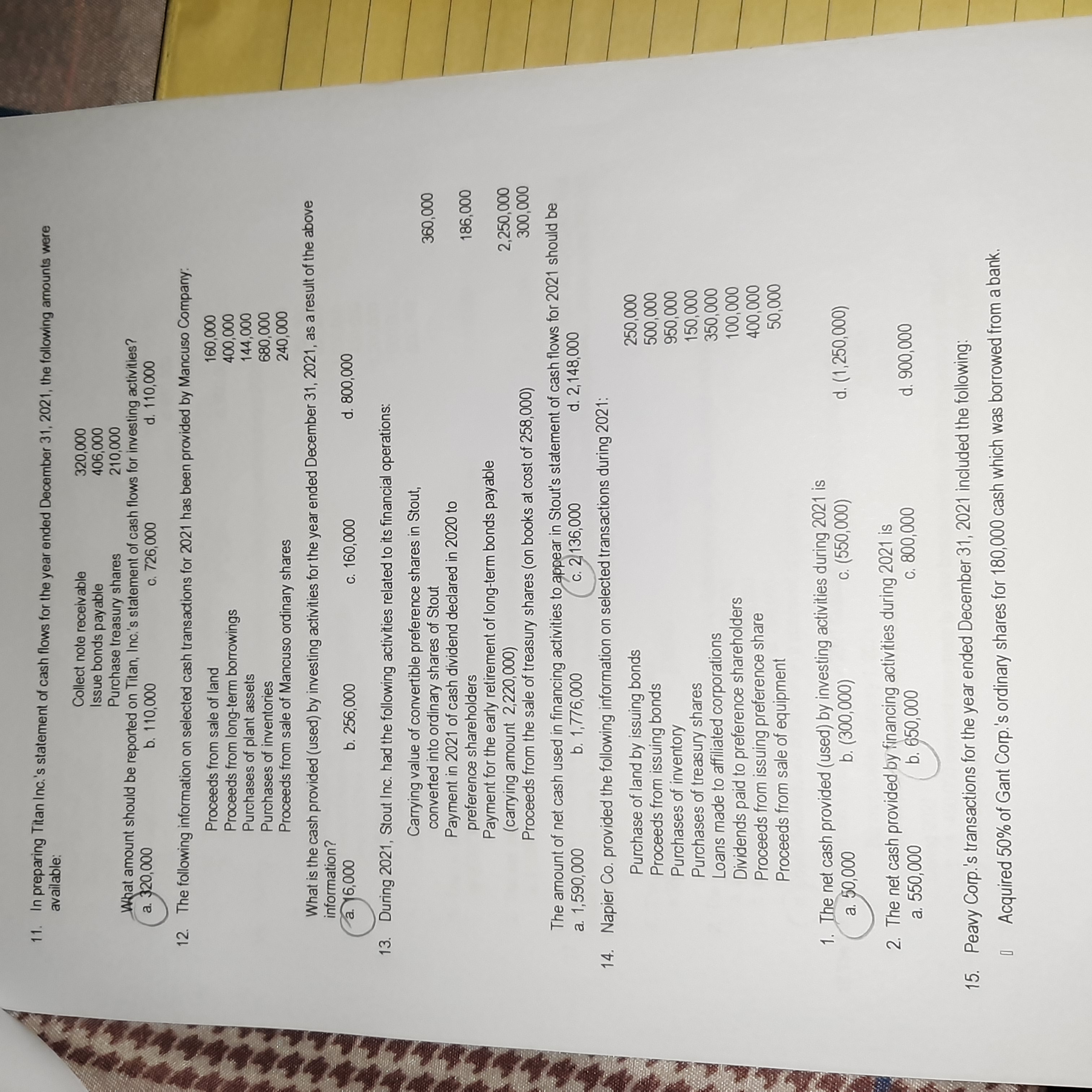

Question: Show complete solution. available: 11. In preparing Titan Inc.'s statement of cash flows for the year ended December 31, 2021, the following amounts were Collect

Show complete solution.

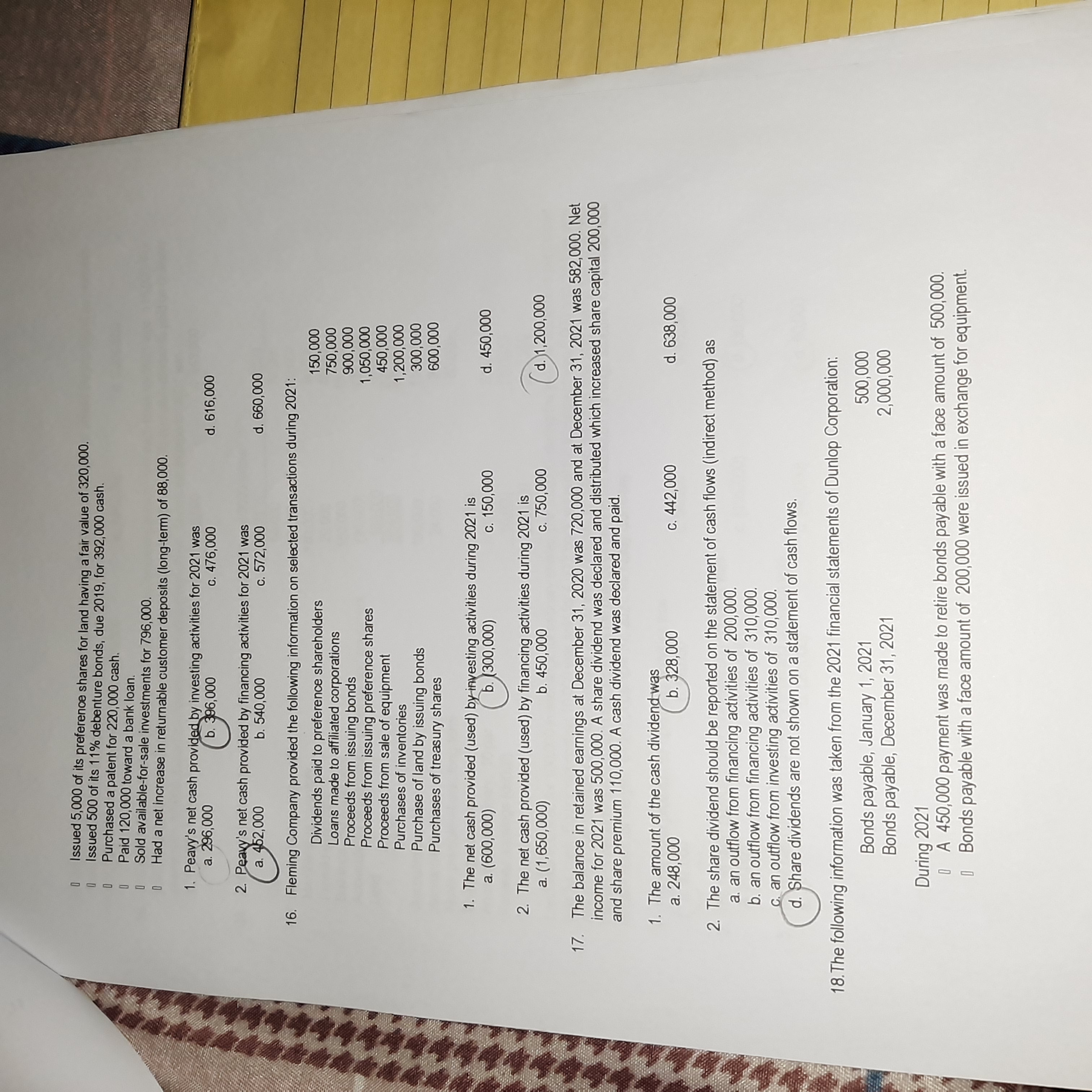

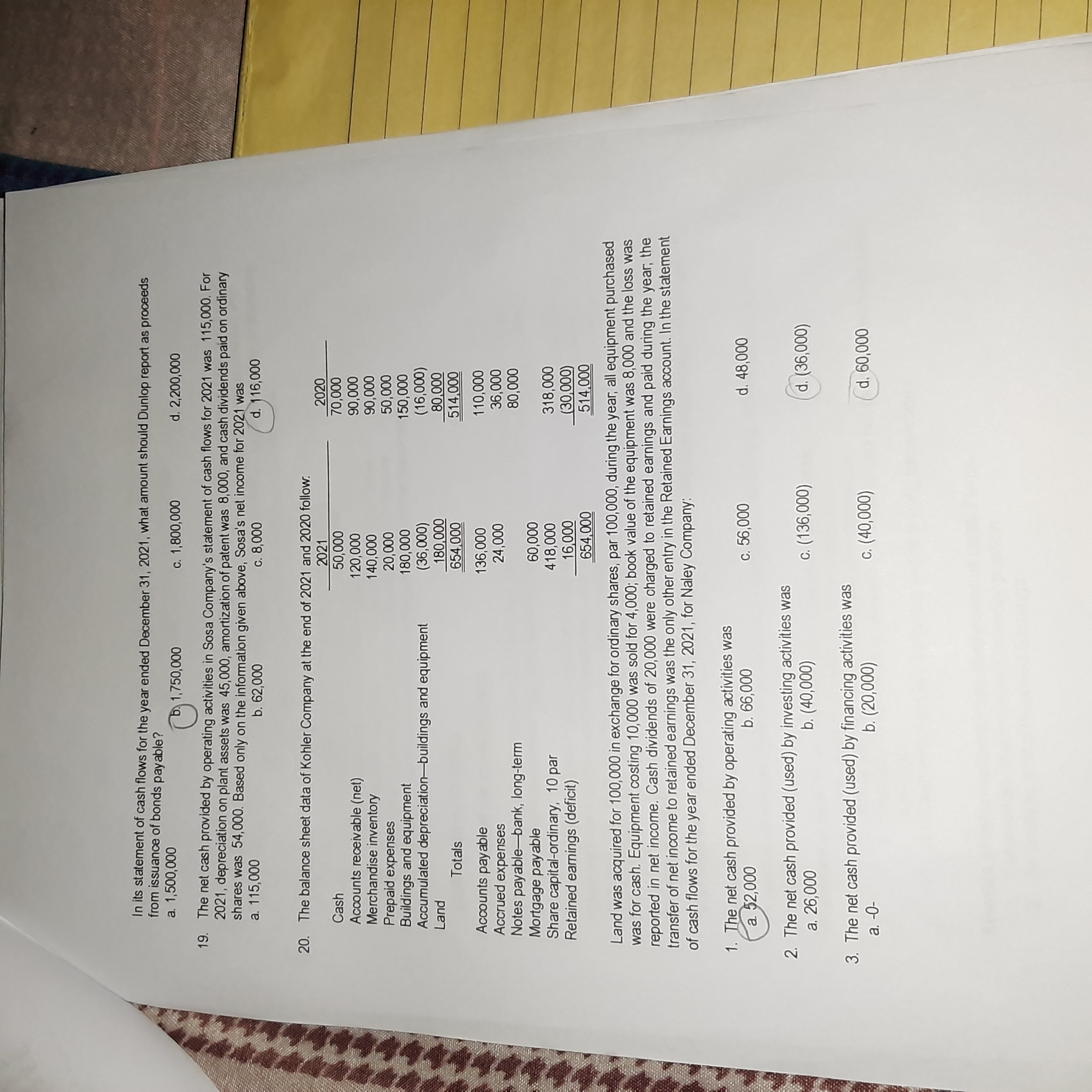

available: 11. In preparing Titan Inc.'s statement of cash flows for the year ended December 31, 2021, the following amounts were Collect note receivable 320,000 ssue bonds payable 406,000 Purchase treasury shares 210,00 What amount should be reported on Titan, Inc.'s statement of cash flows for investing activities? a. 320,000 b. 110,000 C. 726,000 d. 110,000 12. The following information on selected cash transactions for 2021 has been provided by Mancuso Company: Proceeds from sale of land 160,000 Proceeds from long-term borrowings 400,000 Purchases of plant assets 144,000 Purchases of inventories 680,000 Proceeds from sale of Mancuso ordinary shares 240,000 What is the cash provided (used) by investing activities for the year ended December 31, 2021, as a result of the above information? a. 6,000 b. 256,000 C. 160,000 d. 800,000 13. During 2021, Stout Inc. had the following activities related to its financial operations: Carrying value of convertible preference shares in Stout, converted into ordinary shares of Stout 360,000 Payment in 2021 of cash dividend declared in 2020 to preference shareholders 186,000 Payment for the early retirement of long-term bonds payable (carrying amount 2,220,000) 2,250,000 Proceeds from the sale of treasury shares (on books at cost of 258,000) 300,000 The amount of net cash used in financing activities to appear in Stout's statement of cash flows for 2021 should be a. 1,590,000 b. 1,776,000 C. 2 136,000 d. 2, 148,000 14. Napier Co. provided the following information on selected transactions during 2021: Purchase of land by issuing bonds 250,000 Proceeds from issuing bonds 500,000 Purchases of inventory 950,000 Purchases of treasury shares 150,000 Loans made to affiliated corporations 350,000 Dividends paid to preference shareholders 100,000 Proceeds from issuing preference share 400,000 Proceeds from sale of equipment 50,000 1. The net cash provided (used) by investing activities during 2021 is a. 50,000 b. (300,000) C. (550,000) d. (1,250,000) 2. The net cash provided by financing activities during 2021 is a. 550,000 b. 650,000 C. 800,000 d. 900,000 15. Peavy Corp.'s transactions for the year ended December 31, 2021 included the following: Acquired 50% of Gant Corp.'s ordinary shares for 180,000 cash which was borrowed from a bank.Issued 5,000 of its preference shares for land having a fair value of 320,000. Issued 500 of its 11% debenture bonds, due 2019, for 392,000 cash. Purchased a patent for 220,000 cash. Paid 120,000 toward a bank loan. Sold available-for-sale investments for 796,000. Had a net increase in returnable customer deposits (long-term) of 88,000. 1. Peavy's net cash provided by investing activities for 2021 was a. 296,000 b. 396,000 C. 476,000 d. 616,000 2. Peavy's net cash provided by financing activities for 2021 was a. 452,000 b. 540,000 C. 572,000 d. 660,000 16. Fleming Company provided the following information on selected transactions during 2021: Dividends paid to preference shareholders 150,000 Loans made to affiliated corporations 750,000 Proceeds from issuing bonds 900,000 Proceeds from issuing preference shares ,050,000 Proceeds from sale of equipment 450,000 Purchases of inventories 1,200,000 Purchase of land by issuing bonds 300,000 Purchases of treasury shares 600,000 1. The net cash provided (used) by investing activities during 2021 is a. (600,000) b. (300,000) c. 150,000 d. 450,000 2. The net cash provided (used) by financing activities during 2021 is a. (1,650,000) b. 450,000 c. 750,000 ( d. ) 1 ,200 , 00 17. The balance in retained earnings at December 31, 2020 was 720,000 and at December 31, 2021 was 582,000. Net income for 2021 was 500,000. A share dividend was declared and distributed which increased share capital 200,000 and share premium 110,000. A cash dividend was declared and paid 1. The amount of the cash dividend was a. 248,000 b. 328,000 C. 442,000 d. 638,000 2. The share dividend should be reported on the statement of cash flows (indirect method) as a. an outflow from financing activities of 200,000. b. an outflow from financing activities of 310,000 c. an outflow from investing activities of 310,000. d. Share dividends are not shown on a statement of cash flows. 18. The following information was taken from the 2021 financial statements of Dunlop Corporation: Bonds payable, January 1, 2021 500,000 Bonds payable, December 31, 2021 2,000,000 During 2021 1 A 450,000 payment was made to retire bonds payable with a face amount of 500,000. Bonds payable with a face amount of 200,000 were issued in exchange for equipment.In its statement of cash flows for the year ended December 31, 2021, what amount should Dunlop report as proceeds from issuance of bonds payable? a. 1,500,000 b) 1.750,000 C. 1,800,000 d. 2,200,000 19. The net cash provided by operating activities in Sosa Company's statement of cash flows for 2021 was 115,000. For 2021, depreciation on plant assets was 45,000, amortization of patent was 8,000, and cash dividends paid on ordinary shares was 54,000. Based only on the information given above, Sosa's net income for 2021 was a. 115,000 b. 62,000 C. 8,00 d. 16,000 20. The balance sheet data of Kohler Company at the end of 2021 and 2020 follow. 2021 2020 Cash 50,000 70,000 Accounts receivable (net) 120,00 90,000 Merchandise inventory 140,00 90,000 Prepaid expenses 20,000 50,000 Buildings and equipment 180,000 50,000 Accumulated depreciation-buildings and equipment 36,000) (16,000) Land 180,000 80,000 Totals 654,000 514,000 Accounts payable 136,000 110,000 Accrued expenses 24,000 36,000 Notes payable-bank, long-term 80,000 Mortgage payable 60,000 Share capital-ordinary, 10 par 418,000 318,000 Retained earnings (deficit) 16,000 (30,000 654,000 514,000 Land was acquired for 100,000 in exchange for ordinary shares, par 100,000, during the year, all equipment purchased was for cash. Equipment costing 10,000 was sold for 4,000; book value of the equipment was 8,000 and the loss was reported in net income. Cash dividends of 20,000 were charged to retained earnings and paid during the year; the transfer of net income to retained earnings was the only other entry in the Retained Earnings account. In the statement sh flows for the year ended December 31, 2021, for Naley Company: 1. The net cash provided by operating activities was a $2,000 b. 66,000 C. 56,000 d. 48,000 2. The net cash provided (used) by investing activities was a. 26,000 b. (40,000) C. (136,000) d. (36,000) 3. The net cash provided (used) by financing activities was a. -0- b. (20,000) C. (40,000) d. 60,000