Question: Show calculation Test #2 Review Chapter 5 Forward and Futures Contracts: Forward Contracts: What is it? Who uses them and why? Who are the two

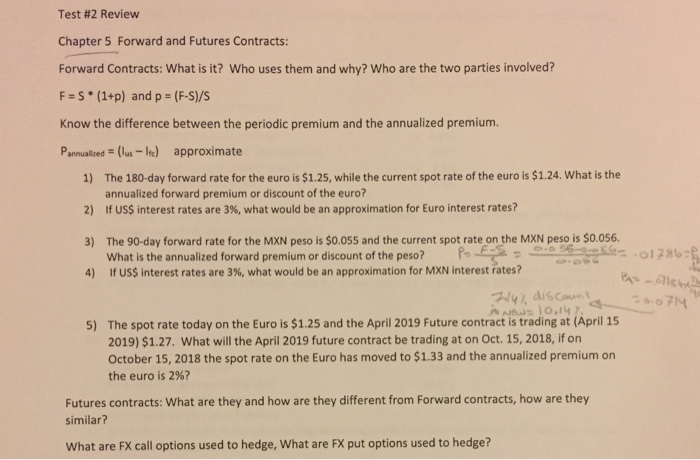

Test #2 Review Chapter 5 Forward and Futures Contracts: Forward Contracts: What is it? Who uses them and why? Who are the two parties involved? F-S (1+p) and p (F-S)/S Know the difference between the periodic premium and the annualized premium. Pannualized (lus-I) approximate The 180-day forward rate for the euro is $1.25, while the current spot rate of the euro is $1.24. What is the annualized forward premium or discount of the euro? If US$ interest rates are 3%, what would be an approximation for Euro interest rates? 1) 2) 3) The 90-day forward rate for the MXN peso is $0.055 and the current spot rate on the MXN peso is $0.056 4) what is the annualized forward premium or discount of the peso? P, Ea-? If US$ interest rates are 3%, what would be an approximation for MXN interest rates? 01786 The spot rate today on the Euro is $1.25 and the April 2019 Future contract is trading at (April 15 2019) $1.27. What will the April 2019 future contract be trading at on Oct. 15, 2018, if on October 15, 2018 the spot rate on the Euro has moved to $1.33 and the annualized premium on the euro is 2%? 5) Futures contracts: What are they and how are they different from Forward contracts, how are they similar? What are FX call options used to hedge, What are FX put options used to hedge

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts