Question: SHOW COMPLETE ANSWER AND SOLUTIONS L Problem 32-17 Problem 37-17 (AICPA Adapted) Gray Company was granted a patent on January 1, 2016 and appropriately capitalized

SHOW COMPLETE ANSWER AND SOLUTIONS

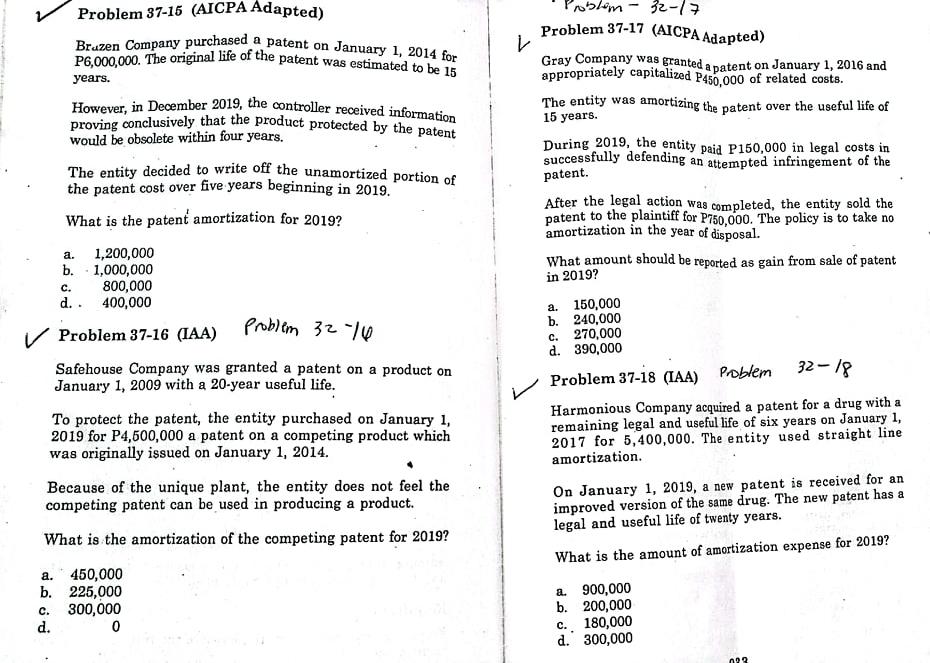

L Problem 32-17 Problem 37-17 (AICPA Adapted) Gray Company was granted a patent on January 1, 2016 and appropriately capitalized P450,000 of related costs. The entity was amortizing the patent over the useful life of 15 years. During 2019, the entity paid P150,000 in legal costs in successfully defending an attempted infringement of the patent. After the legal action was completed, the entity sold the patent to the plaintiff for P750,000. The policy is to take no amortization in the year of disposal. What amount should be reported as gain from sale of patent a. Problem 37-15 (AICPA Adapted) Bruzen Company purchased a patent on January 1, 2014 for P6,000,000. The original life of the patent was estimated to be 15 years. However, in December 2019, the controller received information proving conclusively that the product protected by the patent would be obsolete within four years. The entity decided to write off the unamortized portion of the patent cost over five years beginning in 2019. What is the patent amortization for 2019? 1,200,000 b. 1,000,000 800,000 d.. 400,000 v Problem 37-16 (IAA) Problem 32-70 Safehouse Company was granted a patent on a product on January 1, 2009 with a 20-year useful life. To protect the patent, the entity purchased on January 1, 2019 for P4,500,000 a patent on a competing product which was originally issued on January 1, 2014. Because of the unique plant, the entity does not feel the competing patent can be used in producing a product. What is the amortization of the competing patent for 2019? in 2019? C. a. 150,000 b. 240,000 c. 270,000 d. 390,000 Problem 37-18 (IAA) Problem 32-18 Harmonious Company acquired a patent for a drug with a remaining legal and useful life of six years on January 1, 2017 for 5,400,000. The entity used straight line amortization. On January 1, 2019, a new patent is received for an improved version of the same drug. The new patent has a legal and useful life of twenty years. What is the amount of amortization expense for 2019? a. 450,000 b. 225,000 300,000 d. 0 C. a. 900,000 b. 200,000 C. 180,000 d. 300,000 092

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts