Question: Show Attempt History Current Attempt in Progress Your answer is partially correct. Pharoah Potions, Inc., a pharmaceutical company, bought a machine at a cost of

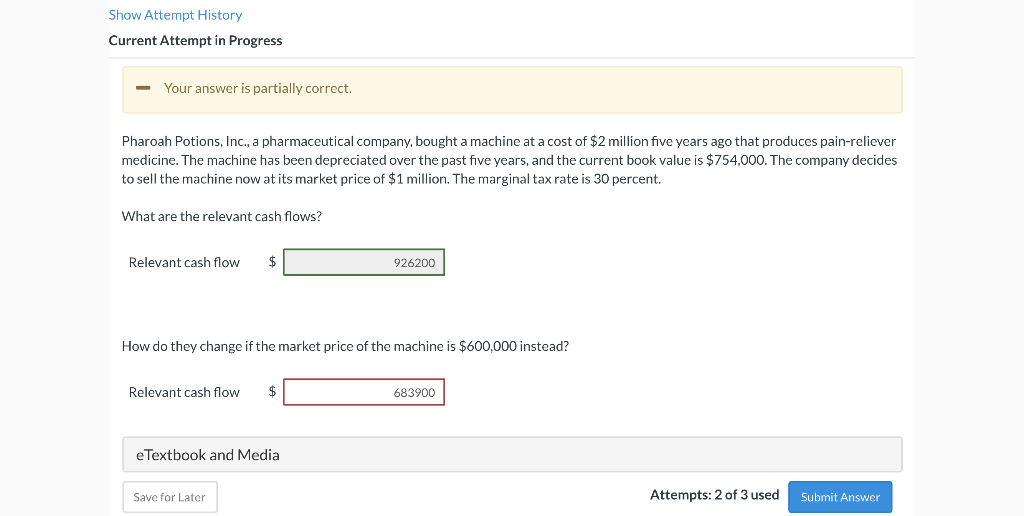

Show Attempt History Current Attempt in Progress Your answer is partially correct. Pharoah Potions, Inc., a pharmaceutical company, bought a machine at a cost of $2 million five years ago that produces pain-reliever medicine. The machine has been depreciated over the past five years, and the current book value is $754,000. The company decides to sell the machine now at its market price of $1 million. The marginal tax rate is 30 percent. What are the relevant cash flows? Relevant cash flow $ 926200 How do they change if the market price of the machine is $600,000 instead? Relevant cash flow $ 683900 e Textbook and Media Save for Later Attempts: 2 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts