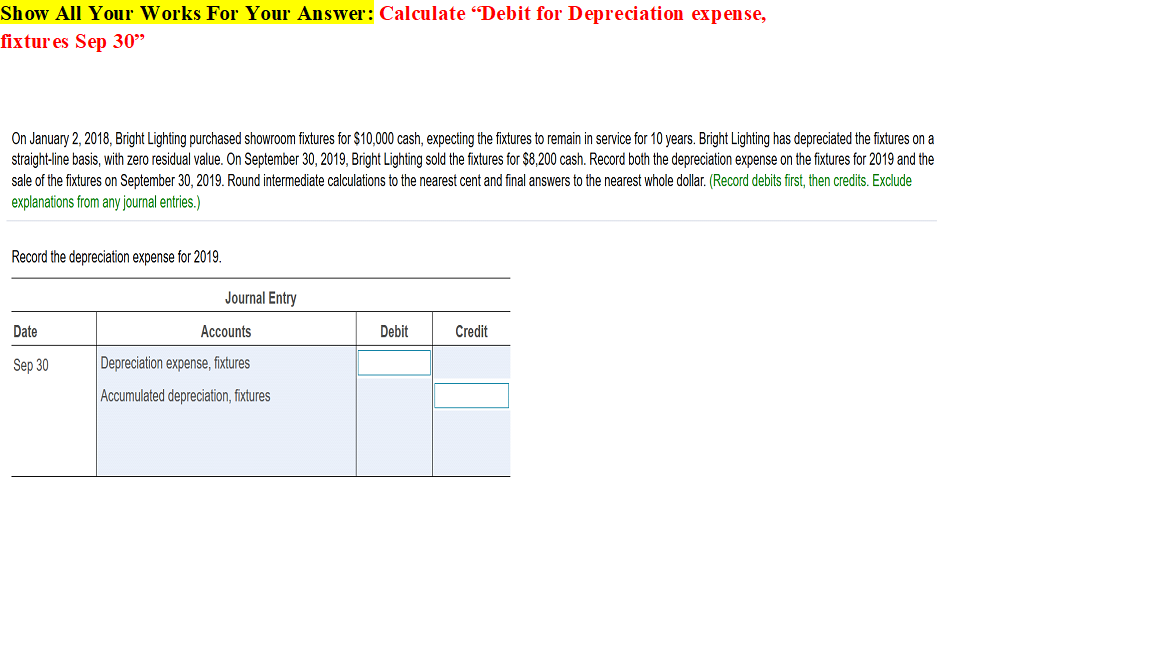

Show All Your Works For Your Answer: Calculate "Debit for Depreciation expense, fixtures Sep 30" On January 2, 2018, Bright Lighting purchased showroom fixtures for $10,000 cash, expecting the fixtures to remain in service for 10 years. Bright Lighting has depreciated the fixtures on a straight-line basis, with zero residual value. On September 30, 2019, Bright Lighting sold the fixtures for $8,200 cash. Record both the depreciation expense on the fixtures for 2019 and the sale of the fixtures on September 30, 2019. Round intermediate calculations to the nearest cent and final answers to the nearest whole dollar. (Record debits first, then credits. Exclude explanations from any journal entries.) Record the depreciation expense for 2019. Journal Entry Date Accounts Debit Credit Sep 30 Depreciation expense, fixtures Accumulated depreciation, fixtures

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts