Question: Show calculations and explain. Thank you! PLEASE DON'T COPY PASTE THE ANSWER OF THE PROBLEMS ALREADY ANSWERED. 1. You are considering investing in JR stock.

Show calculations and explain. Thank you! PLEASE DON'T COPY PASTE THE ANSWER OF THE PROBLEMS ALREADY ANSWERED.

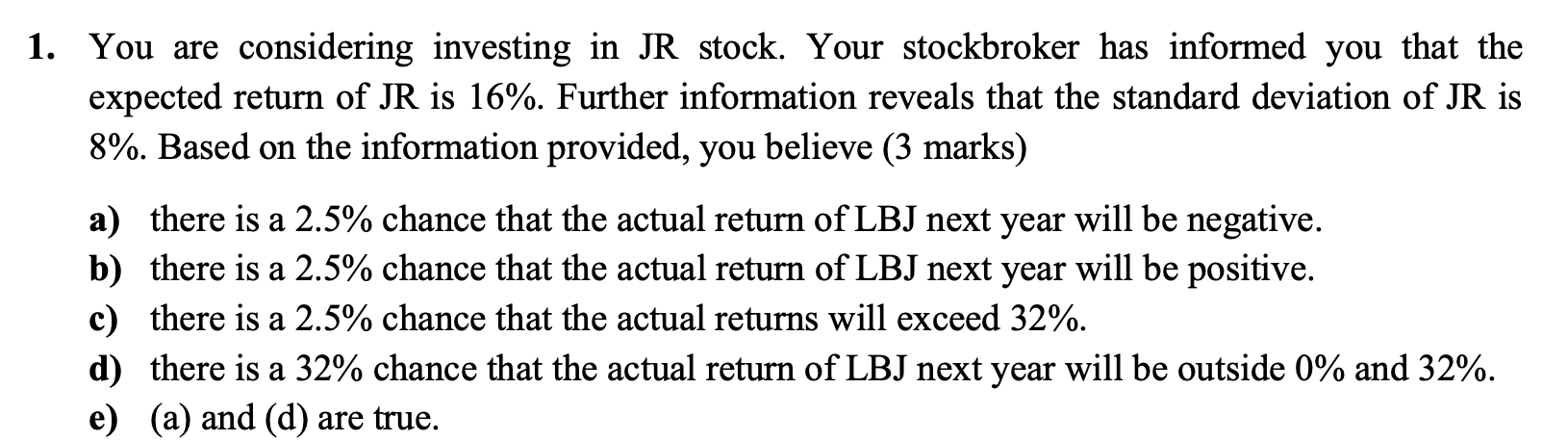

1. You are considering investing in JR stock. Your stockbroker has informed you that the expected return of JR is 16%. Further information reveals that the standard deviation of JR is 8%. Based on the information provided, you believe (3 marks) a) there is a 2.5% chance that the actual return of LBJ next year will be negative. b) there is a 2.5% chance that the actual return of LBJ next year will be positive. c) there is a 2.5% chance that the actual returns will exceed 32%. d) there is a 32% chance that the actual return of LBJ next year will be outside 0% and 32%. e) (a) and (d) are true. a 1. You are considering investing in JR stock. Your stockbroker has informed you that the expected return of JR is 16%. Further information reveals that the standard deviation of JR is 8%. Based on the information provided, you believe (3 marks) a) there is a 2.5% chance that the actual return of LBJ next year will be negative. b) there is a 2.5% chance that the actual return of LBJ next year will be positive. c) there is a 2.5% chance that the actual returns will exceed 32%. d) there is a 32% chance that the actual return of LBJ next year will be outside 0% and 32%. e) (a) and (d) are true. a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts