Question: Show answer with the solution Answer ALL questions and show your working calculations. Marks will be given for all workings. 1. Calculate the weighted average

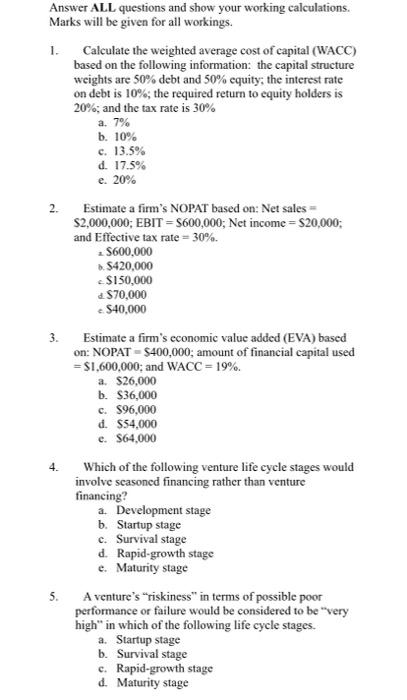

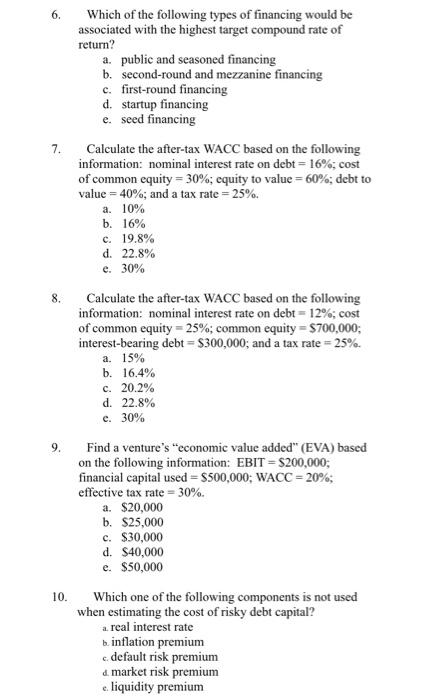

Answer ALL questions and show your working calculations. Marks will be given for all workings. 1. Calculate the weighted average cost of capital (WACC) based on the following information: the capital structure weights are 50% debt and 50% equity, the interest rate on debt is 10%; the required return to equity holders is 20%; and the tax rate is 30% a. 7% b. 10% c. 13.5% d. 17.5% e. 20% 2. Estimate a firm's NOPAT based on: Net sales - $2,000,000; EBIT = $600,000; Net income = $20,000; and Effective tax rate = 30%. 2 S600,000 S420,000 $150,000 $70,000 540,000 3. Estimate a firm's cconomic value added (EVA) based on: NOPAT - $400,000; amount of financial capital used =$1,600,000; and WACC = 19%. a. $26,000 b. $36,000 c. $96,000 d. $54,000 e. $64,000 4. Which of the following venture life cycle stages would involve seasoned financing rather than venture financing? a. Development stage b. Startup stage c. Survival stage d. Rapid-growth stage e. Maturity stage 5. A venture's "riskiness" in terms of possible poor performance or failure would be considered to be "very high" in which of the following life cycle stages. a. Startup stage b. Survival stage c. Rapid-growth stage d. Maturity stage 6. Which of the following types of financing would be associated with the highest target compound rate of return? a. public and seasoned financing b. second-round and mezzanine financing c. first-round financing d. startup financing e. seed financing 7. Calculate the after-tax WACC based on the following information: nominal interest rate on debt = 16%; cost of common equity = 30%, equity to value = 60%; debt to value = 40%; and a tax rate=25%. a. 10% b. 16% c. 19.8% d. 22.8% e. 30% Calculate the after-tax WACC based on the following information: nominal interest rate on debt = 12%; cost of common equity - 25%; common equity = $700,000; interest-bearing debt = $300,000; and a tax rate=25%. a. 15% b. 16.4% c. 20.2% d. 22.8% c. 30% Find a venture's economic value added" (EVA) based on the following information: EBIT = $200,000; financial capital used = $500,000; WACC -20%; effective tax rate = 30%. a. $20,000 b. $25,000 c. $30,000 d. $40,000 e. $50,000 10. Which one of the following components is not used when estimating the cost of risky debt capital? a real interest rate binflation premium c.default risk premium d market risk premium c. liquidity premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts