Question: Show complete work, please. 1. The present value of a bond is the sum of its discounted semi-annual coupon payments and its discounted par value

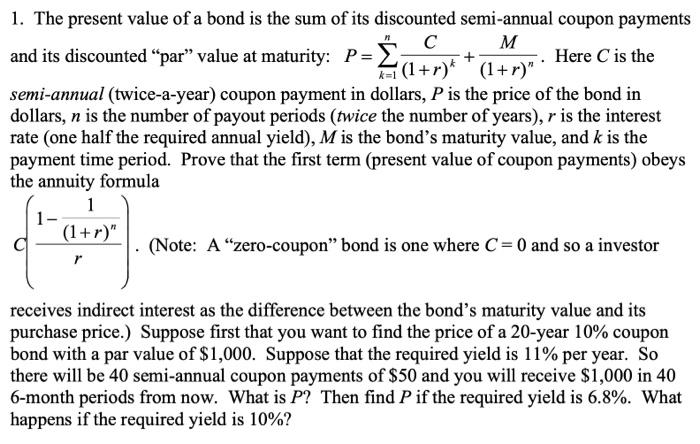

1. The present value of a bond is the sum of its discounted semi-annual coupon payments and its discounted "par" value at maturity: P=k=1n(1+r)kC+(1+r)nM. Here C is the semi-annual (twice-a-year) coupon payment in dollars, P is the price of the bond in dollars, n is the number of payout periods (twice the number of years), r is the interest rate (one half the required annual yield), M is the bond's maturity value, and k is the payment time period. Prove that the first term (present value of coupon payments) obeys the annuity formula C(r1(1+r)n1). (Note: A"zero-coupon" bond is one where C=0 and so a investor receives indirect interest as the difference between the bond's maturity value and its purchase price.) Suppose first that you want to find the price of a 20-year 10% coupon bond with a par value of $1,000. Suppose that the required yield is 11% per year. So there will be 40 semi-annual coupon payments of $50 and you will receive $1,000 in 40 6 -month periods from now. What is P ? Then find P if the required yield is 6.8%. What happens if the required yield is 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts