Question: show calculation for number >> 36 , 37 , 38 35. Jeff Corporation purchased a limited-life intangible asset for $375,000 on May 1, 2016. It

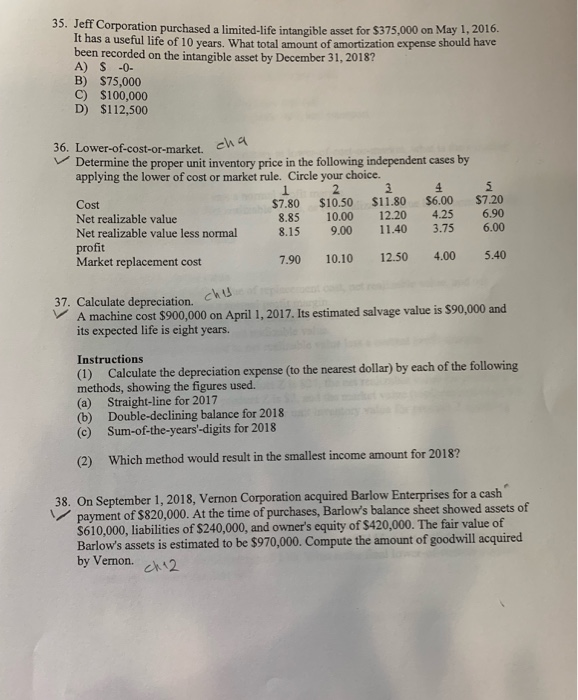

35. Jeff Corporation purchased a limited-life intangible asset for $375,000 on May 1, 2016. It has a useful life of 10 vears. What total amount of amortization expense should have been recorded on the intangible asset by December 31, 2018? A) S -0- B) $75,000 C) $100,000 D) $112,500 36. Lower-of-cost-or-market. ea Determine the proper unit inventory price in the following independent cases by applying the lower of cost or market rule. Circle your choice. 3 $11.80 12.20 5 4 2 $10.50 10.00 $7.20 6.90 $6.00 4.25 $7.80 8.85 Cost Net realizable value 6.00 3.75 11.40 9.00 8.15 Net realizable value less normal profit Market replacement cost 5.40 4.00 12.50 10.10 7.90 37. Calculate depreciation. c A machine cost $900,000 on April 1, 2017. Its estimated salvage value is $90,000 and its expected life is eight years. Instructions Calculate the depreciation expense (to the nearest dollar) by each of the following (1) methods, showing the figures used. (a) Straight-line for 2017 (b) Double-declining balance for 2018 (c) Sum-of-the-years'-digits for 2018 Which method would result in the smallest income amount for 2018? (2) 38. On September 1, 2018, Vernon Corporation acquired Barlow Enterprises for a cash payment of $820,000. At the time of purchases, Barlow's balance sheet showed assets of $610,000, liabilities of $240,000, and owner's equity of $420,000. The fair value of Barlow's assets is estimated to be $970,000. Compute the amount of goodwill acquired by Vernon. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts