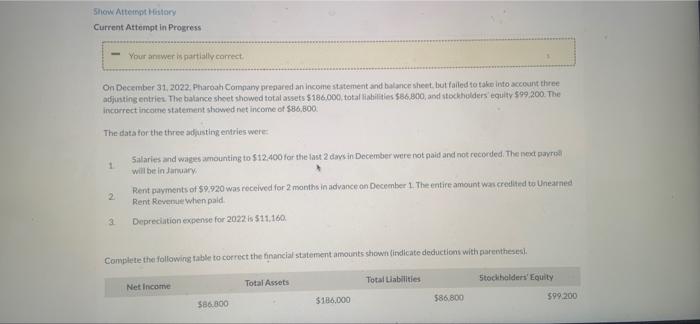

Question: Show Attempt History Current Attempt in Progress - Your answer is partially correct On December 31, 2022. Pharoah Company prepared an income statement and balance

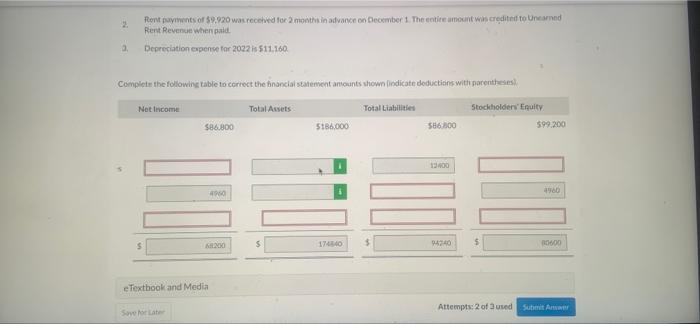

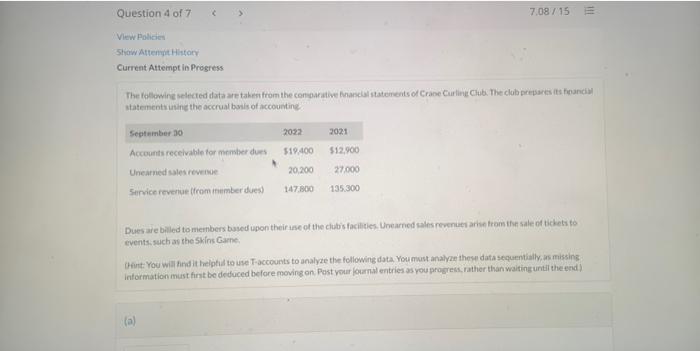

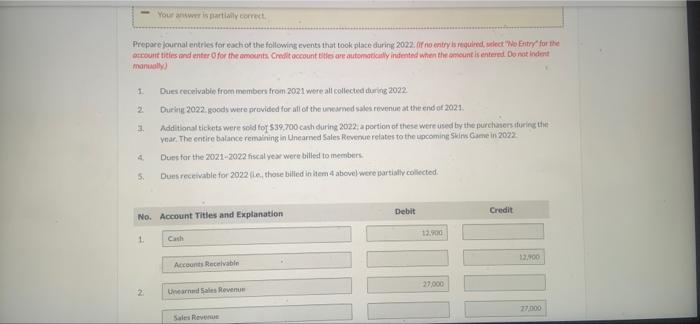

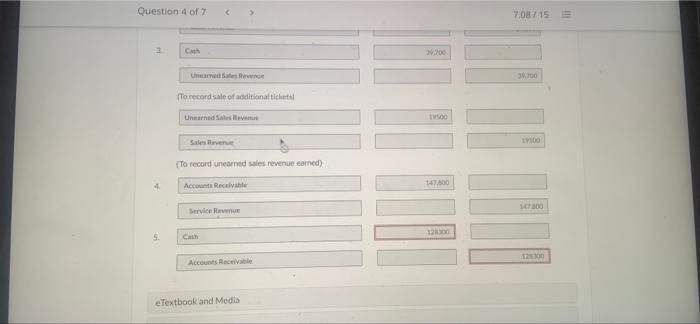

Show Attempt History Current Attempt in Progress - Your answer is partially correct On December 31, 2022. Pharoah Company prepared an income statement and balance sheet but failed to take into account three adjusting entries. The balance sheet showed total assets $186.000 total libilities $86, 800, and stockholders equity 599 200. The incorrect income statement showed net income of $86,800 The data for the three adjusting entries were 1 Salaries and waiges amounting to $12.400 for the last 2 days in December were not paid and not recorded. The next payroll will be in January Renit payments of $9.920 was received for 2 months in advance on December 1. The entire amount was created to Unearned Rent Revenue when paid 2 Deprecation expense for 2022 is 511,160 Complete the following table to correct the hinancial statement amounts shown indicate deduction with parenthesesi. Total Liabilities Total Assets Net Income Stockholders' Equity 586800 $99.200 586,800 $136.000 2 Rent payments of $9.920 was received for 2 months in advance on December 1. The entire amount is credited to earned Rent Revenue when paid Depreciation expense for 2032 511,160 Complete the following table to correct the bnancial statement antounts shown indicate deductions with parents Net Income Total Assets Total Liabilities Stockholders' Equity $86.800 5136.000 586.100 599 200 1300 4980 ITE L200 17 4740 0600 eTextbook and Media Attempts: 2 of 3 used Sutimit A ove for Lator 7.08715 Question 4 of 7 View Police Show Attem History Current Attempt in Progress The following selected data are taken from the comparative and statements of Crane Curtis Club The club pares its and statements using the accrual basis of accounting September 10 2021 2022 519.400 $12.900 Accounts receivable for member des Uneared sales revence Service revenue from member dues) 20.200 27.000 147.300 135.300 Dus we billed to members based upon theirense of the club's facilities. Urtarned sales revenue retrom the sale of tickets to events, such as the Skins Game Dit: You will find it helpful to use Taccounts to analyze the following data. You must analyze these data sequentially as missing Information must first be deduced before moving on Post your journal entries as you progress, rather than waiting until the end) () Your animal correct. Prepare journal entries for each of the following events that took place during 2022: Ofrio entry is required, udlect "Wo Estry for the countities and enter for the amounts Creditoccountitles are automatically indented when the mount is entered Donatinderit manually 1 22 3 Dues receivable from members from 2021 were all collected during 2022 Durin 2022. goods were provided for all of the earned sales revenue at the end of 2021. Additional tickets were sold for 539,700 cash during 2022 a portion of these were used by the purchasersturing the year. The entire balance remaining in Uncanned Sales Revenue relates to the upcoming Skin Game in 2022 Dues for the 2021-2022fiscal year were billed to members Dues receivable for 2022 in those billed in tem 4 above were partially collected 5. Debit Credit No. Account Tities and Explanation 13.00 1 Car 12.00 Accounts Receivable 27.000 2 cared Sales Reven 27.000 Sales Revenue Question 4 of 7 7,08715 3 Cash 20.00 Unandes 300 To record sale of additional tickets Unwarned Slus devenue VOO (To record uneared sales revenue corned) 4 Account Receive 1470 Service 1800 S Cash 1200 Accounts Receivable e Textbook and Media e Textbook and Media Solution List of Accounts Attempts of used (b) Determine the amount of cash received by Crane from the above transactions during the year ended September 30, 2022 $ Cash received by Crane September 30, 2022 e Textbook and Media List of Accounts Attempts of 3 used Sove for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts