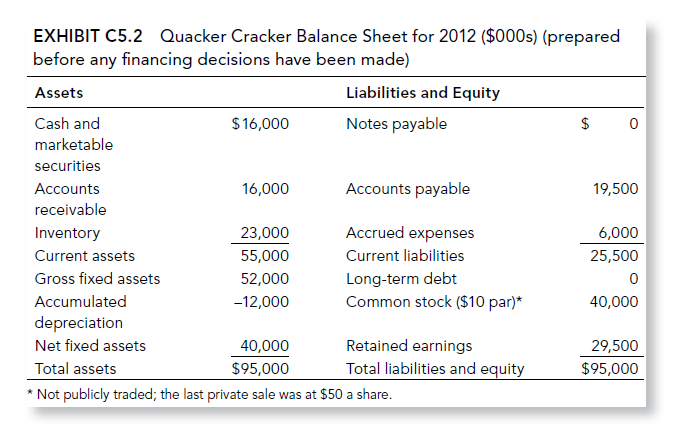

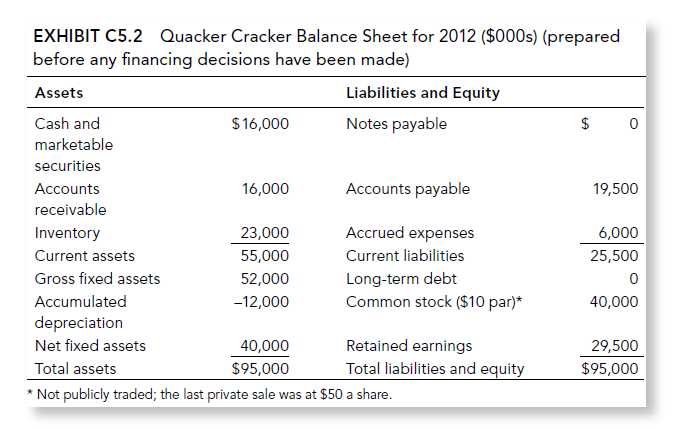

Question: Show changes to the 2012 pro forma balance sheet assuming the company borrows the necessary funds for the capital improvements at an interest rate of

Show changes to the 2012 pro forma balance sheet assuming the company borrows the necessary funds for the capital improvements at an interest rate of 7 percent. Ignore depreciation on the new equipment. Does this cause any significant change in the financials?

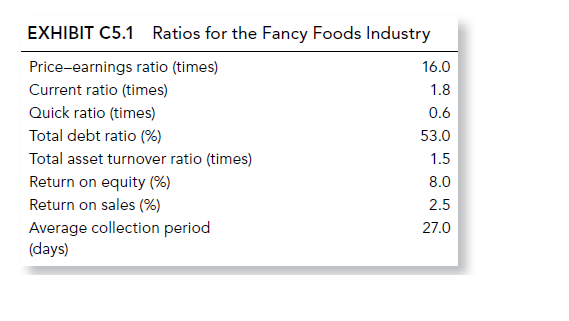

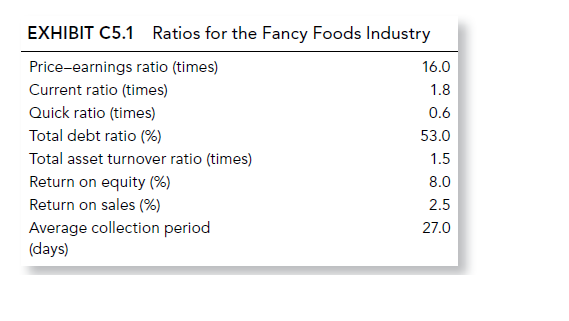

EXHIBIT (35.1 Ratios for the Fancyr Foods Industryr Priceearnings ratio times} 16.0 Current ratio {times} 1.8 Quick ratio {times} {1.5 Total debt ratio {'36) 53.0 Total asset turnover ratio ttimes} 'I .5 Return on equity {96} 8.13 Return on sales [353) 2.5 Average collection period 21D {days} EXHIBIT (35.2 Quacker Cracker Balance Sheet for 2012 [$000s) (prepared before anyr nancing decisions have been made) Assets Cash and $15,000 marketable securities Accounts 15,000 receivable Inventory 23,000 Current assets 55,000 Gross fixed assets 52,000 Accum u lated '| 2 .000 depreciation Net fixed assets 40,000 Total assets $95,000 Liabilities and Equity Notes payable Accounts payable Accrued expenses Current liabilities Longterm debt Common stock {$10 parl" Retained earnings Total liabilities and equity * Not publicly waded; 111a last private sale was at $50 a share. 19,500 6,000 25,500 40,000 29,500 $95,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts