Question: SHOW COMPLETE SOLUTION. I NEED THIS ASAP, PLS. ABCD Corporation had the cashflow from year 2001 to 2019 as shown in the figure (year-end basis).

SHOW COMPLETE SOLUTION. I NEED THIS ASAP, PLS.

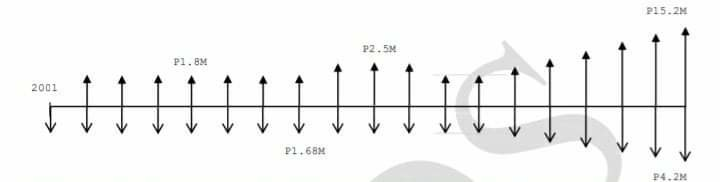

ABCD Corporation had the cashflow from year 2001 to 2019 as shown in the figure (year-end basis).

Furthermore, the list below shows the detailed fixed assets acquisition of the company. Acquisition year: 2001 Equipment : Walk behind compactor Initial cost : 155,000.00 Mobilization : 2,000.00/yr Electricity : 18,000.00/yr Service life : 7 years Salvage value : 10,000.00 Acquisition year: 2001 Equipment : 5.0 kW Diesel generator set Initial cost : 52,800.00 Mobilization : 1,500.00/yr Electricity : 20,000.00/yr Fuel : 14,000.00/yr Service life : 12 years Salvage value : 500.00 Acquisition year: 2013 Equipment : 7.5-ton capacity Dump truck Initial cost : 5.0M Miscellaneous : 85,000.00/yr Service life : 12 years Salvage value : 10% of initial cost Upon reaching service lives of the equipment indicated, the company immediately repurchase these fixed assets for replacement. If all the transactions made in the cashflow diagram were 3% compounded annually, costs of equipment do not vary during the given timebound, and the book depreciation used is straight-line method, determine the:

a. The net income on year 2005 and net income on year 2015.

Its an engineering economy subject.

P15.2M P2.5M P1.8M 2001 HU P1.68M P4.2M P15.2M P2.5M P1.8M 2001 HU P1.68M P4.2M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts