Question: show calculations please Part 4: Answer each question independently, Requirements: 1. Alpha Watches company made cash sales of $4,000 subject to a 5% sales tax.

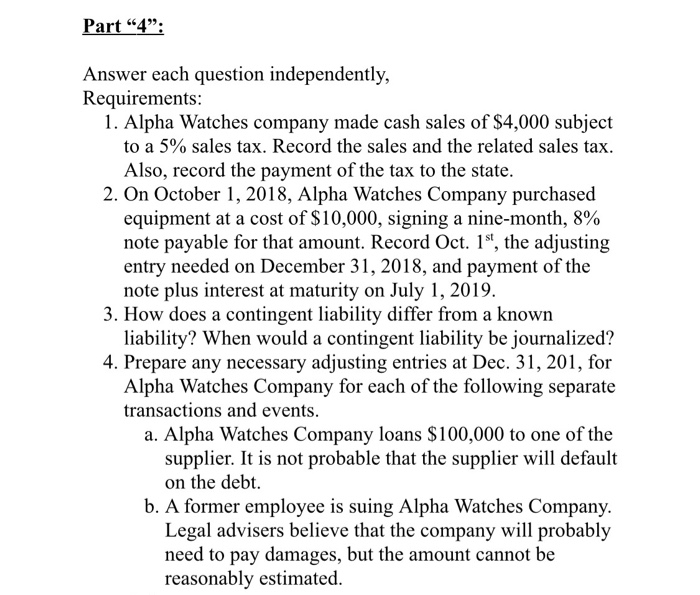

Part "4": Answer each question independently, Requirements: 1. Alpha Watches company made cash sales of $4,000 subject to a 5% sales tax. Record the sales and the related sales tax. Also, record the payment of the tax to the state. 2. On October 1, 2018, Alpha Watches Company purchased equipment at a cost of $10,000, signing a nine-month, 8% note payable for that amount. Record Oct. 1st, the adjusting entry needed on December 31, 2018, and payment of the note plus interest at maturity on July 1, 2019. 3. How does a contingent liability differ from a known liability? When would a contingent liability be journalized? 4. Prepare any necessary adjusting entries at Dec. 31, 201, for Alpha Watches Company for each of the following separate transactions and events. a. Alpha Watches Company loans $100,000 to one of the supplier. It is not probable that the supplier will default on the debt. b. A former employee is suing Alpha Watches Company. Legal advisers believe that the company will probably need to pay damages, but the amount cannot be reasonably estimated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts