Question: Show Attempt History Current Attempt in Progress -Your answer is partially correct Sheffield Leasing Company leases a new machine that has a cost and fair

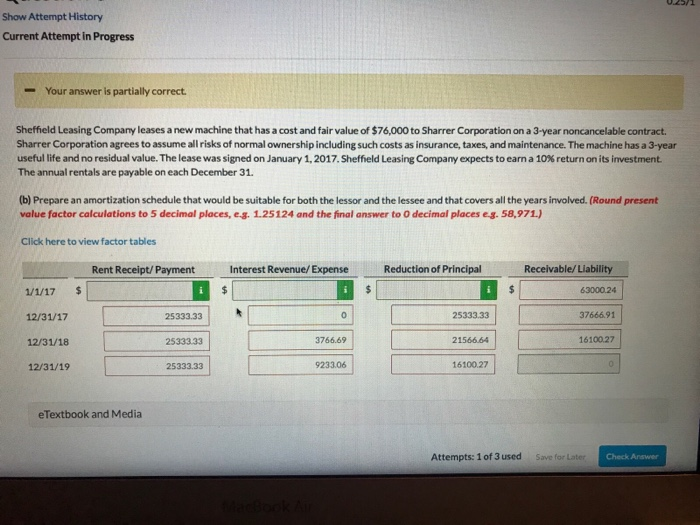

Show Attempt History Current Attempt in Progress -Your answer is partially correct Sheffield Leasing Company leases a new machine that has a cost and fair value of $76,000 to Sharrer Corporation on a 3-year noncancelable contract. Sharrer Corporation agrees to assume all risks of normal ownership including such costs as insurance, taxes, and maintenance. The machine has a 3-year useful life and no residual value. The lease was signed on January 1, 2017, Sheffield Leasing Company expects to earn a 10% return on its investment. The annual rentals are payable on each December 31. (b) Prepare an amortization schedule that would be suitable for both the lessor and the lessee and that covers all the years involved. (Round present value factor calculations to 5 decimal places, es.1.25124 and the final answer to O decimal places e-s. 58,971) Click here to view factor tables Receivable/ Liability 63000.24 3766691 Interest Revenue/Expense Reduction of Principal Rent Receipt/ Payment 2533.3 25333.33 12/31/17 12/31/18 12/31/19 16100.27 3766.69 21566.64 2533333 16100.27 9233.06 25333.33 eTextbook and Media Check Answer Attempts: 1 of 3 used Save for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts